- United States

- /

- Food

- /

- NYSE:HRL

Hormel Foods (HRL): Assessing Valuation After Lowered 2025 Earnings Guidance Despite Higher Sales

Reviewed by Simply Wall St

If you are weighing your next move with Hormel Foods (HRL), it is tough to ignore the company’s recent update. After announcing higher sales for the third quarter compared to last year, Hormel Foods lowered its full-year 2025 earnings and operating income expectations. This shift in forward guidance was a surprise for some investors, especially with sales heading in the right direction. It sends a clear message that management anticipates some profitability pressures ahead.

Shares of Hormel Foods have faced ongoing challenges, with the stock declining nearly 19% over the past year and momentum slowing further over the last three months. This latest guidance cut comes after modest quarterly earnings growth, but it also follows a longer stretch of soft performance. Ongoing market skepticism about the pace of any turnaround has weighed on shares, and today’s revision is likely to reinforce that caution for some investors.

At this point, investors are left asking: is the market now underestimating Hormel’s long-term value, or is the stock accurately reflecting the company’s softer outlook for 2025?

Most Popular Narrative: 22.9% Undervalued

According to community narrative, Hormel Foods is viewed as deeply undervalued. Analysts see significant upside over the next few years if earnings and margins improve as forecast. This projection depends on a clear set of transformative growth drivers and robust international prospects.

The International segment is leveraging growth in China and branded exports, along with a strategic partnership with Garudafood. This is expected to drive an expanded market presence and higher sales. Anticipated impact: international revenue growth.

Curious why analysts are so bullish on Hormel? The narrative outlines a clear growth formula, supported by both steady profit expansion and a market multiple that may be unexpected for this sector. Which numbers matter most, and how bold are the underlying assumptions? Some of the most important forward-looking metrics are in plain sight. Don’t miss the forecasted breakout fueling this valuation.

Result: Fair Value of $33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, potential headwinds include volatile commodity costs and risky assumptions about the pace of recovery for Planters. These factors could challenge these bullish expectations.

Find out about the key risks to this Hormel Foods narrative.Another View: SWS DCF Model’s Take

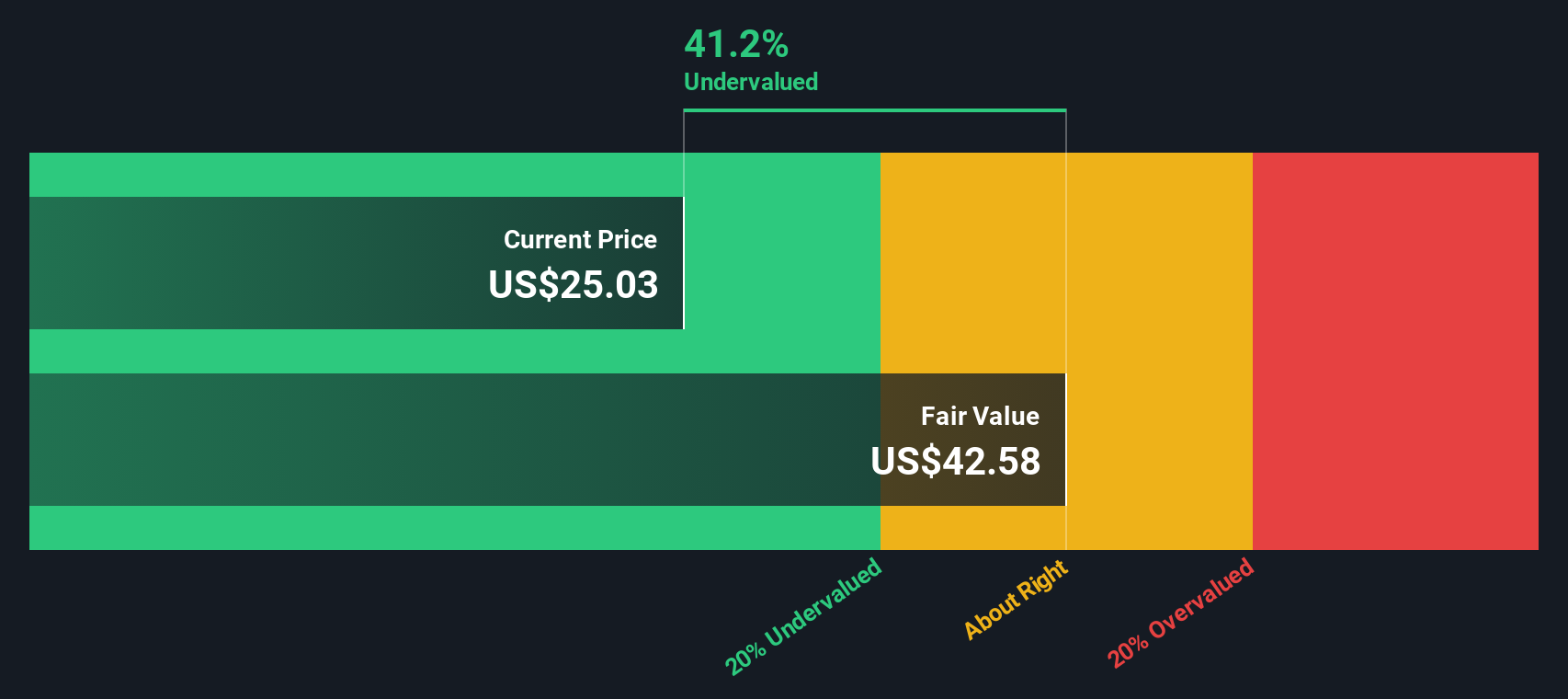

Looking beyond analyst price targets, our SWS DCF model also points to undervaluation. This method weighs future cash flows instead of market multiples and offers a different angle on Hormel Foods. Which approach will prove true?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hormel Foods Narrative

If the analysis above does not match your perspective, or if you want to examine the numbers yourself, you have the option to craft your own view in just a few minutes. Do it your way

A great starting point for your Hormel Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Open up your next big move by tapping into our unique stock ideas that go beyond the obvious choices. Take the lead and make sure you are in front of emerging themes and rewarding sectors before everyone else catches on.

- Tap into major momentum by finding penny stocks with strong financials ready to disrupt their industries through our penny stocks with strong financials.

- Jump ahead of the curve and ride the wave of AI companies transforming everyday business with breakthroughs. See what’s happening in AI penny stocks.

- Put value at the center of your strategy by targeting undervalued stocks based on cash flows using our exclusive undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hormel Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives