- United States

- /

- Food

- /

- NYSE:LW

Lamb Weston (LW): Assessing Valuation as Investor Sentiment Shifts and Recovery Hopes Build

Reviewed by Simply Wall St

See our latest analysis for Lamb Weston Holdings.

Over the past year, Lamb Weston Holdings has seen total shareholder returns fall 17.9%, even with a 13% share price rebound in the last 90 days. This recent price movement signals a shift in momentum. After a tough stretch, recent price action suggests that investors are reassessing growth potential and risk as the business navigates an evolving landscape.

If you’re weighing your next move, this could be the perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

The important question for investors now is whether Lamb Weston is trading below its true value, or if the current share price already reflects all expected growth ahead. Is there a genuine buying opportunity? Alternatively, has the market already priced it all in?

Most Popular Narrative: 6.5% Undervalued

Compared to Lamb Weston Holdings' latest close of $61.73, the most popular narrative sets a fair value at $66 per share. This signals that consensus expects the share price to climb further as the company's recovery story unfolds.

Continued momentum is anticipated from the return of price and mix contributions to growth. Analysts regard this as a key catalyst for future valuation improvement.

There is more beneath the surface. The narrative relies on bold profit margin rebound, long-term revenue gains, and a future earnings multiple that outpaces sector norms. Eager to see what aggressive financial forecasts back this target? Dive in to see what is driving the optimism.

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in restaurant traffic and competitive pricing pressures could still challenge Lamb Weston’s margin recovery and future growth trajectory.

Find out about the key risks to this Lamb Weston Holdings narrative.

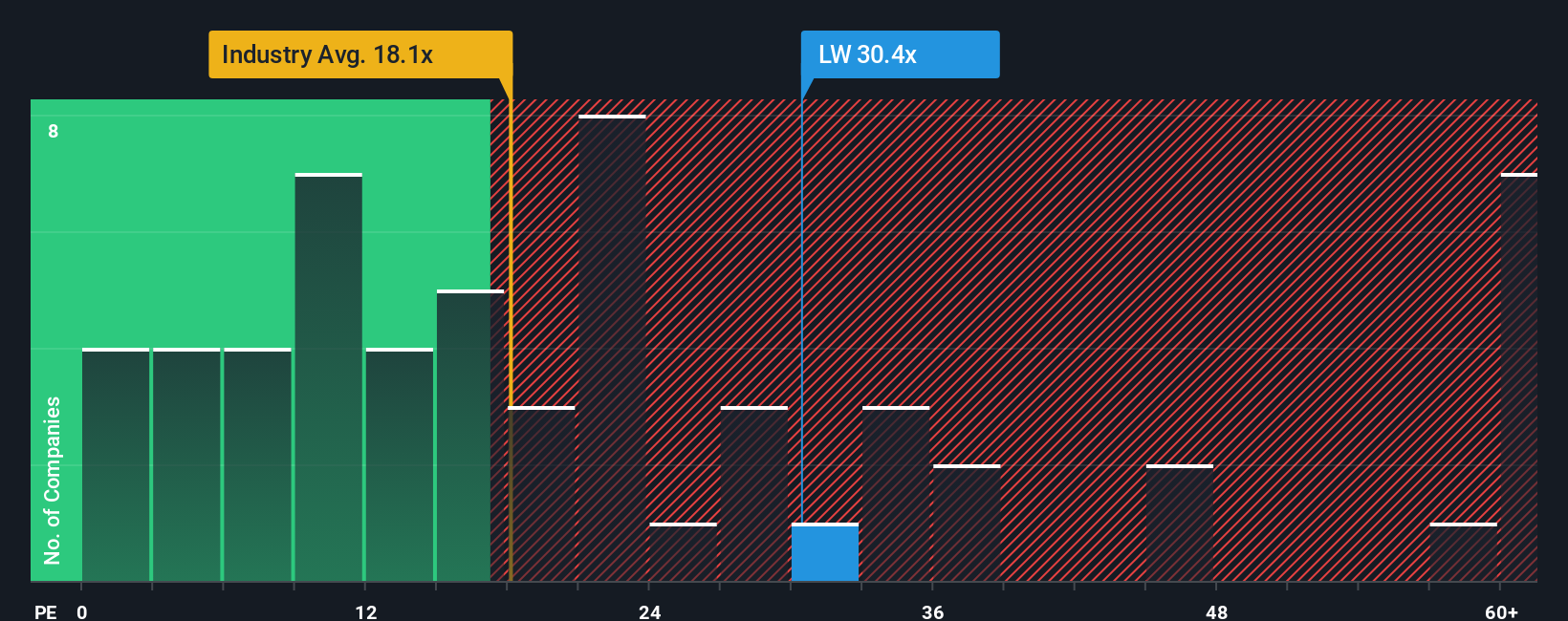

Another View: Valuation Based on Price-To-Earnings Ratios

When viewed through the lens of the price-to-earnings ratio, Lamb Weston looks expensive. Its current multiple of 29.2x stands well above both the US Food industry average of 17.8x and the peer average of 10.5x. It even exceeds the fair ratio of 23.2x that the market could revert to. This premium pricing may signal valuation risk if expectations are not met, raising the question: could the stock's current price be vulnerable to a correction, or is the premium deserved for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lamb Weston Holdings Narrative

If you think there’s more to the story, or want to weigh the numbers for yourself, you can build your own conclusion in just a few minutes. Do it your way

A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready to Find Your Next Big Idea?

Level up your portfolio by taking action today. Don’t miss out on opportunities most investors overlook. Tap into these top lists and outsmart the crowd.

- Maximize your search for steady cash flow by zeroing in on income-rich opportunities with these 22 dividend stocks with yields > 3% offering robust yields above 3%.

- Step into the future of medicine and technology with these 33 healthcare AI stocks, where healthcare meets cutting-edge artificial intelligence for tomorrow’s breakthroughs.

- Catch trends early and seize your edge by reviewing these 81 cryptocurrency and blockchain stocks fueling the blockchain and digital currency revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives