- United States

- /

- Food

- /

- NYSE:THS

TreeHouse Foods (THS): Exploring Valuation After Recent 13% Share Price Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for TreeHouse Foods.

This latest rally follows a long stretch of challenges for TreeHouse Foods, with a one-year total shareholder return of -51.6%. Despite the recent 13% boost in the share price over the past month, momentum is only just starting to build after a tough year marked by significant declines. This suggests ongoing shifts in investor sentiment around its recovery story.

If you’re keeping an eye on stocks with changing fortunes, now is a smart moment to broaden your investing approach and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets and the company posting recent signs of recovery, the key question is whether TreeHouse Foods is undervalued today or if the market has already taken its growth potential into account.

Most Popular Narrative: 7% Undervalued

TreeHouse Foods recently closed at $19.77, which sits noticeably below the narrative's fair value target of $21.31. This difference hints that analysts see more upside despite a sluggish stock performance over the past year.

Supply chain optimization, plant closures in underperforming businesses, and margin management initiatives are structurally lowering TreeHouse's cost base and increasing operational flexibility. These efficiency gains and disciplined capital allocation are expected to strengthen EBITDA margins and translate to higher, more predictable free cash flow over the next several years.

Why do analysts think TreeHouse could stage a comeback? Their narrative hinges on upcoming changes in business efficiency and a financial turnaround that could surprise investors. The story is driven by a few bold assumptions about growth, profitability, and future expectations. Want to see the ingredients of their valuation recipe?

Result: Fair Value of $21.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand and ongoing operational challenges could still undermine TreeHouse Foods' turnaround story. This situation may continue to put pressure on long-term growth expectations.

Find out about the key risks to this TreeHouse Foods narrative.

Another View: Market Multiples Tell a Different Story

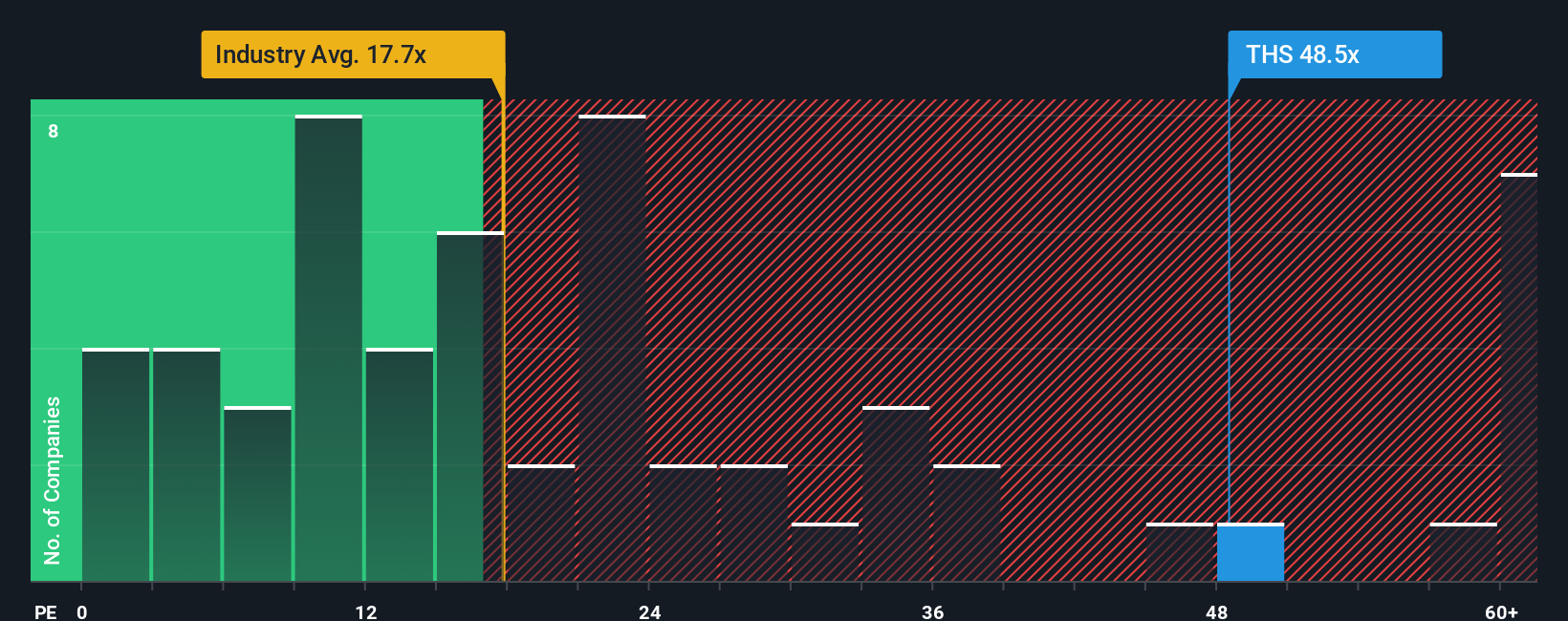

Looking through the lens of price-to-earnings ratios, TreeHouse Foods stands out as expensive. Its current ratio of 48.5x is much higher than the US Food industry average of 17.9x and also above peers at 15.4x. Even compared to its fair ratio of 22.8x, the stock looks stretched. Does this premium reflect hidden growth, or added risk for those hoping for a turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TreeHouse Foods Narrative

If you have your own perspective or want to draw your own conclusions from the data, it’s never been faster to create your own narrative. Do it your way.

A great starting point for your TreeHouse Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next opportunity could be just a click away, so don’t let the best prospects pass you by. Unlock smarter investments with these standout ideas today:

- Target tomorrow’s big payers and reach for reliable passive income through these 19 dividend stocks with yields > 3% with yields above 3%.

- Capture innovation and growth potential by seeking out these 24 AI penny stocks as they reshape industries with artificial intelligence breakthroughs.

- Capitalize on value by snapping up these 899 undervalued stocks based on cash flows that signal buy opportunities based on strong cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TreeHouse Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THS

TreeHouse Foods

Manufactures and distributes private brands snacks and beverages in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion