- United States

- /

- Tobacco

- /

- NYSE:MO

Is There Now an Opportunity in Altria Group After Recent Moves Beyond Traditional Tobacco?

Reviewed by Bailey Pemberton

- Ever wondered if Altria Group is offering real value right now, or if the ship has already sailed? Let’s dig into the numbers and recent movements to find out what is really driving the stock.

- Altria shares have seen a modest 0.3% lift over the last week, but are still up 10.8% year-to-date and 11.6% over the past year, despite a recent 10.5% dip in just the past month.

- Recently, Altria has been making headlines with its efforts to innovate beyond traditional tobacco, particularly with moves in the heated tobacco and nicotine pouch markets. News around its strategic partnerships and diversification efforts has brought new perspective to the factors shifting the stock’s momentum.

- The stock currently scores 5 out of 6 on our value checks, suggesting it offers interesting upside potential. We will break down those valuation methods next, and at the end of the article we will also discuss a smarter, more holistic approach to valuation.

Find out why Altria Group's 11.6% return over the last year is lagging behind its peers.

Approach 1: Altria Group Discounted Cash Flow (DCF) Analysis

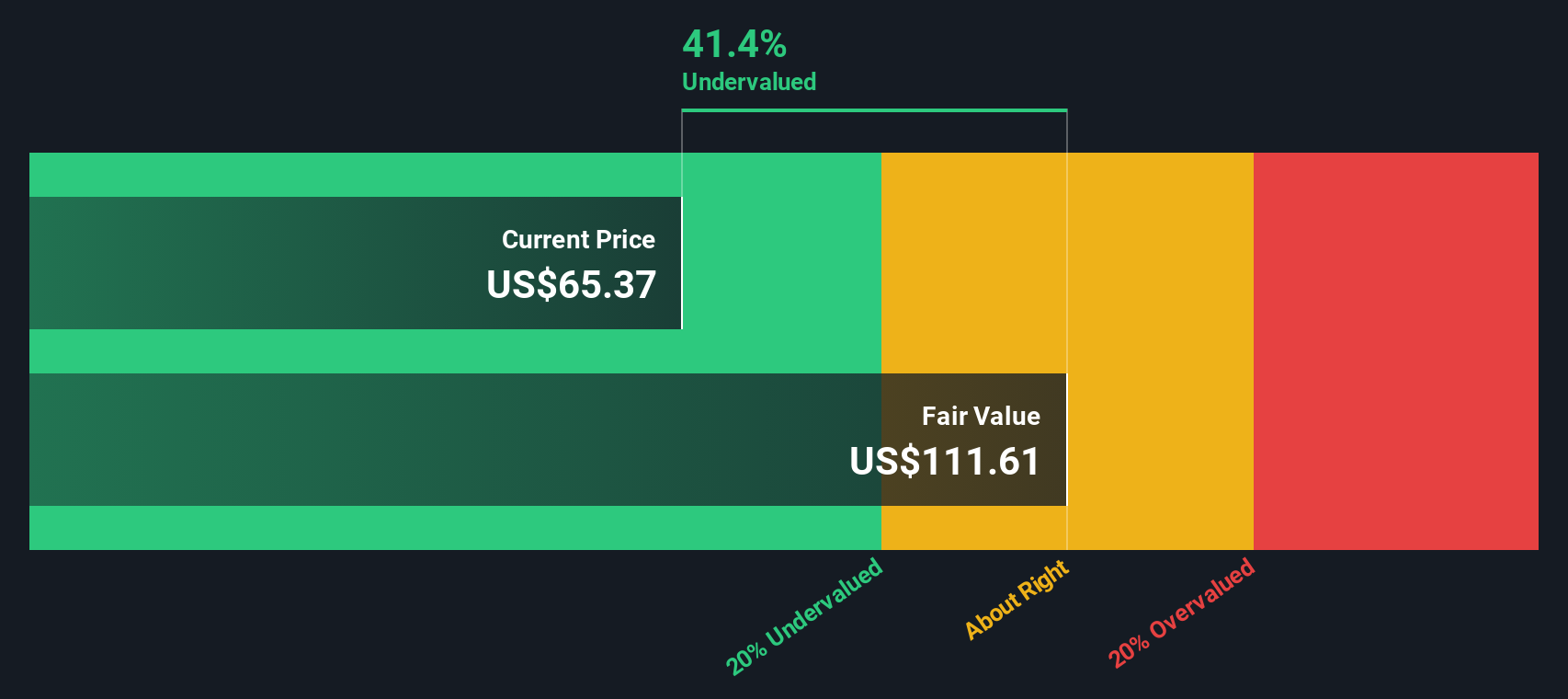

The Discounted Cash Flow (DCF) method estimates a company’s true value by projecting its future cash flows and discounting them to today's dollars. This approach helps investors determine whether a stock is trading below or above its intrinsic worth based on the business’s ability to generate cash over time.

For Altria Group, current Free Cash Flow stands at $9.19 billion. Analysts provide forecasts up to 2027, showing a slight dip to $9.09 billion. Beyond that, projections are extrapolated, with Free Cash Flow expected to gradually rise and reach $10.8 billion by 2035. All these figures are in US dollars, offering a clear perspective on the company’s long-term cash-generating power.

Applying the DCF model, Altria's estimated intrinsic, or fair, value is $103.18 per share. Compared to the current trading price, this implies the stock is about 43.6% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Altria Group is undervalued by 43.6%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Altria Group Price vs Earnings (PE Ratio)

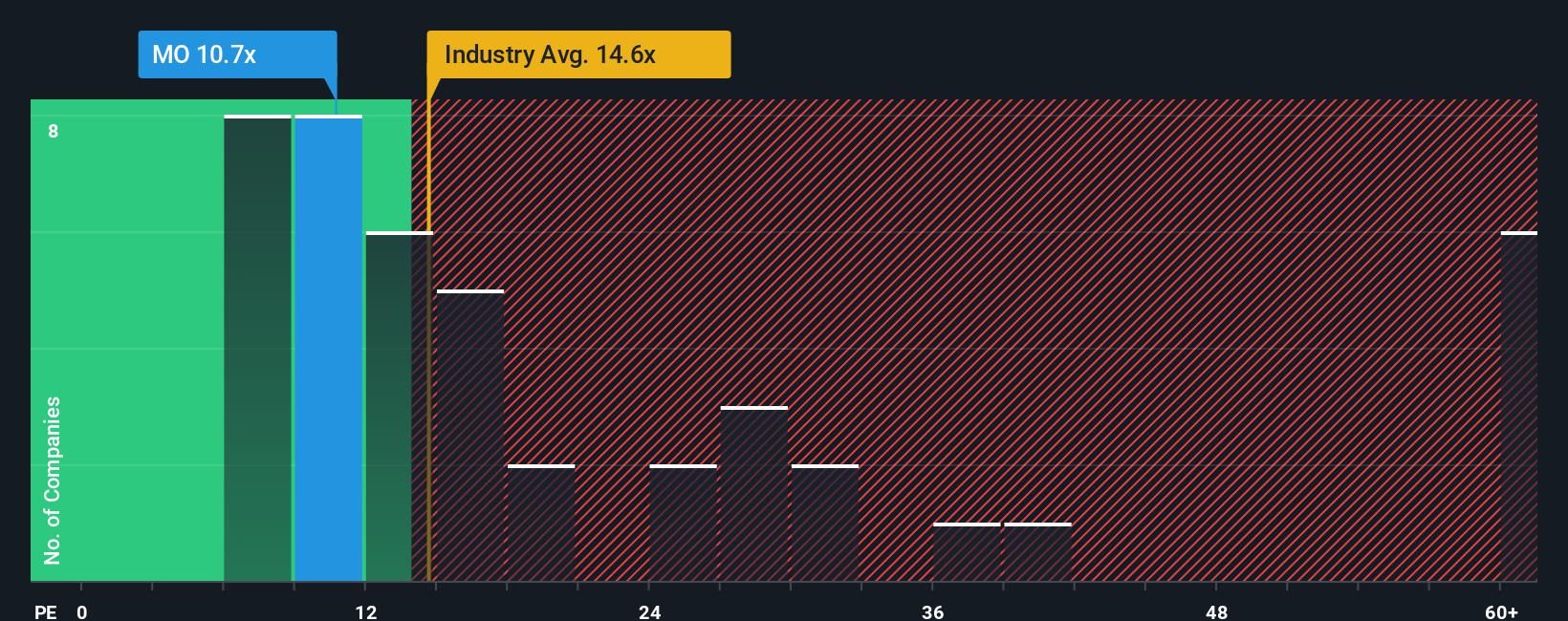

The Price-to-Earnings (PE) ratio is often the preferred valuation metric for profitable companies like Altria Group because it directly relates a company’s share price to its per-share earnings. This makes it a clear and widely used gauge for understanding how much investors are willing to pay for current and future profits.

While the PE ratio is a handy shorthand, what counts as a “normal” or “fair” PE depends on a company’s growth outlook and risk level. Companies with higher expected earnings growth or lower risk typically warrant higher PE ratios. Conversely, firms with slower growth or more uncertainty usually trade at lower multiples.

Altria’s current PE ratio stands at 11x. Compared to the average for Tobacco industry peers at 14.9x and the wider peer group average of 21.1x, Altria is trading at a notable discount. However, instead of just looking at these raw comparisons, it is smart to consider the “Fair Ratio” developed by Simply Wall St, which factors in Altria’s growth prospects, profitability, risk profile, industry standards, and even its market capitalization. For Altria, the calculated Fair Ratio is 18.5x.

The advantage of the Fair Ratio is that it moves beyond simple averages, delivering a nuanced benchmark that takes into account more company-specific drivers. This gives investors a more comprehensive view of what multiple Altria may warrant based on its fundamentals and outlook.

When comparing Altria’s current PE of 11x to its Fair Ratio of 18.5x, the stock appears to be trading well below what would be expected given its characteristics, which may suggest the shares are undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Altria Group Narrative

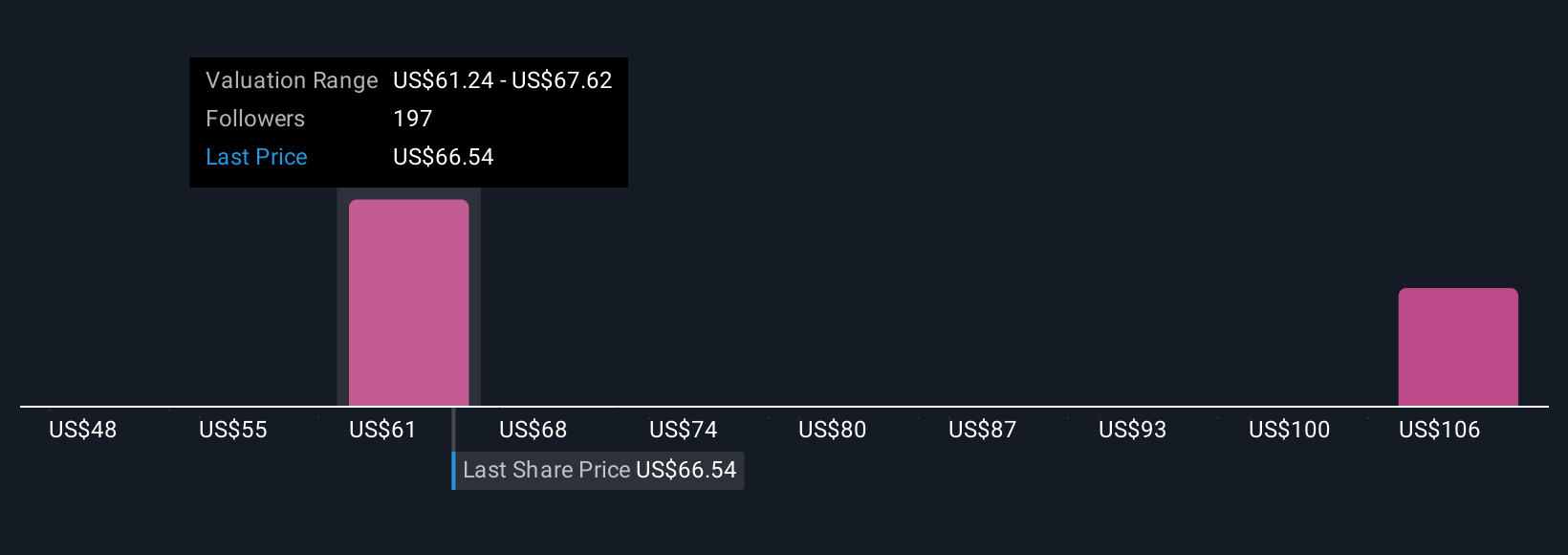

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective behind a company’s numbers; it connects how you see Altria’s future (like growth, margins or risks) to the financial forecasts and fair value you believe are most reasonable.

With Narratives, you are not just relying on one-size-fits-all metrics. Instead, you link your view of the business to your own numbers for future revenue, earnings, and margins, and see how those assumptions translate into a fair value today. Narratives are available to everyone on Simply Wall St’s Community page, giving you an accessible and dynamic way to check your investment logic, compare Fair Value against the current Price, and decide for yourself when to buy or sell.

Narratives are always being updated, so when big news or earnings reports are released, the community’s views and fair values evolve automatically. For Altria Group, you will see a wide range of investor Narratives. For example, some believe tough competition and margin pressure mean fair value is just $49 per share, while others expect brand strength and a robust dividend to drive a much higher $73 fair value.

Do you think there's more to the story for Altria Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MO

Altria Group

Through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives