- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM): A Fresh Look at Current Valuation and Market Sentiment

Reviewed by Simply Wall St

See our latest analysis for Philip Morris International.

After a mixed stretch this quarter, Philip Morris International’s 1-year total shareholder return stands at 23.15%, reflecting solid value for long-term holders even as short-term momentum has cooled. The year-to-date share price return of 29.22% hints at underlying optimism, likely driven by shifts in both its smoke-free segment and investor sentiment toward the broader tobacco sector.

If you’re weighing new ideas beyond traditional tobacco, now is a great time to discover fast growing stocks with high insider ownership.

With Philip Morris International trading nearly 17% below consensus analyst price targets and at a 23% intrinsic discount to its estimated fair value, is the market offering a genuine buying opportunity, or is anticipated growth already reflected in the price?

Most Popular Narrative: 14.6% Undervalued

With Philip Morris International closing at $156.49, the most popular narrative puts its fair value higher, making the valuation case hard to ignore. Enthusiasm for the company’s transformation and future profit engine is driving this bullish divergence from the market price.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time.

Want to unlock the numbers behind this valuation leap? This narrative pivots on a set of bold growth assumptions and a profit expansion pace that could surprise even sector veterans. Ready to see what forecasts make this case so compelling? Dive in and discover the pillars holding up this striking fair value calculation.

Result: Fair Value of $183.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory headwinds or a sharper-than-expected drop in cigarette demand could present challenges to the bullish outlook and put pressure on future profitability.

Find out about the key risks to this Philip Morris International narrative.

Another View: Multiples Raise a Red Flag

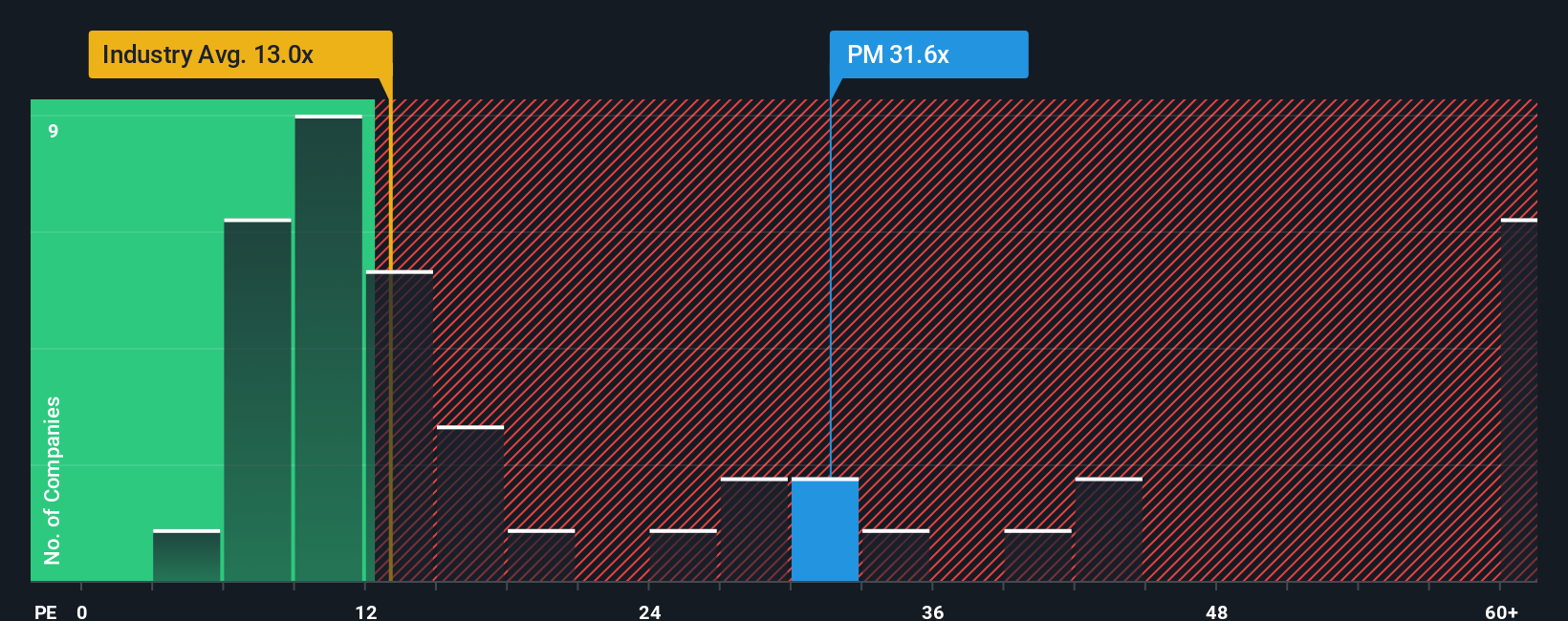

Looking at valuation from a different angle, Philip Morris International is trading at a price-to-earnings ratio of 28.3x. That is not just higher than the peer average of 23.8x, but also above the global tobacco industry’s average of just 14.1x and above our fair ratio estimate of 26.9x. This premium suggests the market already bakes in a lot of optimism. The question is whether the real opportunity lies in the price, or if risk is increasing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If you see the story differently or want to dig into the numbers yourself, it is easy to build your own perspective in just a few minutes with Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at one great opportunity. Real wealth is built by spotting tomorrow’s winners early. There are exciting alternatives just waiting for you to notice them.

- Tap into income potential by examining these 15 dividend stocks with yields > 3%, featuring companies offering robust yields above 3% that could boost your regular returns.

- Unlock innovation by scanning these 30 healthcare AI stocks to connect with businesses applying artificial intelligence to solve healthcare’s biggest challenges.

- Catch the next market surge with these 81 cryptocurrency and blockchain stocks, where digital leaders in blockchain and cryptocurrency are reshaping how the world transacts and stores value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success