- United States

- /

- Food

- /

- NYSE:LW

Lamb Weston (LW): Evaluating Valuation After Recent Share Price Slide

Reviewed by Simply Wall St

See our latest analysis for Lamb Weston Holdings.

Lamb Weston Holdings' share price has been sliding recently, losing over 13% in the past month and down nearly 15% so far this year. While the company has posted steady annual revenue and profit growth, momentum has clearly faded, with the one-year total shareholder return still deep in negative territory at -23.2%.

If you’re wondering where else to look in the food sector, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below recent highs and analyst targets, the question is whether Lamb Weston is undervalued based on its fundamentals, or if the market is already factoring in softer future growth. Could there be a buying opportunity here, or is caution warranted?

Most Popular Narrative: 14.9% Undervalued

Lamb Weston’s fair value according to the most widely followed narrative is $66, compared to a last close of $56.18. This sets the stage for a bullish outlook anchored in operational momentum, but the analysis also weighs long-term growth headwinds and cost factors.

The global expansion of QSRs and modernization of foodservice channels, especially in emerging markets, is creating new distribution opportunities for Lamb Weston. The company's focus on strategic investments in priority global markets positions it to capture this demand, potentially driving sustained volume growth and topline revenue expansion.

Want to see what’s driving this valuation? High-margin global growth, rising earnings and a projected profit multiple are just the headline numbers. The real surprise is how each of these pieces fits together in the narrative’s calculation. Ready to unlock the precise projections and catalysts behind the fair value? Dive in for the full story.

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent headwinds from competitive pricing or long-term shifts in consumer preferences could quickly dampen even the most optimistic recovery outlook for Lamb Weston.

Find out about the key risks to this Lamb Weston Holdings narrative.

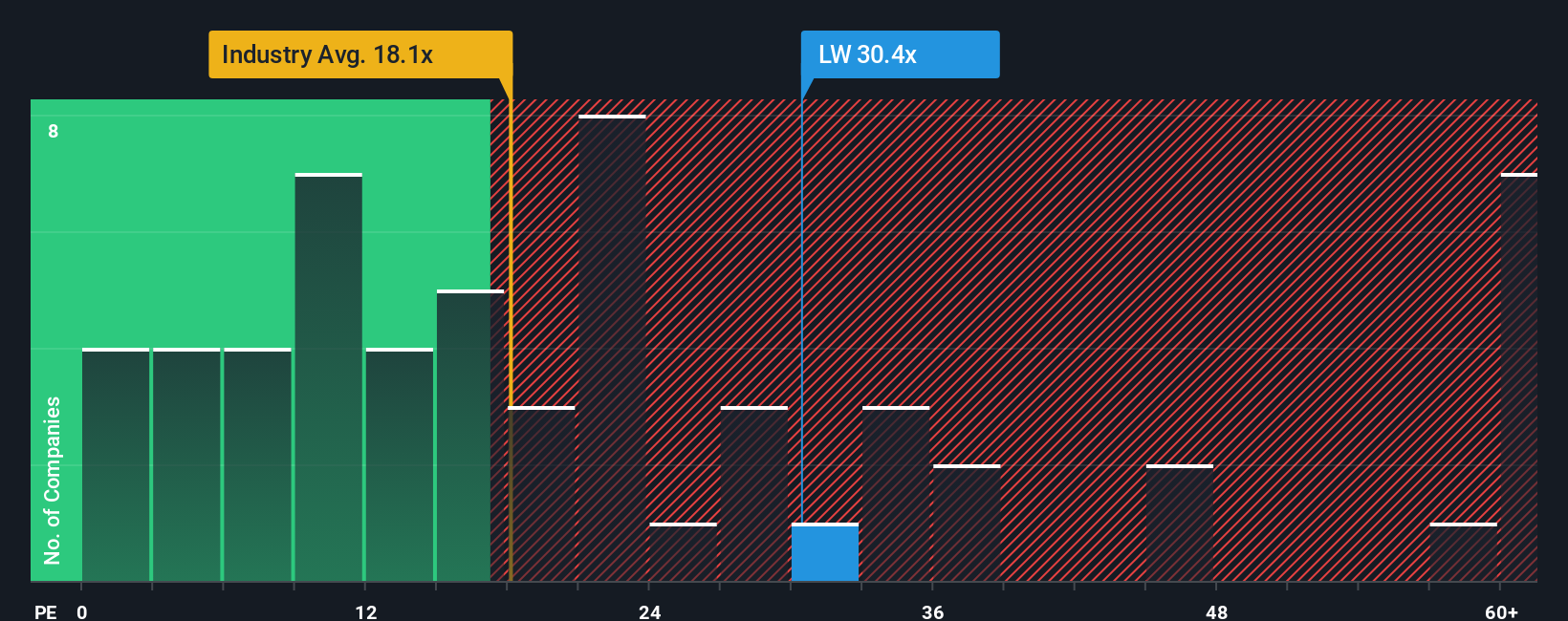

Another View: Market Ratios Paint a Cautionary Picture

While the fair value narrative suggests Lamb Weston is undervalued, market price-to-earnings ratios tell a different story. Lamb Weston is trading at 26.6 times earnings, which is far higher than both peer (12.1x) and industry averages (19.5x). Even the so-called fair ratio of 22.9x is lower than Lamb Weston’s current multiple. This sizable gap may signal added valuation risk if expectations shift. Is the market seeing something the models are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lamb Weston Holdings Narrative

If the current valuations or narratives do not fully align with your perspective, you can quickly piece together your own viewpoint using the same data. This process takes less than 3 minutes. Do it your way

A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next great opportunity pass you by. Take charge of your portfolio and find unique stocks with the potential to outperform the market.

- Uncover new potential by tracking these 906 undervalued stocks based on cash flows, which have attractive price tags and robust fundamentals right now.

- Target future-defining sectors when you check out these 31 healthcare AI stocks, advancing innovation in patient care, intelligent diagnostics, and biotech breakthroughs.

- Maximize passive income by researching these 18 dividend stocks with yields > 3%, offering yields above 3% and reliable, growing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives