- United States

- /

- Food

- /

- NYSE:TR

Tootsie Roll Industries (TR): Exploring Valuation Following Strong Q3 Revenue and Net Income Growth

Reviewed by Simply Wall St

Tootsie Roll Industries (TR) just posted its third quarter earnings, showing higher revenue and net income compared to last year. The latest financials offer investors a snapshot of how the company’s performance is trending in 2025.

See our latest analysis for Tootsie Roll Industries.

Tootsie Roll Industries’ latest results arrive as its share price has gathered impressive momentum, rallying over 24% year-to-date and delivering a total shareholder return of nearly 29% over the past year. The stock’s recent surge suggests that investors are responding positively to upbeat financials and renewed growth prospects, even after some short-term bumps.

If you're curious where else opportunity is building, now is a great moment to expand your search and discover fast growing stocks with high insider ownership

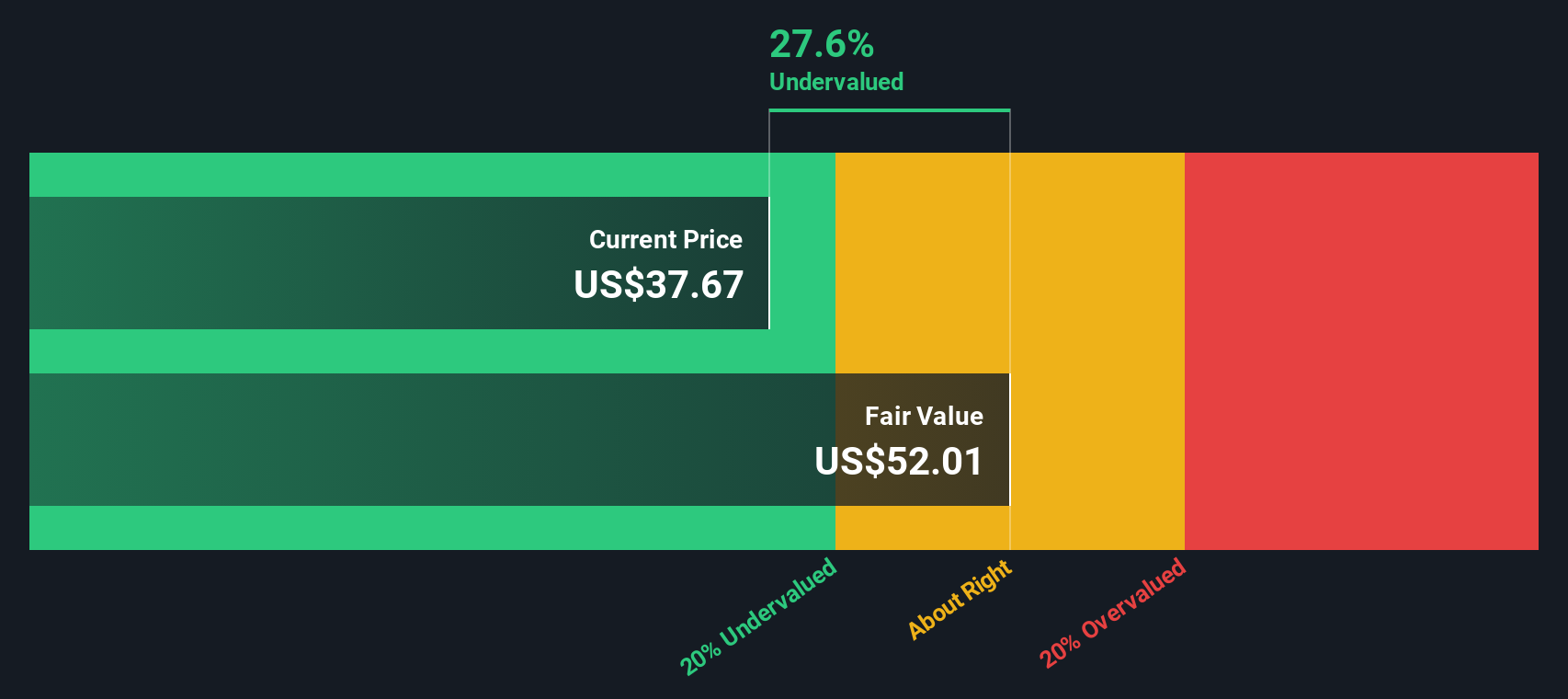

With shares rallying and earnings on the rise, the key question for investors is whether Tootsie Roll Industries remains undervalued or if the solid gains reflect expectations for future growth and leave little room for upside.

Price-to-Earnings of 30.6x: Is it justified?

Tootsie Roll Industries is currently valued at a price-to-earnings (P/E) ratio of 30.6 times, which puts it well above its industry and peer benchmarks. At the last close of $39.37, the stock commands a significant premium in terms of what investors are willing to pay for its earnings.

The price-to-earnings ratio measures how much investors are paying for each dollar of company earnings. In the food sector, P/E is a widely referenced gauge to assess whether a stock appears cheap or expensive relative to profits.

With a P/E ratio of 30.6x, Tootsie Roll Industries trades at a much higher multiple than the US Food industry average of 18.5x and the peer average of 15.1x. This notable premium suggests the market is pricing in elevated expectations for future performance. However, it also means the stock may be vulnerable if growth does not accelerate meaningfully from here.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 30.6x (OVERVALUED)

However, risks remain, such as a pullback in consumer demand or margin pressures. These factors could challenge the market’s bullish outlook on Tootsie Roll Industries.

Find out about the key risks to this Tootsie Roll Industries narrative.

Another View: Discounted Cash Flow Perspective

Looking at Tootsie Roll Industries through the lens of our DCF model delivers a different perspective. The current share price of $39.37 is above our estimate of fair value at $37.26, which suggests the stock may be overvalued on a cash flow basis. Does this contrast in valuations signal caution, or is there more to the story as market optimism persists?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tootsie Roll Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tootsie Roll Industries Narrative

If you see the numbers differently or want to take a hands-on approach, you can build your own view using our tools in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Tootsie Roll Industries.

Looking for more investment ideas?

Don't limit yourself to just one opportunity. Put your money to work on your terms, and make smarter, faster decisions with Simply Wall Street's powerful screener tools.

- Power up your income potential by checking out these 16 dividend stocks with yields > 3%, delivering high yields and long-term stability for savvy investors like you.

- Spot future winners early when you browse these 879 undervalued stocks based on cash flows that the market might be overlooking, giving you a real shot at strong upside.

- Seize the momentum in artificial intelligence by reviewing these 25 AI penny stocks, shaping industries with emerging technologies and disruptive innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tootsie Roll Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TR

Tootsie Roll Industries

Manufactures and sells confectionery products in the United States, Canada, Mexico, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives