- United States

- /

- Beverage

- /

- NYSE:KO

Is Coca-Cola Attractively Priced After 11.4% Rally and Emerging Market Expansion?

Reviewed by Bailey Pemberton

- Ever wondered whether Coca-Cola is a great value buy or if the current price tag is simply the cost of owning an iconic brand? Let’s dig in, especially if you’re curious about what’s truly behind the ticker.

- The stock has seen its fair share of action lately, dipping 1.7% over the last week but posting a solid 11.4% gain for the year so far.

- News has been swirling about Coca-Cola's strategic product launches and an increased focus on emerging markets. Investors are watching closely as global beverage trends shift. These headlines have added fresh context to recent price swings and indicate that significant movements may be ahead.

- When it comes to valuation, Coca-Cola scores a 3 out of 6 on our checks for being undervalued. See the full breakdown here. We’ll cover a few classic approaches to valuation next, but stay tuned, because we will also show you a smarter way to interpret what all this really means by the end of the article.

Approach 1: Coca-Cola Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting those cash flows back to today's value. This approach tries to answer what Coca-Cola is worth based on what it can earn in the years ahead, all expressed in today’s dollars.

Coca-Cola’s latest twelve-month Free Cash Flow sits at just under $5.6 Billion. Analysts forecast this will rise significantly, projecting annual increases in cash flow over the next five years. By 2029, Simply Wall St’s model, using a combination of analyst estimates and further extrapolation, expects Coca-Cola’s annual Free Cash Flow to reach roughly $15.2 Billion.

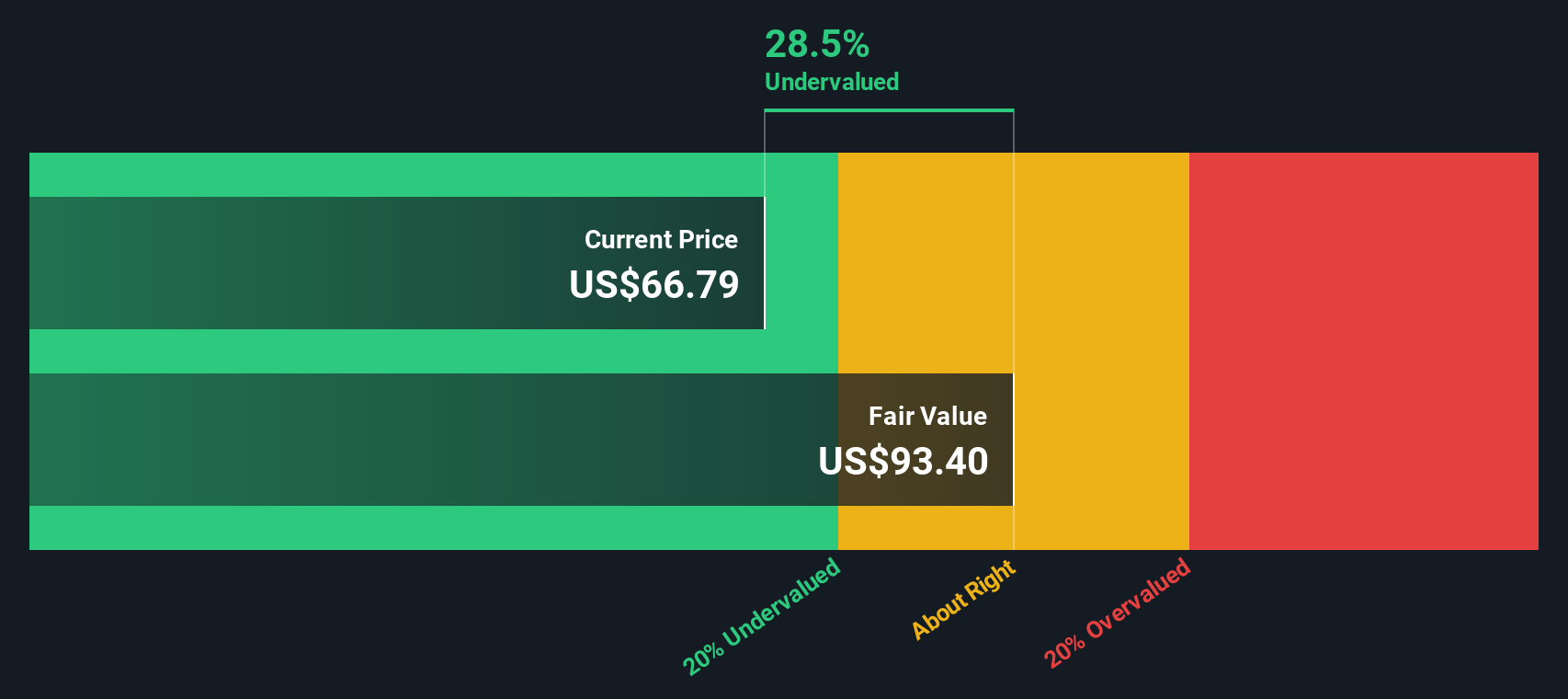

After plugging these numbers into a 2 Stage Free Cash Flow to Equity DCF model, the estimated intrinsic value per share comes out to $90.61. Compared to its current share price, this signals that the stock is trading at a 24.0% discount to its estimated fair value.

In simple terms, the DCF suggests Coca-Cola shares are undervalued based on future cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola is undervalued by 24.0%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Coca-Cola Price vs Earnings

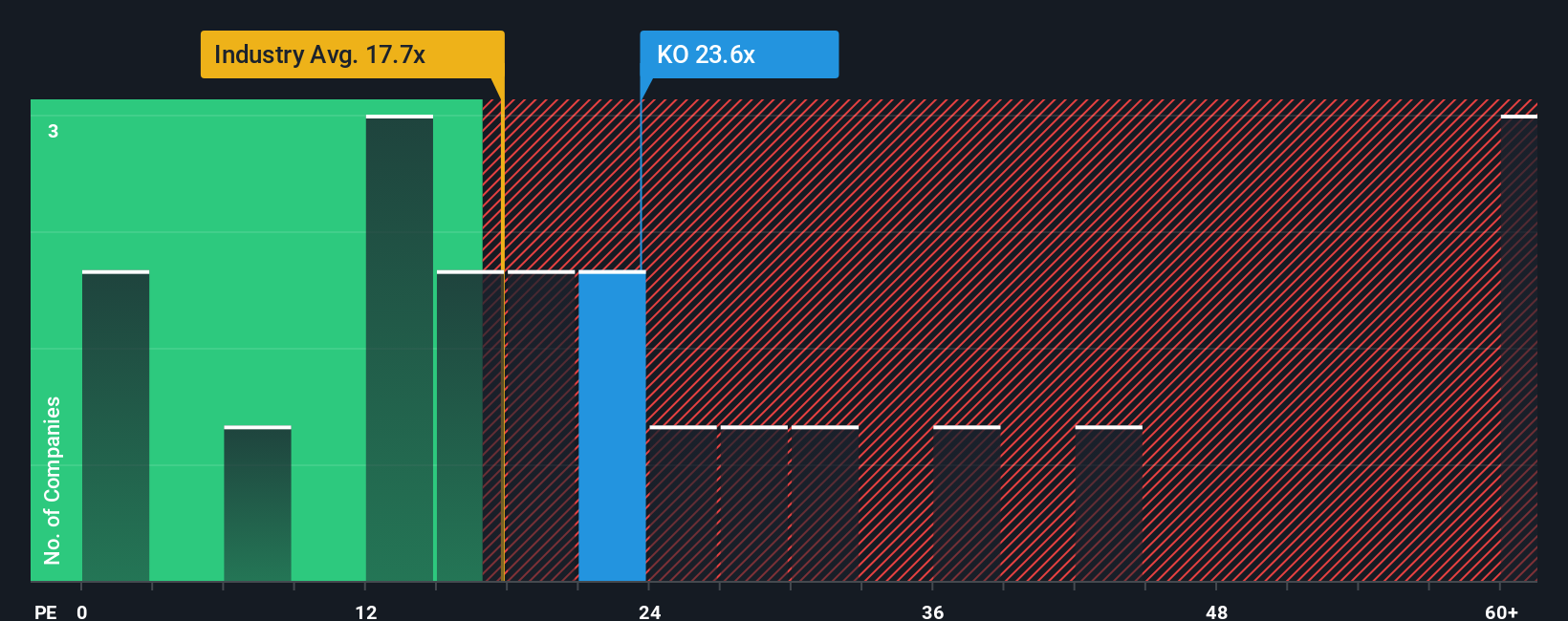

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies, such as Coca-Cola, because it tells investors how much they are paying for each dollar of earnings today. This makes it especially relevant for established businesses that generate consistent profits.

It is important to remember that growth expectations and risk profiles have a significant influence on what is considered a "normal" or "fair" PE ratio. Higher growth companies or those with less perceived risk can often justify a higher PE, while slower growers or riskier companies tend to warrant a lower multiple.

Currently, Coca-Cola trades on a PE ratio of 22.7x. This sits just above the Beverage industry average of 17.6x, but it is lower than the typical peer average at 26.7x. Using Simply Wall St's proprietary metric, the Fair Ratio for Coca-Cola is calculated at 22.6x.

The Fair Ratio stands out because, unlike simple peer or industry comparisons, it incorporates a range of important factors including Coca-Cola’s earnings growth outlook, profit margin, industry trends, market cap, and even relevant company-specific risks. This presents a more holistic and tailored valuation benchmark for investors.

Since Coca-Cola’s current PE of 22.7x is almost identical to its Fair Ratio of 22.6x, the stock appears to be valued about right based on this analysis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

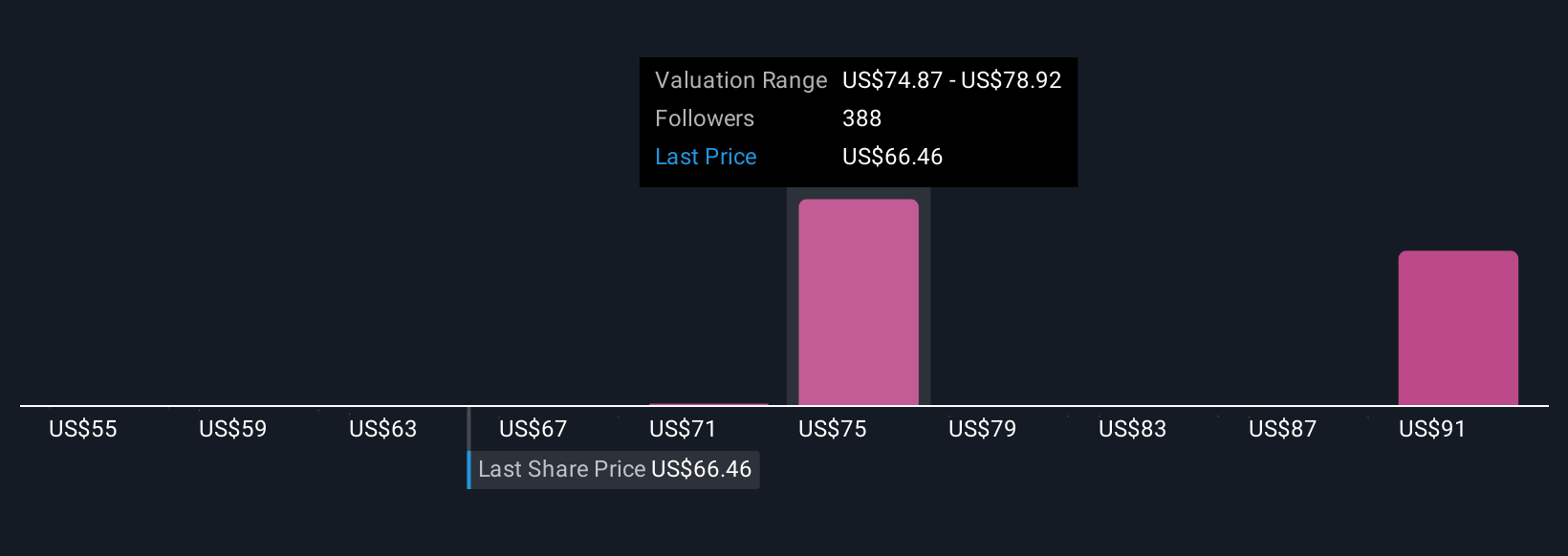

Upgrade Your Decision Making: Choose your Coca-Cola Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your investment story: the perspective that you, as an investor, use to connect what you believe about Coca-Cola’s future (like growth, margins, and fair value) to the actual numbers driving its financial forecasts. Rather than relying only on ratios or models, Narratives help you anchor your investment decision in what you think really matters about Coca-Cola, whether that’s its global growth, resilience in a downturn, or innovations in health-focused drinks.

With Narratives, available on the Simply Wall St Community page, millions of investors can put their own estimates side by side with others, see how their assumptions stack up, and track changes as new company news or earnings come in. This makes it a dynamic, always-updated investment tool. Narratives make it much easier to see at a glance if the Price is above or below your own Fair Value and help you decide when it might be time to buy, hold, or sell.

For example, some investors see Coca-Cola’s fair value as low as $67 if they’re wary of soft drink headwinds and regulatory risks, while the most optimistic expect it to be as high as $85, banking on premium growth opportunities, resilient margins, and a falling discount rate.

For Coca-Cola, we will make it easy for you by providing previews of two leading Coca-Cola Narratives:

Fair Value: $71.00

Currently trading at approximately 2.96% below this fair value.

Revenue Growth Rate: 6.64%

- Coca-Cola’s stability, decades-long dividend growth, and low volatility make it attractive for conservative and income-focused investors, especially during periods of economic uncertainty.

- The company’s digital transformation and expansion into emerging markets are key growth drivers. These efforts also present risks, such as currency volatility and potential regulatory changes.

- Despite challenges including new tariffs or environmental criticism, efficient management and a strong core business support a fair valuation, with balanced share buyback and dividend policies.

Fair Value: $67.50

Currently trading at approximately 2.07% above this fair value.

Revenue Growth Rate: 5.23%

- The recent Fed rate cut has increased intrinsic value for Coca-Cola. However, small changes in discount rates have a noticeable impact, making the stock sensitive to macroeconomic shifts.

- Although KO maintains best-in-class margins, strong cash flow, and defensive appeal, future growth may moderate as premium valuations become harder to justify and regulatory risks increase over the long term.

- Current valuations are just slightly above fair value, so the stock remains attractive compared to bonds, especially for yield-focused investors. Upside could be limited if growth slows.

Do you think there's more to the story for Coca-Cola? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives