- United States

- /

- Food

- /

- NYSE:TR

Are Ingredient Costs Reshaping Tootsie Roll’s (TR) Manufacturing Priorities or Reinforcing Its Competitive Edge?

Reviewed by Sasha Jovanovic

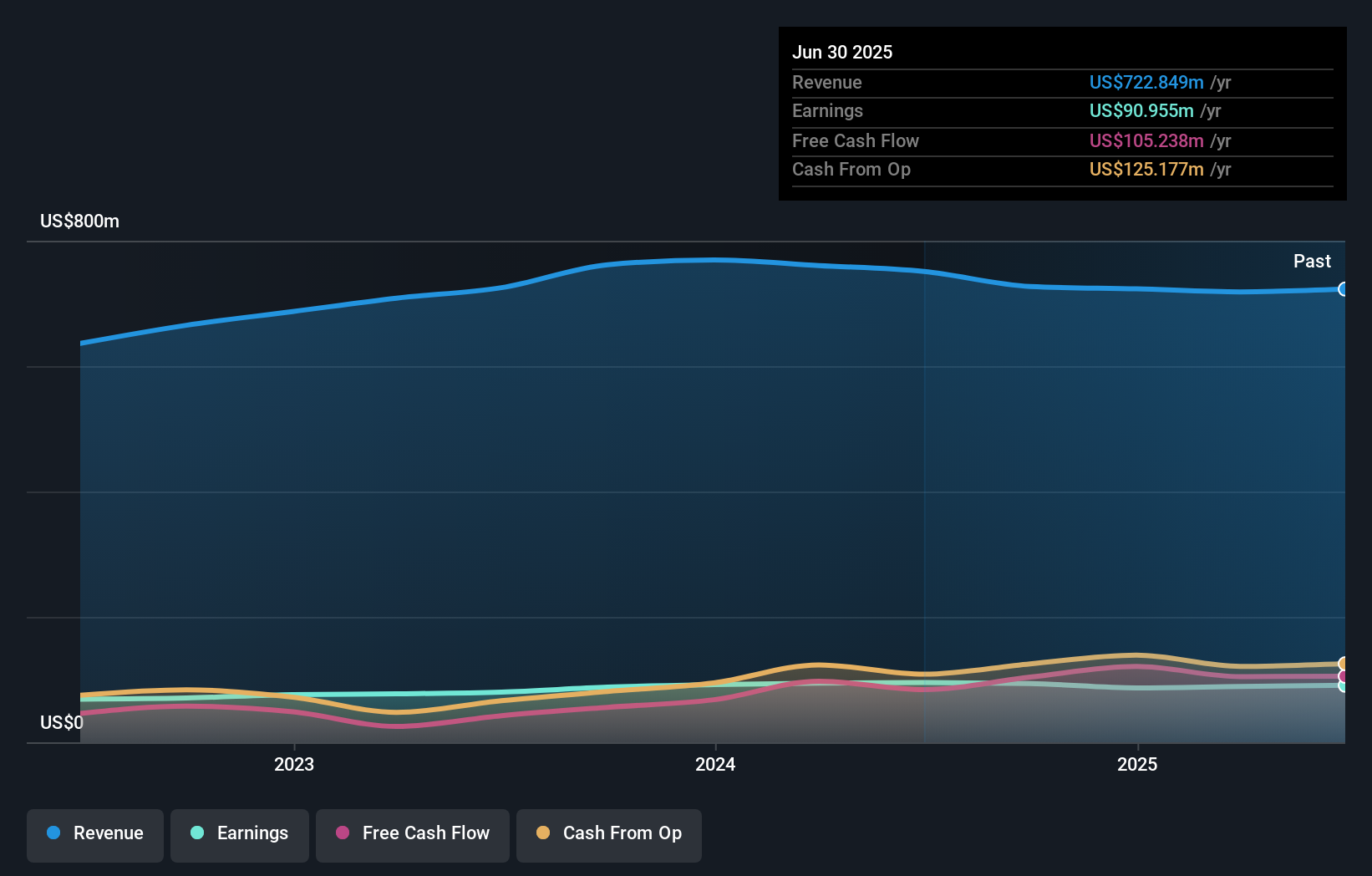

- Tootsie Roll Industries recently reported its third quarter 2025 earnings, revealing year-on-year growth in both sales and earnings supported by successful pre-Halloween marketing initiatives and operational efficiencies.

- Despite ongoing margin pressures from elevated cocoa and chocolate prices, the company is allocating resources toward manufacturing upgrades to keep up with changing consumer tastes.

- We'll explore how Tootsie Roll's manufacturing investments and higher ingredient costs shape the company's investment narrative going forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Tootsie Roll Industries' Investment Narrative?

To own shares of Tootsie Roll Industries, you need to believe in the enduring value of its iconic brands, the company's ability to navigate commodity headwinds, and its steady approach to reinvestment and operational improvements. The recent third-quarter earnings beat, led by Halloween-driven sales, is a short-term catalyst that offset some of the ingredient cost pressures that have weighed on margins all year. However, this positive news did little to completely change the main risks, especially given the steep recent dip in share price and continued concern about higher cocoa and chocolate prices persisting into 2026. The focus on upgrading manufacturing and targeting evolving consumer tastes is promising, but governance and incentive misalignment remain front and center, echoing ongoing debates about financial engineering and underinvestment. The latest results serve as a near-term boost but do not fully resolve these deeper issues.

Yet, questions remain over how well the company rewards long-term investors amid ongoing governance concerns. Despite retreating, Tootsie Roll Industries' shares might still be trading 28% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Tootsie Roll Industries - why the stock might be worth as much as 39% more than the current price!

Build Your Own Tootsie Roll Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tootsie Roll Industries research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Tootsie Roll Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tootsie Roll Industries' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tootsie Roll Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TR

Tootsie Roll Industries

Manufactures and sells confectionery products in the United States, Canada, Mexico, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives