- United States

- /

- Food

- /

- NYSE:UTZ

Utz (UTZ) Profit Margin Beats, Challenging Bearish Narratives on Earnings Growth

Reviewed by Simply Wall St

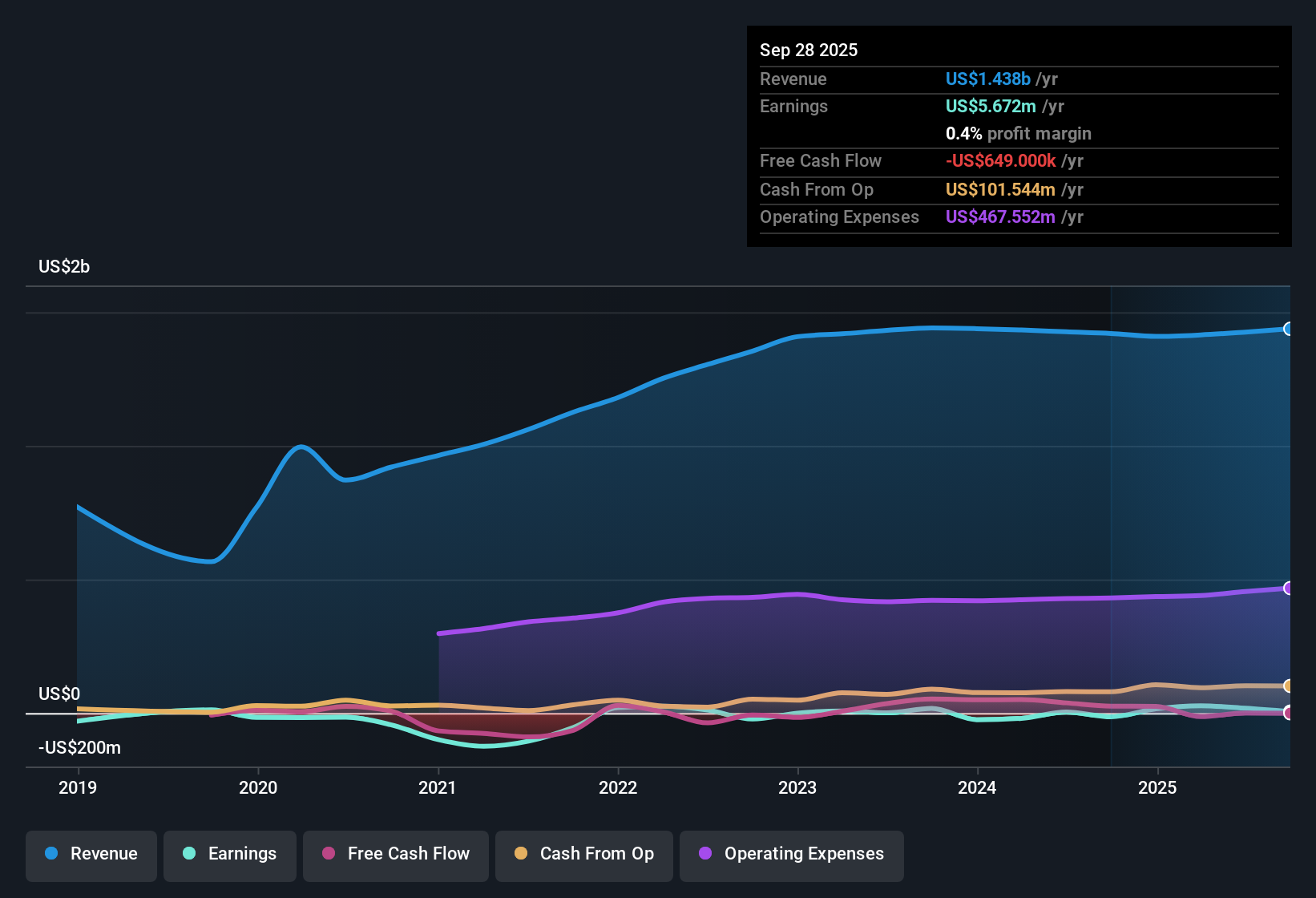

Utz Brands (UTZ) reported net profit margins of 1.3%, well above last year's 0.3%, and earnings growth of 371.9% over the past year compared to a five-year average of 61% per year. Despite trading below some analyst valuations at $10.44 per share, the stock commands a price-to-earnings ratio of 49.5x, significantly higher than industry and peer averages. As investors consider a solid stretch of profit growth and recent profitability, they will be weighing these achievements against the company’s premium valuation and ongoing financial risks.

See our full analysis for Utz Brands.Let’s dive into how these figures measure up against the prevailing narratives and expectations. Some long-held views might be confirmed, while others could get a reality check.

See what the community is saying about Utz Brands

Margins Projected to Expand to 7.8%

- Analysts expect Utz Brands' profit margins to increase from 1.3% today to 7.8% within three years, a substantial improvement if achieved.

- According to the analysts' consensus view, several forces are fueling this optimism:

- Supply chain improvements, such as automation and plant consolidation, are driving gross margin expansion. Management guides for further margin increases through 2026.

- Innovation in "better-for-you" products and growing sales of premium brands, especially Boulder Canyon, are pushing up mix and margins, counteracting some inflationary cost pressures.

See what the community is debating about Utz's future margin expansion. Consensus on the story is shifting. 📊 Read the full Utz Brands Consensus Narrative.

Revenue Growth Lags the Industry

- Forecast revenue growth for Utz Brands is 2.8% per year, well below the broader US food market average of 10.3% per year.

- The analysts' consensus narrative highlights key drivers and challenges for the brand's top line:

- Geographic expansion into the Midwest and Western US, combined with enhanced marketing, is helping Utz outperform some peers in revenue growth within the snacking segment.

- However, the company's reliance on classic potato chips, pretzels, and tortilla chips, where demand is growing slower than for healthier snacks, could limit long-term revenue acceleration, especially in the face of fierce competition.

Premium Valuation Despite Risks

- Utz Brands trades at a P/E ratio of 49.5x, sharply above the US food industry average of 17.3x and the peer average of 14.1x, signaling investor willingness to pay a premium even as current financial strength is only modest.

- The consensus narrative urges investors to weigh:

- Current share price of $10.44 stands 23.3% below the $16.75 consensus analyst price target, suggesting upside potential if profit and margin improvements are realized as expected.

- Risks regarding the sustainability of Utz’s dividend and questions about the company’s ability to consistently deliver profitable growth, given slim margins and an aggressive expansion strategy.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Utz Brands on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these results with a fresh perspective? Share your take and shape your own view in just a few minutes. Do it your way

A great starting point for your Utz Brands research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Utz Brands' lofty valuation, slim margins, and questions around consistent profit growth highlight how its financial fundamentals lag sector leaders.

If you want to avoid these premium-priced risks, use these 850 undervalued stocks based on cash flows to discover stocks trading at more attractive valuations with better upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTZ

Utz Brands

Engages in manufacture, marketing, and distribution of snack foods in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives