- United States

- /

- Food

- /

- NYSE:TSN

Tyson Foods (TSN): Evaluating Valuation After Beef Business Restructuring and Facility Closures

Reviewed by Simply Wall St

Tyson Foods (TSN) is making some big changes to its beef business, closing the Lexington, Nebraska, facility and streamlining operations at Amarillo, Texas. These adjustments are designed to improve efficiency and position the company for future growth.

See our latest analysis for Tyson Foods.

The beef segment shakeup comes after a volatile period for Tyson Foods shares. Recent operational changes have coincided with a sharp uptick, reflected in a 13.4% share price return over the past month. However, longer-term momentum remains muted, with the one-year total shareholder return still down nearly 6%, highlighting both renewed optimism and lingering caution around the stock.

If Tyson’s streamlining has you rethinking your investment strategy, it could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

Given these sweeping changes and the stock’s recent surge, investors are left wondering if Tyson Foods is trading below its true value or if the market has already priced in all the potential upside. Is there still a buying opportunity, or has future growth been fully accounted for?

Most Popular Narrative: 7% Undervalued

Followers of the most widely tracked valuation narrative see Tyson Foods as offering some upside, with a fair value just north of $62 per share and a discount rate of 7%. This is compared to a last close price of $58.30, signaling that the market has not fully priced in anticipated earnings momentum and operational improvements the narrative expects.

Continuous operational efficiencies, supply chain optimization, and manufacturing improvements are delivering tangible cost savings, higher fill rates, and reduced waste. These factors are expected to support net margin expansion and greater earnings stability. As protein demand grows in emerging international markets and the company continues to expand its operational discipline overseas, there is further potential for stable international earnings contribution and top-line growth.

Wondering how analysts arrive at this bullish fair value? The secret sauce involves more than just higher sales. Consider higher margins, industry-leading profit forecasts, and a long-term earnings runway. The details behind these assumptions might surprise you. Discover what is driving the optimism within Tyson’s most popular valuation narrative.

Result: Fair Value of $62.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cattle supply shortages and rising input costs remain key risks that could challenge Tyson Foods' path to sustained earnings improvement.

Find out about the key risks to this Tyson Foods narrative.

Another View: Stretching the Multiple?

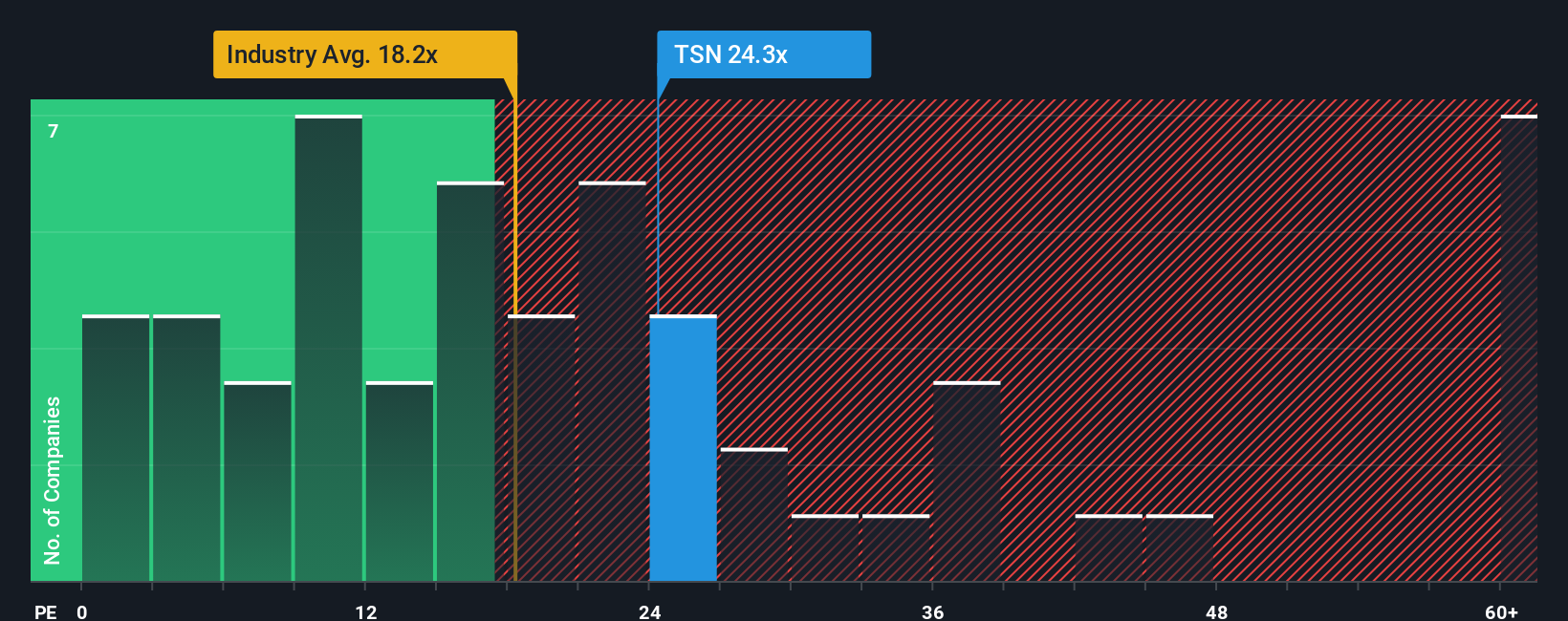

While the most popular valuation narrative paints Tyson Foods as undervalued, a closer look at its price-to-earnings ratio sparks debate. At 43.4x earnings, Tyson trades well above both the food industry average of 20.6x and peers at 15.5x. Even compared to the fair ratio of 29x, the current multiple could signal a valuation risk if earnings growth does not accelerate. Will the market reward this premium, or is there a correction waiting to happen?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyson Foods Narrative

If you see the numbers differently or want to dig into Tyson Foods' story your own way, it only takes a few minutes to create a narrative that fits your view. Do it your way

A great starting point for your Tyson Foods research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors avoid relying on a single opportunity. Make your next move count by focusing on sectors with high potential and companies that match your strategy. Explore these handpicked ways to uncover actionable stock ideas today:

- Target future-shaping disruptors by scanning these 27 quantum computing stocks as they transform industries with quantum breakthroughs and unique technology advantages.

- Seek reliable cash flow with these 14 dividend stocks with yields > 3% that deliver consistent yields above 3% to help strengthen your portfolio’s defensive core.

- Stay ahead of market trends with these 25 AI penny stocks that are applying artificial intelligence to drive innovation across multiple sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026