- United States

- /

- Food

- /

- NYSE:GIS

General Mills (GIS): Exploring Valuation After $54 Million Technical Center Expansion Spurs Innovation

Reviewed by Simply Wall St

Most Popular Narrative: 10% Undervalued

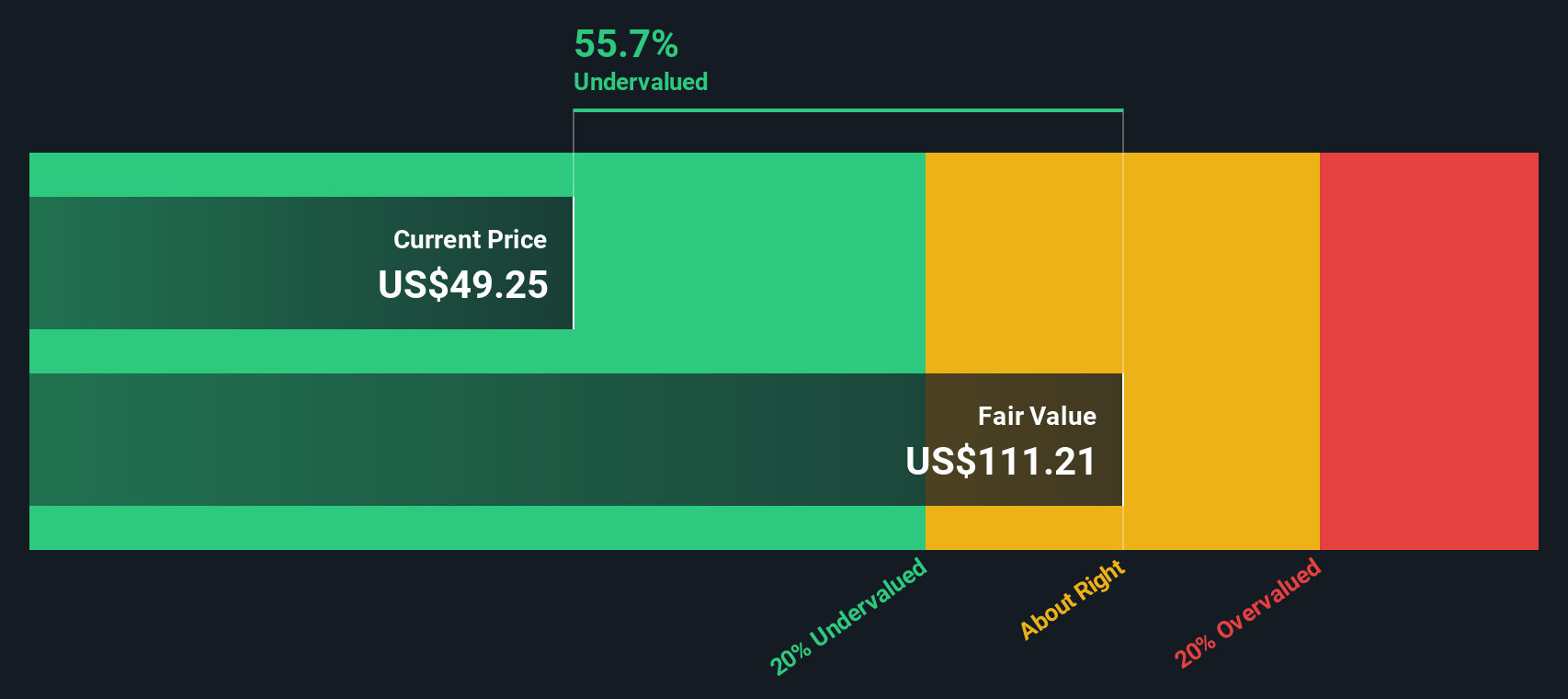

According to the community narrative, General Mills is currently viewed as undervalued by analysts, with a consensus fair value above the recent share price. This perspective is based on projections of future earnings and a discounted cash flow approach.

General Mills plans a sizable step-up in investment for fiscal '26, including at least 5% through Holistic Margin Management (HMM) savings and $100 million in additional cost savings. However, reinvestment of these savings into pricing, innovation, in-store activity, and media could delay improvements in net margins and overall earnings in the short term.

Curious about the forces steering General Mills’ valuation higher, even as profits plateau? Find out which bold investment strategies and profit forecasts are driving this 10% upside call. What are the quantitative assumptions that set analyst expectations apart from market sentiment? The details behind this fair value might surprise you.

Result: Fair Value of $54.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, stronger than expected results from new product launches or effective marketing could boost earnings and challenge the current cautious outlook. Find out about the key risks to this General Mills narrative.Another View

Looking at General Mills through the lens of our DCF model, the outlook again points to undervaluation and supports the analyst consensus. However, what if long-term cash flows evolve differently than expected? Is the market mispricing potential surprises?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out General Mills for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own General Mills Narrative

If you want to draw your own conclusions or take a deeper look at the numbers, you're free to create a narrative in just a few minutes. Do it your way.

A great starting point for your General Mills research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart investment ideas?

Don’t limit yourself to just one opportunity when so many exciting paths are available. Let the Simply Wall Street Screener guide you to new stocks with upside potential, reliable growth, or strong future prospects. Take action now to expand your watchlist with companies you might wish you had found sooner:

- Spot unbeatable value in overlooked businesses and gain an edge with undervalued stocks based on cash flows, which flags promising stocks trading below their fair value.

- Target the future of medicine by checking out healthcare AI stocks, where cutting-edge healthcare meets artificial intelligence for growth you won’t want to miss.

- Ramp up your portfolio’s income by searching for dividend stocks with yields > 3%. Find companies delivering attractive yields of over 3% and steady, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:GIS

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives