- United States

- /

- Beverage

- /

- NYSE:KO

Coca-Cola (KO): Exploring Valuation After Recent Steady Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Coca-Cola.

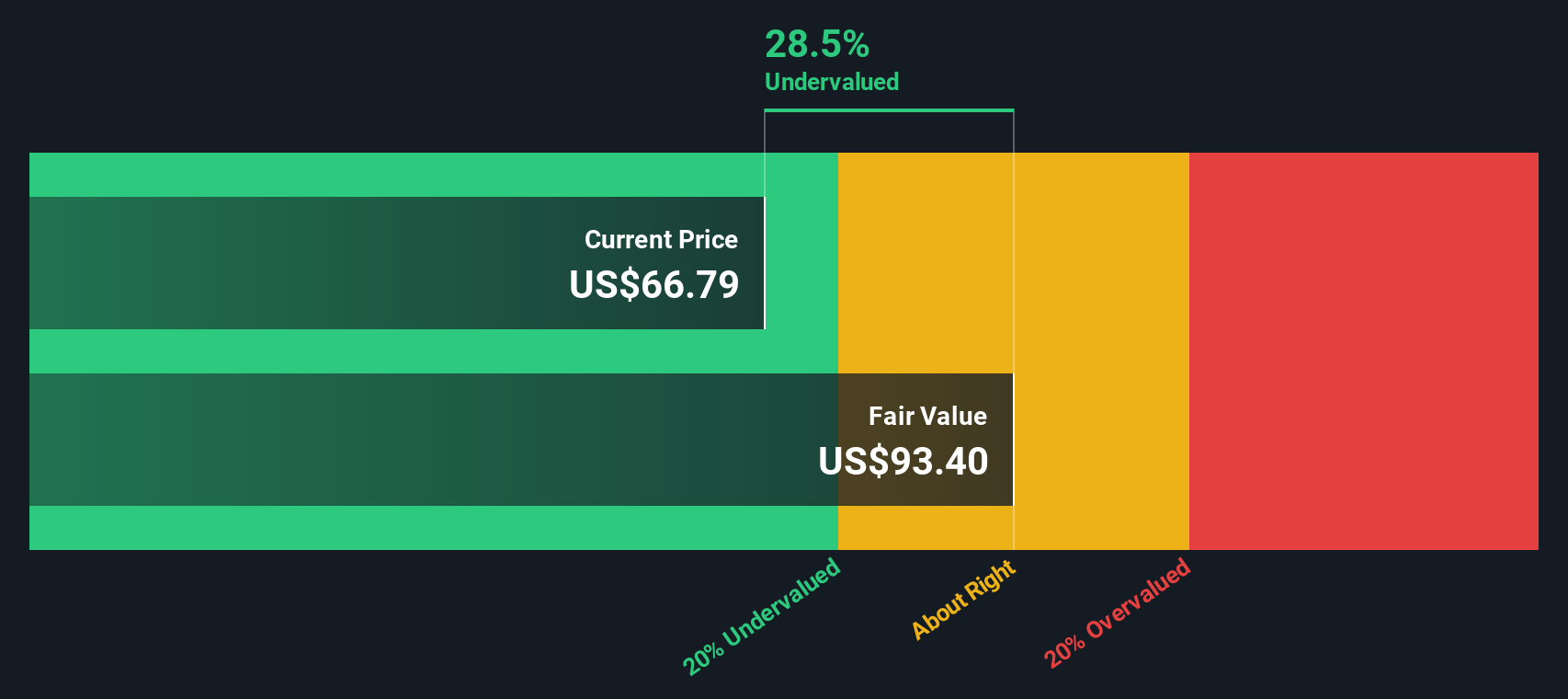

Coca-Cola’s share price has been quietly building momentum, with a 4% rise over the past month and a solid 11.6% year-to-date price return reflecting renewed confidence in its growth prospects. Looking out longer term, its total shareholder return of 8.8% over the past year and more than 62% over five years highlights steady value creation amid changing market conditions.

If you’re curious which other consumer giants and established brands are trending, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

The question now for investors is whether Coca-Cola's recent gains hint at further upside, or if the current share price already reflects the company's stable growth and solid earnings outlook. Is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 2% Overvalued

With Coca-Cola's recent close at $68.98, the most-followed narrative pegs its intrinsic value just below at $67.50. This creates a tension between current momentum and what might lie ahead. Investors tracking this narrative will want to scrutinize the economic underpinnings before making the next move.

The Federal Reserve’s recent 25 basis point cut may appear modest, but for Coca-Cola (NYSE: KO), it carries meaningful implications for valuation. As a consumer staples giant with steady free cash flows and a reputation as a dividend aristocrat, KO is highly sensitive to discount rates in long-term models.

Think fair value is all about simple ratios? Not here. The narrative’s pricing secrets are all about what happens when rates drop, profit margins rise, and global beverage dominance continues. Which core financial lever does this forecast lean on, and what’s the hidden link between cash flows and a market premium? Hit the full narrative to see how the forecast unlocks KO’s next big move.

Result: Fair Value of $67.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sudden uptick in interest rates or shifts in consumer trends away from sugary drinks could quickly challenge Coca-Cola's premium valuation.

Find out about the key risks to this Coca-Cola narrative.

Another View: DCF Suggests Deeper Value

While narrative-based models suggest Coca-Cola is slightly overvalued, our SWS DCF model offers a sharply different take. It estimates KO's fair value at $90.61 per share, which is well above current market levels and points to a significant potential discount that the market might be overlooking. Could the DCF method be capturing value that short-term sentiment misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coca-Cola for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coca-Cola Narrative

Feel like you see the story differently, or want to dig into the figures and draw your own conclusions? It only takes a few minutes to put your own view together. Do it your way

A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Plays?

Don't sit on the sidelines while fresh investment opportunities pass you by. The Simply Wall Street Screener spotlights dynamic sectors and hidden value, all waiting for you to take the next step.

- Unlock powerful growth stories by checking out these 26 AI penny stocks as these companies push the boundaries of artificial intelligence.

- Capture potential bargains and amplify your returns using these 848 undervalued stocks based on cash flows, which highlights underpriced stocks based on strong cash flow fundamentals.

- Boost your passive income strategy with these 24 dividend stocks with yields > 3%, showcasing reliable companies paying yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives