- United States

- /

- Tobacco

- /

- NYSE:PM

How New Credit Lines and Dividend Policy Will Impact Philip Morris International (PM) Investors

Reviewed by Sasha Jovanovic

- Earlier in December, Philip Morris International’s board declared a regular quarterly dividend of US$1.47 per share, payable on January 14, 2026, to shareholders of record and ex-dividend as of December 26, 2025.

- On the financing side, PMI lined up a new US$2.00 billion revolving credit facility and extended a separate €1.50 billion line, reinforcing its liquidity while it leans into higher-margin smoke-free products after a stronger-than-expected quarter.

- We’ll now examine how PMI’s new US$2.00 billion revolving credit facility and extended liquidity reshape its existing investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Philip Morris International Investment Narrative Recap

To own Philip Morris International today, you generally need to believe that its shift toward smoke-free products can more than offset the structural decline in cigarettes, while funding this transition without overextending its balance sheet. The new US$2.00 billion revolving credit facility and extended €1.50 billion line enhance liquidity but do not materially change the near term catalyst of smoke-free growth or the key risk of slower-than-expected adoption.

The most relevant update here is the replacement and extension of PMI’s US$2.00 billion revolving credit facility out to 2031. This, combined with the longer-dated €1.50 billion facility, supports ongoing investment in higher-margin products like ZYN and IQOS at a time when PMI has paused buybacks and is focusing on dividends and deleveraging after the Swedish Match deal, reinforcing the financial flexibility behind the smoke-free growth story.

Yet while liquidity looks secure, the real risk investors should be aware of is whether smoke-free growth can consistently offset declining combustible volumes and...

Read the full narrative on Philip Morris International (it's free!)

Philip Morris International's narrative projects $49.4 billion revenue and $14.5 billion earnings by 2028. This requires 8.2% yearly revenue growth and about a $6.3 billion earnings increase from $8.2 billion today.

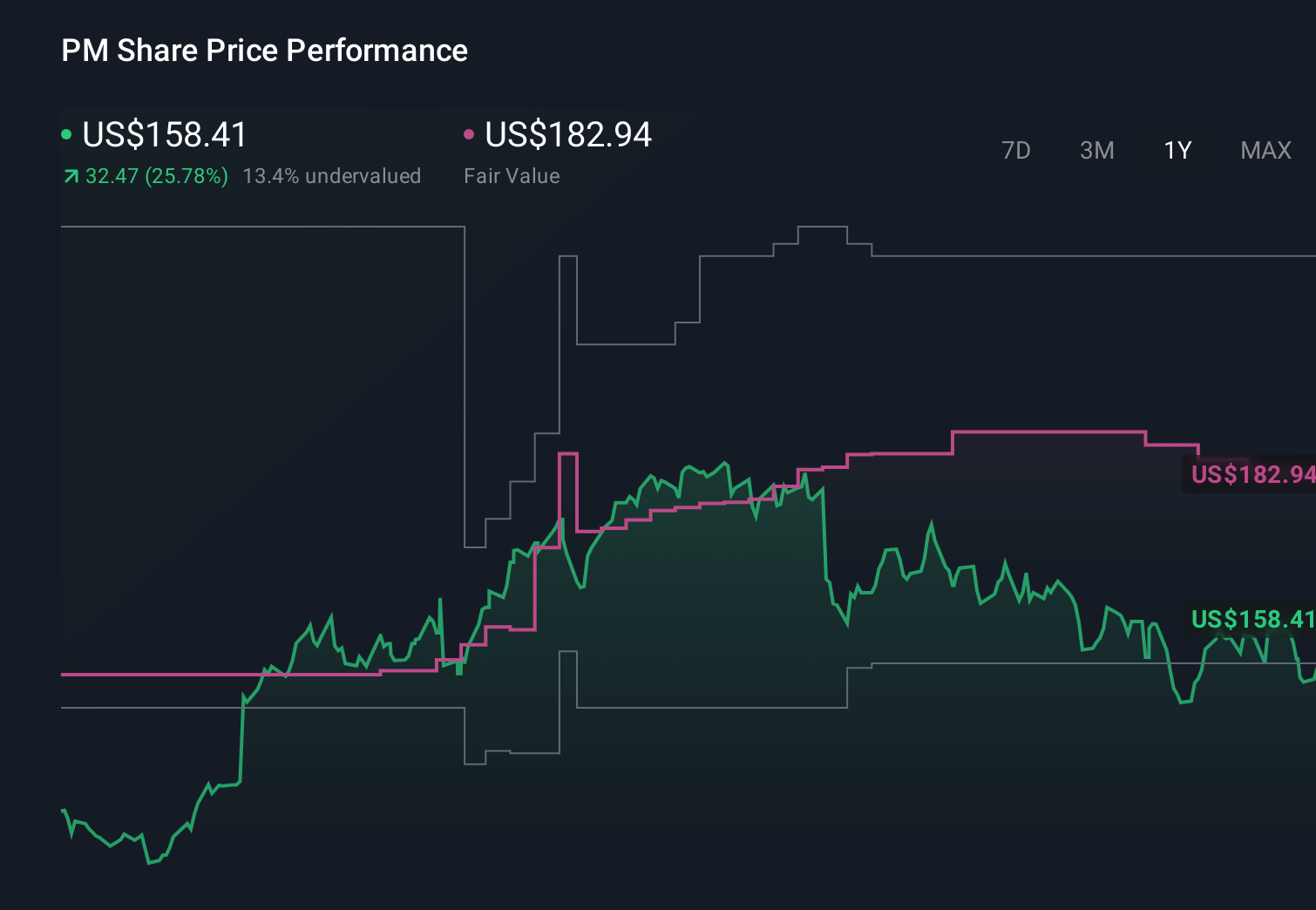

Uncover how Philip Morris International's forecasts yield a $182.94 fair value, a 15% upside to its current price.

Exploring Other Perspectives

The most bullish analysts were penciling in revenue of about US$53.2 billion and earnings of US$15.7 billion by 2028, which is far more optimistic than consensus on how quickly smoke-free products can grow and absorb regulatory and ESG pressures. This new credit facility could either support that bolder view or prompt revisions, so it is worth weighing both narratives before you decide where you stand.

Explore 11 other fair value estimates on Philip Morris International - why the stock might be worth as much as 38% more than the current price!

Build Your Own Philip Morris International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Philip Morris International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Philip Morris International's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion