- United States

- /

- Food

- /

- NYSE:SJM

J. M. Smucker (SJM) Swings to $241M Q2 Profit, Challenging Persistent Loss Narratives

Reviewed by Simply Wall St

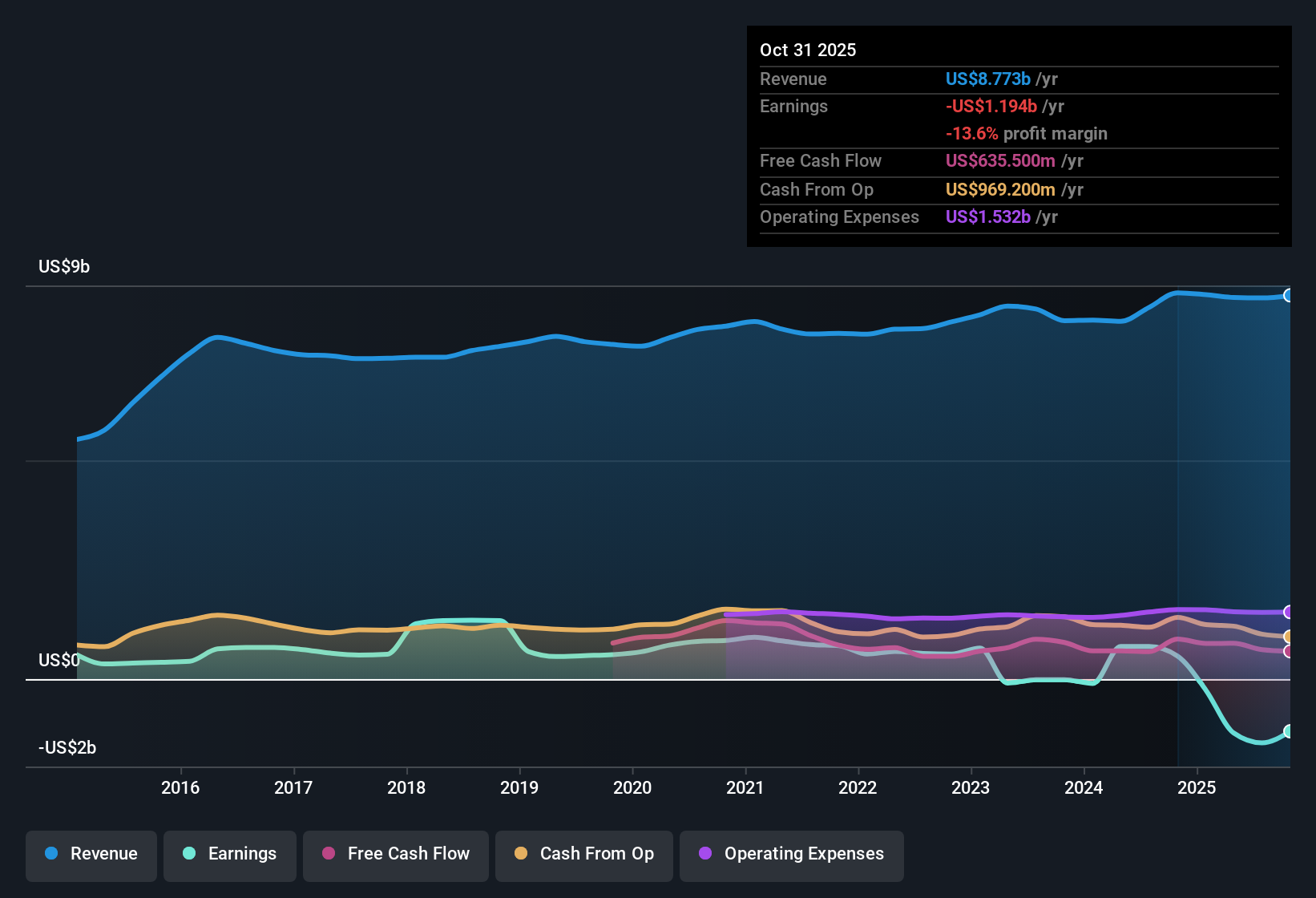

J. M. Smucker (SJM) just reported results for Q2 2026, notching revenue of $2.3 billion and basic EPS of $2.26, with net income for the period coming in at $241.3 million. Over the past few quarters, revenue has hovered near the $2.1 to $2.3 billion mark while EPS has fluctuated, with recent periods swinging from negative to positive territory. Investors will be weighing these headline numbers in the context of volatile earnings margins as the company aims for sustained profitability.

See our full analysis for J. M. Smucker.Let's look at how this latest financial update measures up against the prevailing narratives. Some expectations might be confirmed, while others could see a sharp challenge as we move through the numbers.

See what the community is saying about J. M. Smucker

Losses Mount Even as Turnaround Forecast Takes Shape

- Trailing twelve-month net income was a loss of $1.2 billion, extending a multi-year stretch of unprofitability. Five-year losses have compounded at a 56.2% annual rate.

- According to the consensus narrative, analysts note the planned shift in pricing strategies and investments in brand and e-commerce. These changes support projections for profit margins to rebound from -16.7% today to 9.4% by 2028.

- Consensus expects the company to move from deep annual losses to estimated earnings per share of $8.28 within three years.

- The analysts’ price target of $115.88 is only 12% above the current share price of $103.18, suggesting a measured outlook despite the forecast recovery.

Consensus narrative sees the Q2 rebound as validation of the turnaround plan, but margin and valuation concerns linger. 📊 Read the full J. M. Smucker Consensus Narrative.

Valuation Gap Remains Despite Losses

- J. M. Smucker trades at a 1.3x Price-to-Sales ratio, which is above the food industry and peer average of 0.7x. However, the stock is still priced 52.9% below its DCF fair value of $218.84.

- Bulls point to this 52.9% discount as a compelling entry point if turnaround targets are met. The consensus narrative tempers expectations by emphasizing how the market still sees significant operational risk.

- The muted price target increase compared to current levels signals the Street’s skepticism that the company can fully deliver on margin and cash flow improvements.

- Investors must weigh the deep discount against the company’s ongoing inability to translate sales leadership into bottom-line strength.

High Dividend Raises Payout Concerns

- The company offers a 4.26% dividend yield. However, the past year’s unprofitability means the payout is not covered by earnings or by operating cash flow.

- The consensus narrative questions the sustainability of the payout in light of recurring losses and recent insider selling, urging a watchful approach.

- While the dividend yield appears attractive, debt coverage by operating cash flow also remains weak, compounding questions about future dividend safety.

- Recent notable insider selling signals caution from those closest to the business, mirroring the risk flagged by analysts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for J. M. Smucker on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on the results? Take just a few minutes to share your unique perspective and shape the story your way by using the following link: Do it your way.

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite revenue stability, J. M. Smucker’s persistent losses, weak dividend cover, and insider selling create ongoing doubts about its financial strength.

If you want companies with stronger financial foundations and less risk to future payouts, check out solid balance sheet and fundamentals stocks screener (1924 results) for ideas built on balance sheet health and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success