- United States

- /

- Food

- /

- NYSE:SJM

A Fresh Look at J. M. Smucker's Valuation After Reporting Quarterly Net Loss and Margin Pressures

Reviewed by Simply Wall St

J. M. Smucker has landed in the spotlight after posting a quarterly net loss, marking quite the reversal from last year’s profit. The news comes amid a series of headwinds: rising input costs, tariffs cutting into the coffee business, and softer sales volumes have all put downward pressure on margins. Even with management’s efforts to reassure investors by raising the annual sales growth outlook and maintaining the full-year earnings guidance, the recent numbers were less than inspiring and missed what many expected to see.

This set of results adds to a year already marked by challenges for J. M. Smucker. While the stock’s long-term performance has seesawed, its momentum is now lagging, with shares treading water over the past year and trailing well behind broader market gains over the last three years. In addition, ongoing legal investigations tied to recent impairment charges and underperformance in acquired brands are weighing on sentiment, raising questions about the company’s ability to deliver consistent profitability.

After this mixed stretch and headline-grabbing quarterly miss, investors are left to decide if J. M. Smucker has become a value play or if the current price is simply reflecting the risk of more bumps ahead.

Most Popular Narrative: 4.7% Undervalued

The most widely followed narrative currently views J. M. Smucker as slightly undervalued, with analysts estimating its fair value to be about 4.7% above the company’s latest share price.

“Continued investments in advertising, innovation (e.g., new Milk-Bone PB Bites), and category expansion, especially in growing urban, convenience, and pet segments, are positioning the portfolio to leverage both changing consumer demographics and rising demand for convenient, branded packaged foods, supporting top-line and volume growth.”

What is the secret ingredient powering this narrative’s valuation? It comes down to a bold set of projections: improving margins, faster earnings growth, and future profit multiples that rival some of the hottest growth stocks. Curious what numbers underpin this fair value? The details might just change how you see Smucker’s future.

Result: Fair Value of $116 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as continued coffee commodity volatility and heavy reliance on price hikes could quickly undermine the case for Smucker’s rebound.

Find out about the key risks to this J. M. Smucker narrative.Another View: Market Ratios Say Otherwise

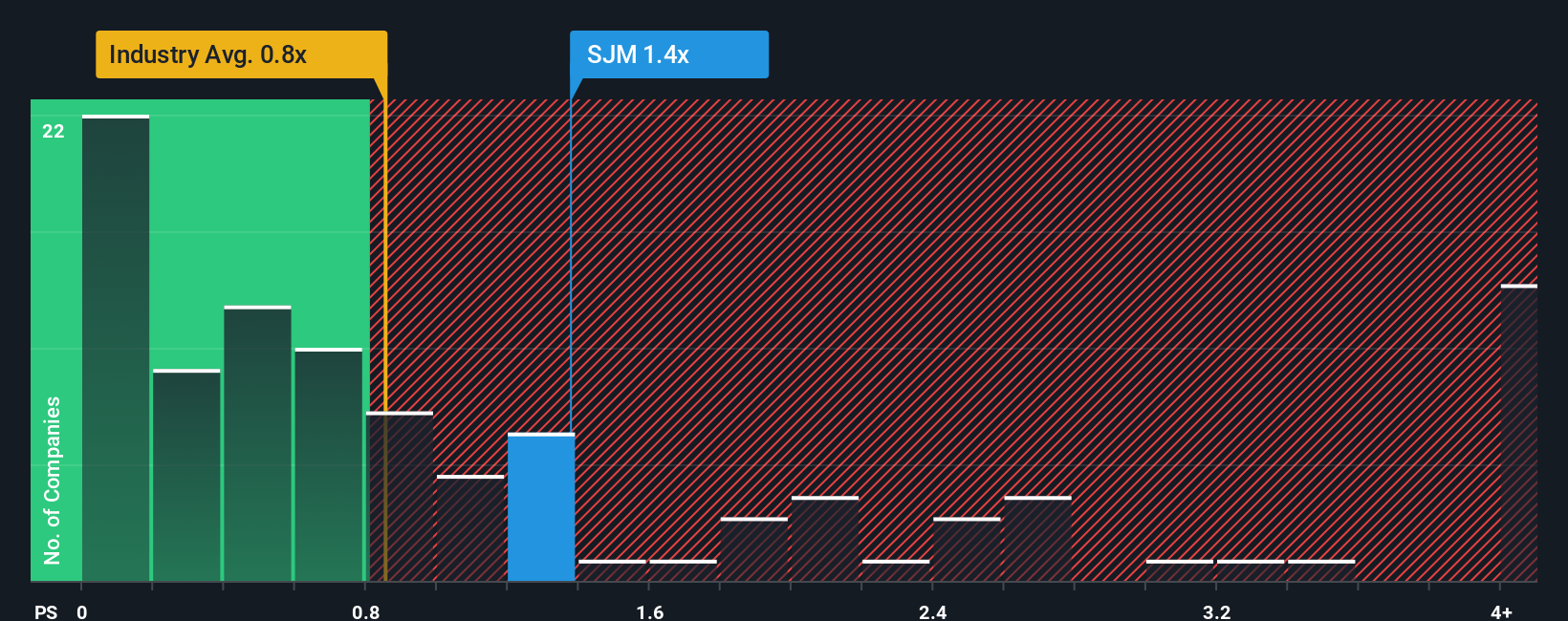

Taking a different approach, evaluating the company based on its sales ratio relative to the sector actually suggests it might be priced higher than the average for similar businesses. Does this signal caution or just a temporary mismatch?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J. M. Smucker Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can put together your own take in just a few minutes with Do it your way.

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay ahead by checking out fresh opportunities. Don’t miss your chance to uncover stocks primed for growth, income, or technological breakthroughs with the Simply Wall Street Screener. Your smartest next move could be just a click away.

- Unlock consistent cash flow and stability by checking out companies that offer dividend stocks with yields > 3%, perfect for those seeking reliable returns above 3%.

- Tap into rapid innovation and future growth by spotting AI penny stocks transforming industries with revolutionary artificial intelligence.

- Find opportunities trading below their intrinsic value by scanning for undervalued stocks based on cash flows and position yourself before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives