- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM) Valuation in Focus After Strong Earnings and Investor Caution on Future Margins

Reviewed by Simply Wall St

Philip Morris International (PM) posted higher revenue and profit for the third quarter, fueled by strong demand in its smoke-free product lines like IQOS and Zyn. However, increased spending on U.S. promotions has some investors eyeing future margins with caution.

See our latest analysis for Philip Morris International.

Despite reporting another quarter of strong earnings and completing multiple fixed-income offerings, Philip Morris International's share price has given up some ground recently, with a 1-day price return of -2.80% and a 30-day share price return of -7.08%. While short-term price momentum has turned negative, the bigger picture is far more impressive. The company has delivered a 21.79% total shareholder return over one year and a striking 173.87% total return over the past five years, underscoring its resilience and ability to create long-term value even as investor focus shifts to costs and promotions.

If this mix of near-term volatility and long-term growth has you exploring what's next, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares off recent highs even after an earnings beat and a solid growth outlook, the question is whether Philip Morris International is being undervalued by a cautious market, or if future upside is already factored in.

Most Popular Narrative: 18.5% Undervalued

Compared to the recent closing price, the narrative’s fair value points to a significant gap. This highlights a potential opportunity that captures analysts’ attention and sets the tone for a deeper look at what is really driving sentiment and where expectations could land next.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time.

Want to know what bold growth forecasts justify this valuation? The narrative is fueled by aggressive expansion plans and a profit outlook that rivals blue-chip expectations. The real surprise is which quantitative levers have the biggest impact on the target valuation. See how these projections set the stage for the next big move.

Result: Fair Value of $188 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in cigarette demand or regulatory shifts in key markets could challenge Philip Morris International's bullish narrative and future growth outlook.

Find out about the key risks to this Philip Morris International narrative.

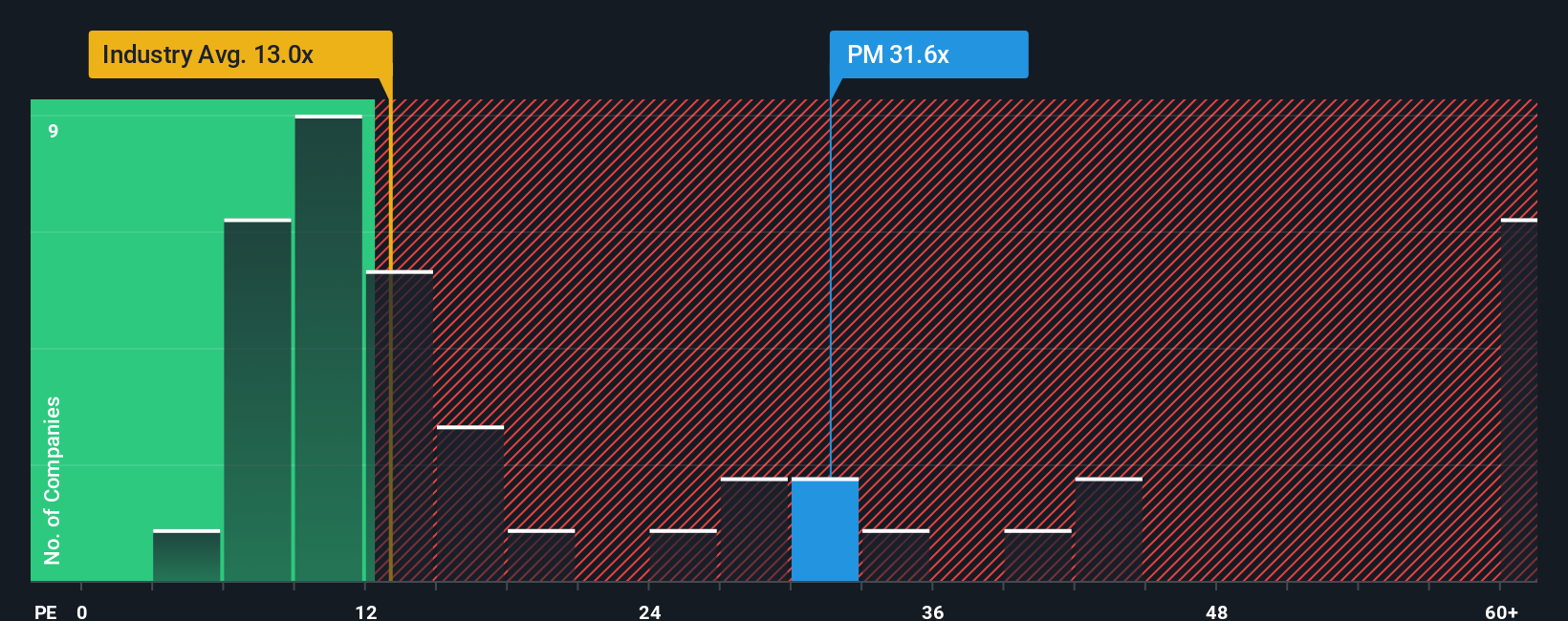

Another View: Testing Value with Market Ratios

While our primary narrative sees Philip Morris International as strongly undervalued, a quick reality check against the price-to-earnings ratio gives a more measured take. The company’s ratio of 27.7 times is well above its global tobacco peers at 14.8 times and higher than the peer group average at 19.2 times. However, this multiple sits just below the estimated fair ratio of 29.8 times. This suggests that the market may already be weighing up the company’s growth prospects and risks. Could this set investors up for disappointment or surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If you’re curious about shaping your own view or want to dig deeper into the numbers, the narrative is yours to build in just a few minutes. You can Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the curve and put yourself in the best position to catch tomorrow’s winners. Time spent now could mean you never miss a big opportunity again.

- Supercharge your strategy by targeting steady income streams through these 19 dividend stocks with yields > 3%, featuring companies with yields that outpace the market.

- Accelerate your portfolio’s potential and ride the AI wave by checking out these 27 AI penny stocks, set to capitalize on artificial intelligence breakthroughs.

- Strengthen your peace of mind by searching for value with these 869 undervalued stocks based on cash flows, where resilient businesses are trading below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives