- United States

- /

- Food

- /

- NYSE:HSY

A Fresh Look at Hershey (HSY) Valuation After Bold Holiday Marketing Push and Rockefeller Launch

Reviewed by Simply Wall St

Hershey (HSY) just kicked off its holiday season marketing with a bang, celebrating 35 years of its iconic 'Holiday Bells' commercial and joining as a premier sponsor for NBC's 'Christmas in Rockefeller Center' special. The company is putting its brand front and center for shoppers during a crucial sales period by launching an interactive event in Rockefeller Center and highlighting new holiday-themed products.

See our latest analysis for Hershey.

Amid its high-profile holiday marketing moves, Hershey has seen a steady build in momentum, with an 11.5% year-to-date share price return and a 1-year total shareholder return of 11.65%. In the longer term, however, its three-year total return is still down. This reflects tougher post-pandemic conditions, even as strategic brand initiatives could help shift sentiment.

If Hershey’s seasonal push has you rethinking what companies can accomplish with the right brand moves, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock now rebounding and trading near analyst price targets, the question for investors is whether Hershey remains an undervalued opportunity, or if the market has already priced in its holiday lift and long-term growth.

Most Popular Narrative: 2% Undervalued

Compared to the last close price, the most widely followed narrative estimates Hershey's fair value at $191.95, just slightly above current levels. This suggests limited room for upside in the near term. The narrative considers both the strength of category growth and ongoing earnings momentum as it sets this outlook.

Hershey's expansion into sweets and better-for-you snacks categories, alongside salty snacks with new acquisitions, indicates strategic diversification beyond just chocolate. This positions the company to capture additional market share and drive incremental revenue growth, potentially improving profitability in the long term.

Want to know what forecasts back this valuation? This narrative is built on major product innovation and bold bets on revenue and profit growth. Find out which game-changing projections underpin Hershey’s potential and what could make this fair value reality.

Result: Fair Value of $191.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, still, high cocoa prices and muted consumer demand could quickly shift Hershey's outlook. This could potentially cap both revenue growth and market share gains.

Find out about the key risks to this Hershey narrative.

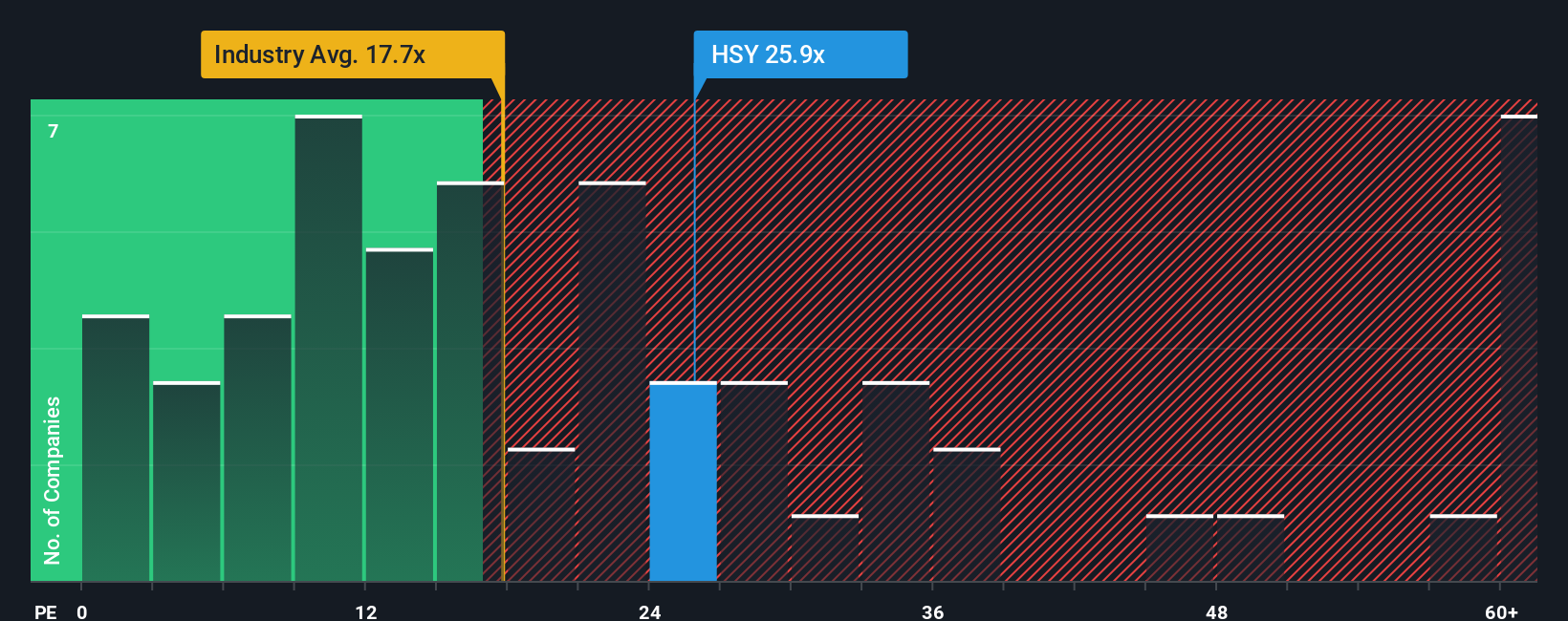

Another View: Multiples Tell a Different Story

Looking at valuations through the lens of the price-to-earnings ratio, Hershey trades at 28.1x, much higher than its industry peers, who average 18.9x, and well above its fair ratio of 22.3x. This premium suggests investors may be overestimating growth, which raises the question: how sustainable is this optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hershey Narrative

If you see things differently or prefer digging into the details, you can quickly craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Unlock new opportunities beyond Hershey by checking out unique screens designed to spot market outliers. Take action now or you might miss the next standout performer.

- Boost your portfolio’s growth potential with these 25 AI penny stocks as artificial intelligence transforms entire industries and accelerates innovation.

- Capture resilient income streams by targeting these 15 dividend stocks with yields > 3% that consistently deliver yields above 3% for reliable returns.

- Expand your strategy with these 81 cryptocurrency and blockchain stocks that are shaping tomorrow’s financial landscape through blockchain advances and disruptive digital solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success