- United States

- /

- Food

- /

- NYSE:HRL

Could Hormel Foods’ (HRL) Expanding Food Security Initiatives Strengthen Its Long-Term Stakeholder Appeal?

Reviewed by Sasha Jovanovic

- Hormel Foods recently celebrated its 15th consecutive Hunger Action Month by donating $10,000 to each of its U.S. production facilities, supporting local hunger-relief organizations through team member-led decisions, and launching a new national partnership with Share Our Strength in 2025 to expand summer meal programs for children.

- This community giving continues Hormel's history of corporate philanthropy, with over US$53 million in hunger-relief contributions since 2020 and a focus on empowering employees to strengthen local impact.

- We'll explore how Hormel's increased investment in food security initiatives influences its longer-term growth narrative and stakeholder appeal.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Hormel Foods Investment Narrative Recap

To be a shareholder in Hormel Foods, you need confidence in its ability to balance margin recovery with innovation in core branded proteins and emerging categories amid shifting consumer trends, all while navigating prolonged commodity cost pressures. The recent Hunger Action Month donation program, while affirming Hormel’s community roots and supporting its reputation, does not materially alter the company’s most pressing short-term catalyst, which remains successful execution of supply chain automation and pricing actions to offset ongoing input cost volatility. Margin recovery remains the biggest immediate risk, as unstable pork and beef costs continue to compress profitability and cloud earnings visibility.

One recent announcement especially relevant to this narrative is Hormel’s ongoing rollout of major supply chain modernization and automation initiatives, which management believes are set to improve efficiency and cost control. These efforts are viewed as the primary driver to restore net margins and defend earnings in the current environment, standing alongside strategic price increases as central to Hormel’s near-term outlook. Yet, while community-oriented programs enhance stakeholder goodwill, they do not move the needle on resolving input cost headwinds...

Read the full narrative on Hormel Foods (it's free!)

Hormel Foods' narrative projects $13.0 billion in revenue and $952.2 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $197.7 million earnings increase from $754.5 million today.

Uncover how Hormel Foods' forecasts yield a $28.75 fair value, a 20% upside to its current price.

Exploring Other Perspectives

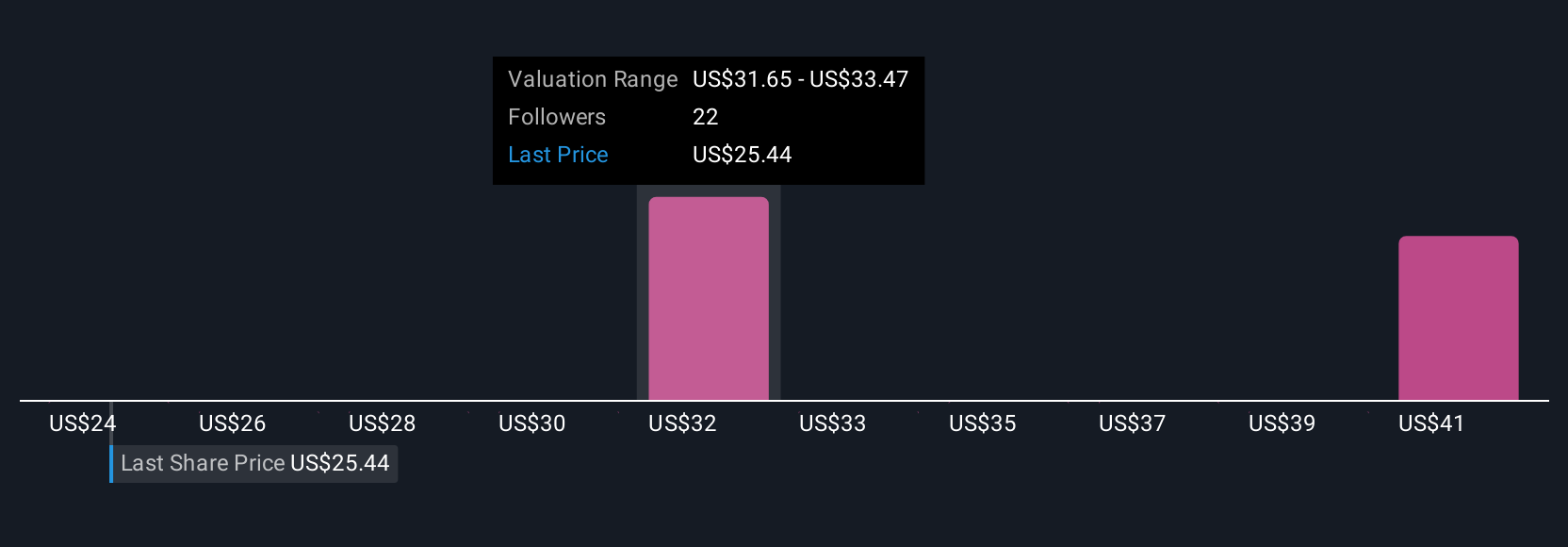

Fair value estimates from five Simply Wall St Community members range from US$24.36 to US$42.58 per share. While many point to operational modernization as a key catalyst, remember persistent commodity inflation may still challenge any margin rebound, so reviewing multiple viewpoints is essential.

Explore 5 other fair value estimates on Hormel Foods - why the stock might be worth as much as 77% more than the current price!

Build Your Own Hormel Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hormel Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hormel Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hormel Foods' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hormel Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives