- United States

- /

- Beverage

- /

- NYSE:STZ

Constellation Brands (STZ): Assessing Valuation as Analyst Outlooks Shift on Weaker Demand and Changing Consumer Trends

Reviewed by Simply Wall St

Constellation Brands (STZ) has recently come under renewed scrutiny as several analysts have adjusted their outlooks, citing softer demand trends and declining sales among its core Hispanic customer base. This shift in sentiment follows recent revenue results and has fueled ongoing questions about the company’s near-term trajectory.

See our latest analysis for Constellation Brands.

Constellation Brands’ latest share price of $132.11 reflects ongoing caution in the market, with a 30-day share price return of -5.38% and year-to-date share price return of -40.64%. Momentum has clearly faded this year as concerns over demand and customer trends weigh on sentiment. Its one-year total shareholder return of -43.95% underscores how challenging the period has been for long-term investors.

If you’re looking for new opportunities beyond beverage stocks, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets, investors are left to wonder if Constellation Brands is now undervalued and set for a rebound, or if the market is already factoring in all of its future growth.

Most Popular Narrative: 23.2% Undervalued

Constellation Brands' narrative fair value estimate sits at $172.09, a significant premium to the recent close of $132.11. This valuation gap brings attention to what could be driving analysts' bullishness on the long-term outlook, even as short-term turbulence remains.

The company plans to generate approximately $9 billion in operating cash flow and $6 billion in free cash flow from fiscal '26 to fiscal '28. This robust cash flow will support investment in growth initiatives, primarily the modular development of their third brewery in Veracruz and additions to existing facilities in Mexico, potentially enhancing revenue.

Wondering what bold assumptions are underpinning this valuation? This narrative is built around future cash windfalls, aggressive margin expansion, and a rebounding consumer segment. Want to know the exact levers analysts expect Constellation Brands to pull to turn the tide? The suspense is in the details. Discover what drives the fair value that stands out.

Result: Fair Value of $172.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as new tariffs or further declines in beer demand could quickly undermine even cautious optimism around Constellation Brands’ future valuation.

Find out about the key risks to this Constellation Brands narrative.

Another View: What Do Earnings Ratios Reveal?

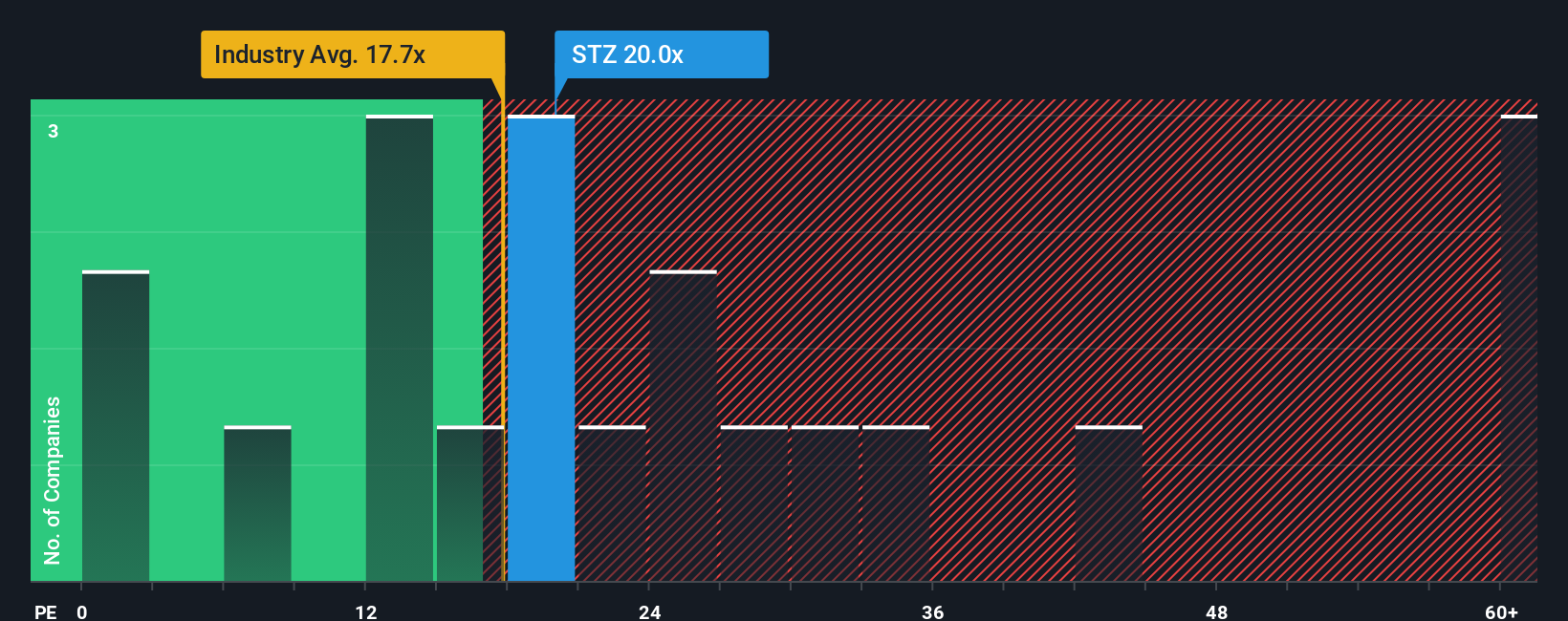

Looking at Constellation Brands through its price-to-earnings ratio, the story changes. The company trades at 18.8x earnings, higher than the industry average of 17.7x but just below its peer average of 19.1x. Compared to its fair ratio of 20.8x, the current level may suggest opportunity, but there is also valuation risk if investor confidence sours. Will the market move toward that fair ratio, or does caution still prevail?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Brands Narrative

The data is all right here if you want to dig deeper and reach your own conclusions. It only takes a few minutes to shape your personal perspective. Do it your way

A great starting point for your Constellation Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Smarter Investment Opportunities?

There are abundant opportunities beyond today's headlines. Give yourself an edge and catch tomorrow’s winners by screening for stocks with outstanding potential, solid fundamentals, and unique market trends before everyone else does.

- Capitalize on strong, stable returns by tapping into these 14 dividend stocks with yields > 3% delivering yields above 3%, which can be ideal for building reliable income streams.

- Ride the wave of innovation and uncover fresh potential by searching through these 26 AI penny stocks that are transforming businesses with advanced artificial intelligence.

- Stay ahead of market mispricings by targeting these 924 undervalued stocks based on cash flows that offer rare, compelling value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success