- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM): Evaluating Valuation After Strong Growth in Smoke-Free Products and Upgraded Outlook

Reviewed by Simply Wall St

Philip Morris International (NYSE:PM) just released its second-quarter numbers, and the market took notice for good reason. The company’s smoke-free portfolio—such as IQOS heated tobacco, ZYN nicotine pouches, and VEEV e-vapor—drove notable jumps in shipment volume, revenue, and gross profit over last year. Management’s optimism is evident as they adjust their growth outlook upward for smoke-free product volumes. This is not just another quarterly update; it is a clear marker that Philip Morris’s transformation strategy is gaining speed and catching investor attention.

Looking at the bigger picture, the past year has been strong for Philip Morris International, with the stock up 41% and gaining momentum from smoke-free product adoption. The company is now generating over 40% of revenue and gross profit from products that are newer bets, not legacy cigarettes. This sets Philip Morris apart in the usually slow-growing tobacco sector. Investors have observed cigarette volumes edging lower, but the faster expansion in high-margin alternatives is starting to outweigh those declines and influence valuation debates.

With the share price rallying and management setting ambitious targets, the question is whether Philip Morris stock is still attractively priced for future gains or if the market has already factored in this accelerated growth story.

Most Popular Narrative: 12% Undervalued

The dominant narrative sees Philip Morris International as undervalued, based on a substantial gap between consensus fair value and the current share price.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time.

How do analysts arrive at such a bullish target? There are bold forecasts behind the scenes. Think significant margin expansion, surging non-cigarette sales, and a growth rate not typical for legacy tobacco giants. Want to know which single financial lever could be the biggest swing factor for PMI's future worth? The numbers might surprise you.

Result: Fair Value of $190.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heightened regulatory risks in Europe or a slowdown in smoke-free adoption could quickly temper these bullish expectations for Philip Morris International's future growth.

Find out about the key risks to this Philip Morris International narrative.Another View: Market Valuation Sends a Different Signal

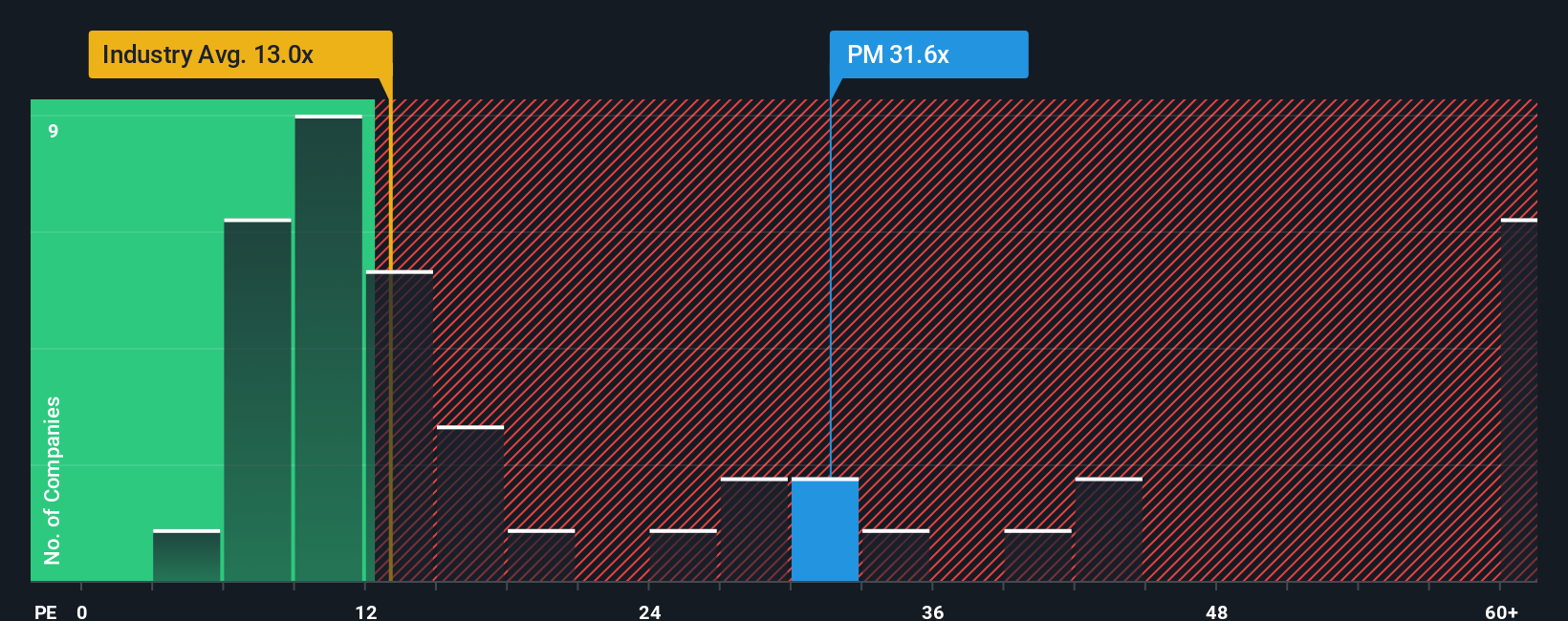

But looking from a different angle, the market-based valuation presents a less optimistic story. Compared to the global average, the company's current share price appears high for its sector. Are expectations running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Philip Morris International to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Philip Morris International Narrative

If you have a different perspective or want to dig into the numbers yourself, creating your own analysis takes just a few minutes. Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors know that opportunity does not wait around, and the next breakthrough could already be catching momentum. Uncover your next portfolio move with a world of stock ideas available right now in the Simply Wall Street Screener.

- Capture streams of reliable income by tracking companies offering dividend stocks with yields > 3% and secure cash flows with yields above 3%.

- Spot emerging trends in healthcare technology with leading healthcare AI stocks to stay ahead as medical innovation accelerates.

- Seize overlooked bargains and build confidence in your picks by hunting for undervalued stocks based on cash flows that the market has not caught onto yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PM

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives