- United States

- /

- Food

- /

- NYSE:TSN

Does Tyson’s Plant-Based Expansion Signal Opportunity Amid a 10.5% Share Price Drop in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Tyson Foods is a hidden value play or just another food stock making headlines, you are in good company. Let's break it down together.

- Tyson shares have dipped slightly by 0.2% over the past week and are down 10.5% year-to-date, which has certainly piqued investors' curiosity about growth potential and shifting risk perceptions.

- Recent headlines have focused on Tyson's ongoing expansion into plant-based alternatives and a push to streamline its operations. Both moves seem to be fueling fresh discussion around the company's long-term prospects and how flexible it can be in a fast-evolving food industry.

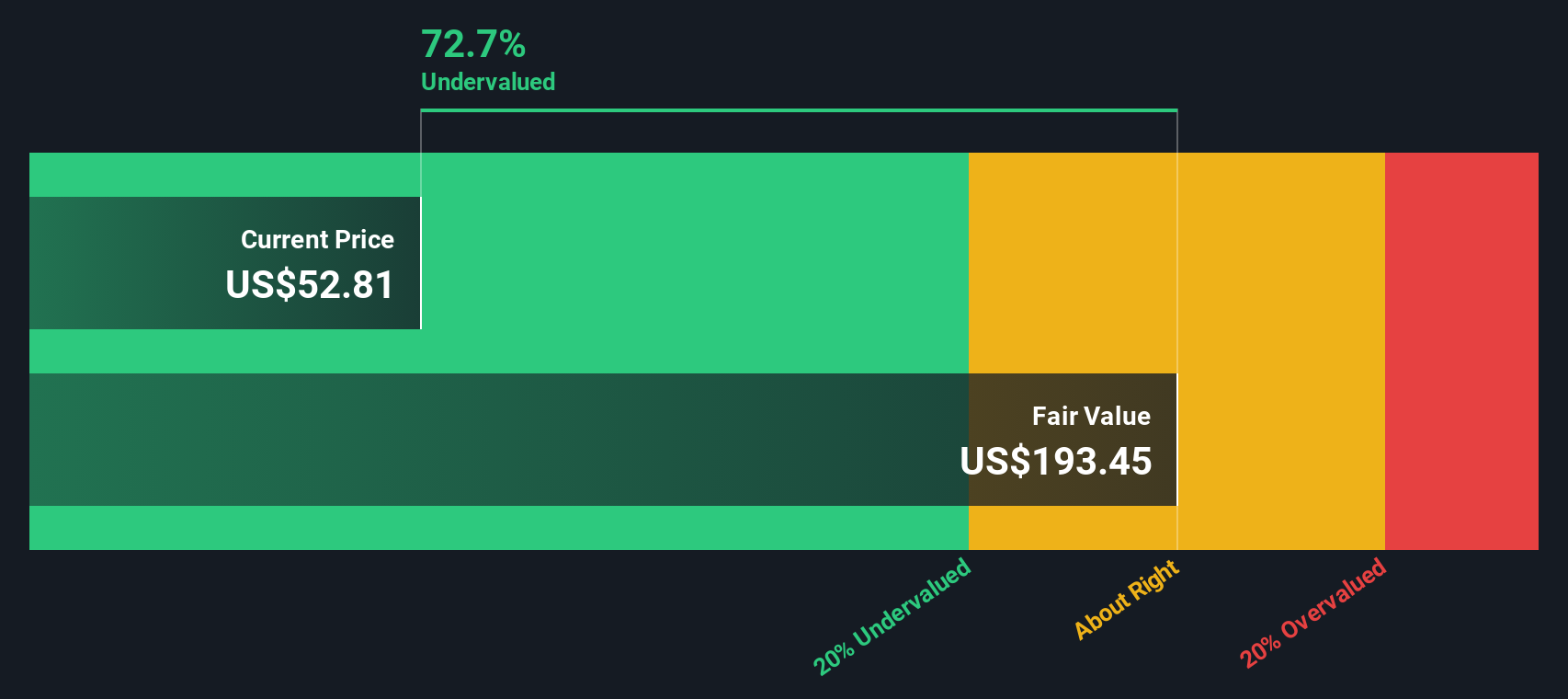

- On our valuation checks, Tyson Foods scores a 3 out of 6, meaning it appears undervalued in half of the listed areas. We will review the popular valuation methods in detail, and at the end, I will share an even more insightful way to think about how valuation shapes your investing journey.

Approach 1: Tyson Foods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's underlying value by projecting its future cash flows and discounting them back to their present worth. For Tyson Foods, this involves analyzing how much cash the company is expected to generate in the coming years and converting those forecasts into today's dollars using a rigorous financial model.

Currently, Tyson Foods generates approximately $777 Million in annual Free Cash Flow. According to analyst estimates, this figure is expected to increase steadily, with projections reaching $1.22 Billion by 2028 and further extrapolated growth to about $2.43 Billion by 2035. These forecasts are based on expert analyst inputs for the next five years, with longer-range estimates extending from historical growth patterns and industry trends.

Based on this DCF analysis, Tyson Foods' intrinsic value is calculated at $130.19 per share. Since this is around 60.0% higher than the current share price, it suggests the stock is significantly undervalued at today's levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tyson Foods is undervalued by 60.0%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Tyson Foods Price vs Earnings (PE)

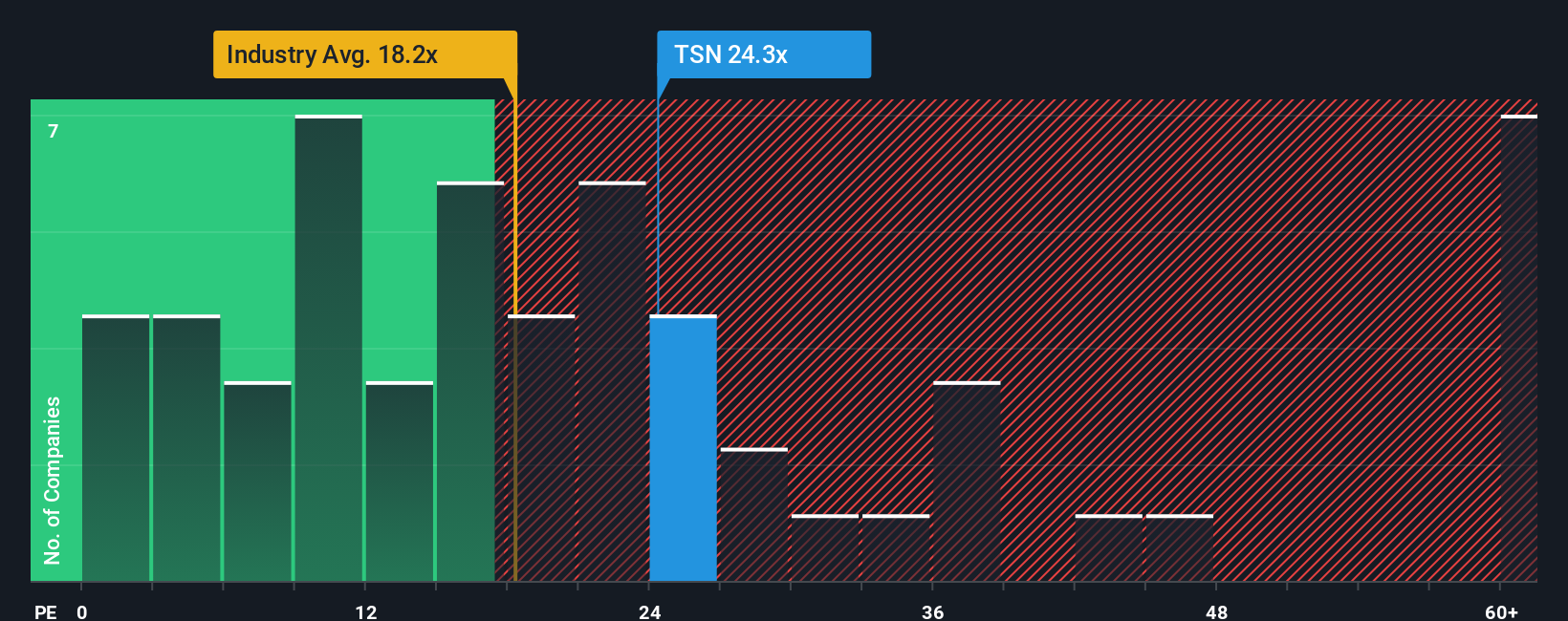

For profitable companies like Tyson Foods, the Price-to-Earnings (PE) ratio is widely seen as a practical way to assess stock valuation. This metric compares a company’s current share price to its annual earnings per share, helping investors understand how much they’re paying for each dollar of profit.

It is important to note that a “normal” or “fair” PE ratio is often influenced by growth prospects and perceived risk. Companies with strong growth potential and stable earnings usually command higher PE ratios, while those facing uncertainty or slower growth tend to have lower ones.

Tyson Foods currently trades at a PE ratio of 23.6x. When we compare this with the industry average PE of 17.7x and a peer average of 13.2x, Tyson appears more expensive than its competitors. However, headline multiples do not always tell the whole story. Different companies in the same industry can have wide-ranging growth expectations, margins, and risk profiles.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Calculated based on Tyson’s specific characteristics such as its earnings growth outlook, industry dynamics, profit margins, market cap, and risk factors, the Fair Ratio for Tyson Foods is 29.5x. This approach offers a more tailored benchmark, going beyond basic peer or industry comparisons and giving a more holistic view of what’s genuinely fair for the company’s valuation.

Since Tyson’s actual PE of 23.6x is clearly below the Fair Ratio of 29.5x, this suggests the stock is undervalued on an earnings basis, even if it looks pricier than most competitors at first glance.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tyson Foods Narrative

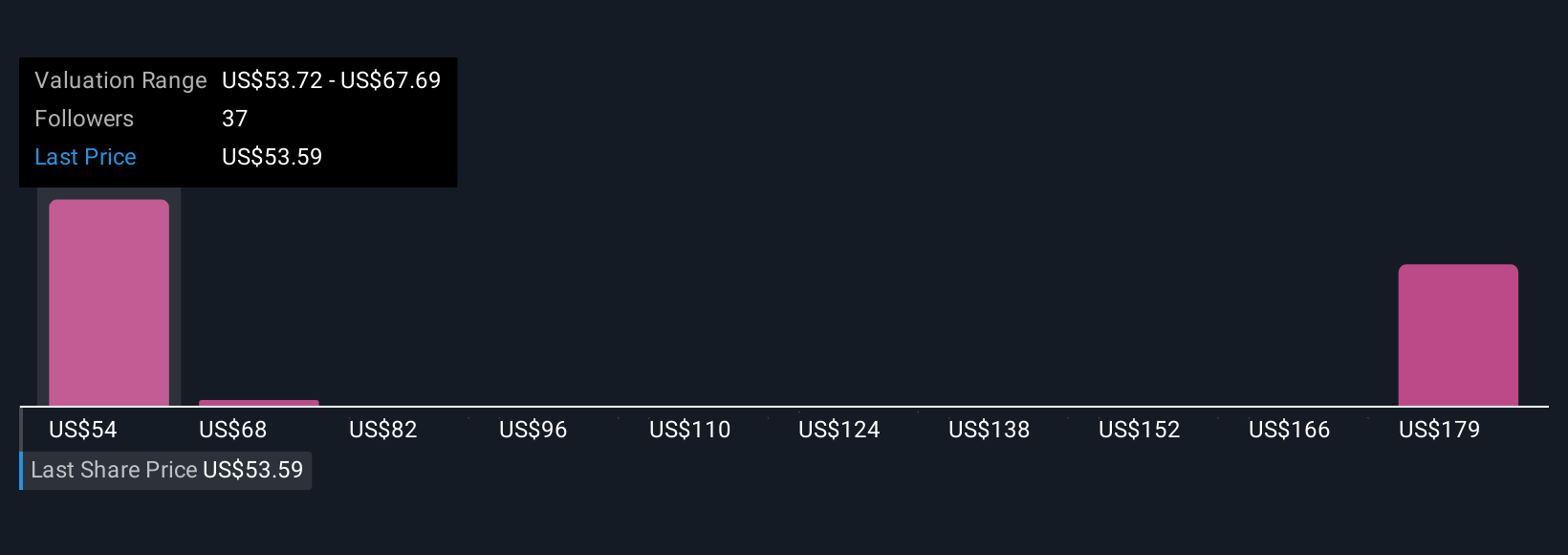

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective on a company like Tyson Foods. It’s how you connect what you believe about its future, such as revenue growth, margins, and market opportunities, to specific financial forecasts and ultimately to your own fair value estimate.

Narratives make investing both accessible and structured by letting you map out your view in clear, logical steps and compare it directly to the latest estimates and share price. On Simply Wall St’s Community page, used by millions of investors, you can easily create your own Narrative for Tyson Foods and see how it compares to others, helping you decide whether now is the right time to buy, hold, or sell.

What makes Narratives so powerful is that they update dynamically as new news, earnings, or company disclosures are released, so your thesis stays relevant and responsive. For example, one investor might see Tyson’s brand strength and margin improvements and set a higher fair value in the $80 range, while another focused on margin pressure and ongoing risks could argue for a fair value closer to $55. This means every investor can make decisions based on their own convictions, not just analysts’ opinions or headline numbers.

Do you think there's more to the story for Tyson Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives