- United States

- /

- Food

- /

- NYSE:POST

How Investors Are Reacting to Post Holdings (POST) Granting Shareholders More Power to Call Special Meetings

Reviewed by Sasha Jovanovic

- On October 16, 2025, Post Holdings’ Board of Directors amended the company’s bylaws to enable shareholders holding at least 25% of voting stock to call a special meeting.

- This bylaw change potentially empowers shareholders with greater influence over corporate governance and could impact the company’s responsiveness to investor concerns.

- We’ll explore how this updated shareholder meeting threshold may influence Post Holdings' investment narrative around management accountability and future flexibility.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Post Holdings Investment Narrative Recap

To be a shareholder in Post Holdings right now, you need confidence in the company’s ability to maintain growth through product innovation, cost optimization, and market share resilience in the packaged foods sector. The recent bylaw amendment giving 25%+ shareholders the power to call special meetings aims to strengthen management accountability, but it does not materially impact near-term catalysts such as upcoming earnings or acute risks like ongoing core volume declines.

The most relevant recent announcement is Post Holdings’ plan to release Q4 2025 results and a fiscal 2026 outlook on November 20, an event that often provides new data that can influence investor sentiment and leadership discussions. With corporate governance changes fresh in effect, attention will likely remain on whether management will address persistent category challenges and update strategies to tackle evolving consumer demand.

Yet, unlike short-term headlines, investors should be aware of the company’s exposure to sustained volume declines in key categories...

Read the full narrative on Post Holdings (it's free!)

Post Holdings' narrative projects $9.2 billion revenue and $537.3 million earnings by 2028. This requires 5.2% yearly revenue growth and a $171 million earnings increase from $366.3 million.

Uncover how Post Holdings' forecasts yield a $127.44 fair value, a 18% upside to its current price.

Exploring Other Perspectives

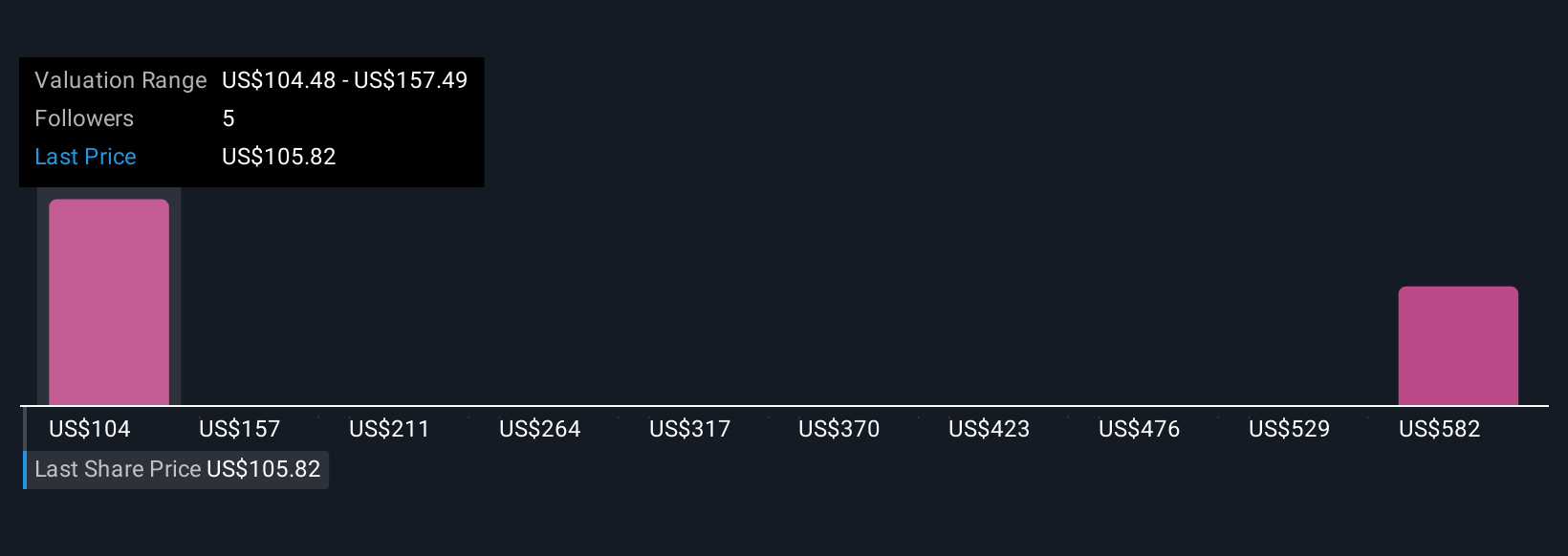

The Simply Wall St Community provides four fair value estimates for Post Holdings ranging from US$104.48 to US$562.19 per share, illustrating dramatically differing views. Earnings resilience and management flexibility remain front of mind for many, especially as customer trends threaten core volume stability.

Explore 4 other fair value estimates on Post Holdings - why the stock might be worth just $104.48!

Build Your Own Post Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Post Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Post Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Post Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POST

Post Holdings

Operates as a consumer packaged goods holding company in the United States and internationally.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives