- United States

- /

- Food

- /

- NYSE:FLO

Does the Recent 41% Drop in Flowers Foods Signal Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Flowers Foods stock is a bargain or just another loaf past its prime? Let's break down the numbers to see if the current price offers real value for investors like you.

- After drifting down by 0.5% this week and losing 5.4% over the last month, Flowers Foods' price has fallen more than 41% this year, with a steep 43.1% drop over the last 12 months.

- Ongoing shifts in the packaged foods market and persistent margin pressures have kept Flowers Foods in the spotlight, impacting investor confidence. Recent headlines have focused on cost control initiatives and evolving consumer habits, fueling debate about whether these moves can spark a turnaround.

- When it comes to valuation, the company scores a 4 out of 6 on key value checks. This suggests room for optimism. We will look closely at what goes into this score and share an even better way to cut through the noise at the end of the article.

Find out why Flowers Foods's -43.1% return over the last year is lagging behind its peers.

Approach 1: Flowers Foods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting those back to today's dollars. This method aims to capture what the business is truly worth based on how much cash it can generate over time.

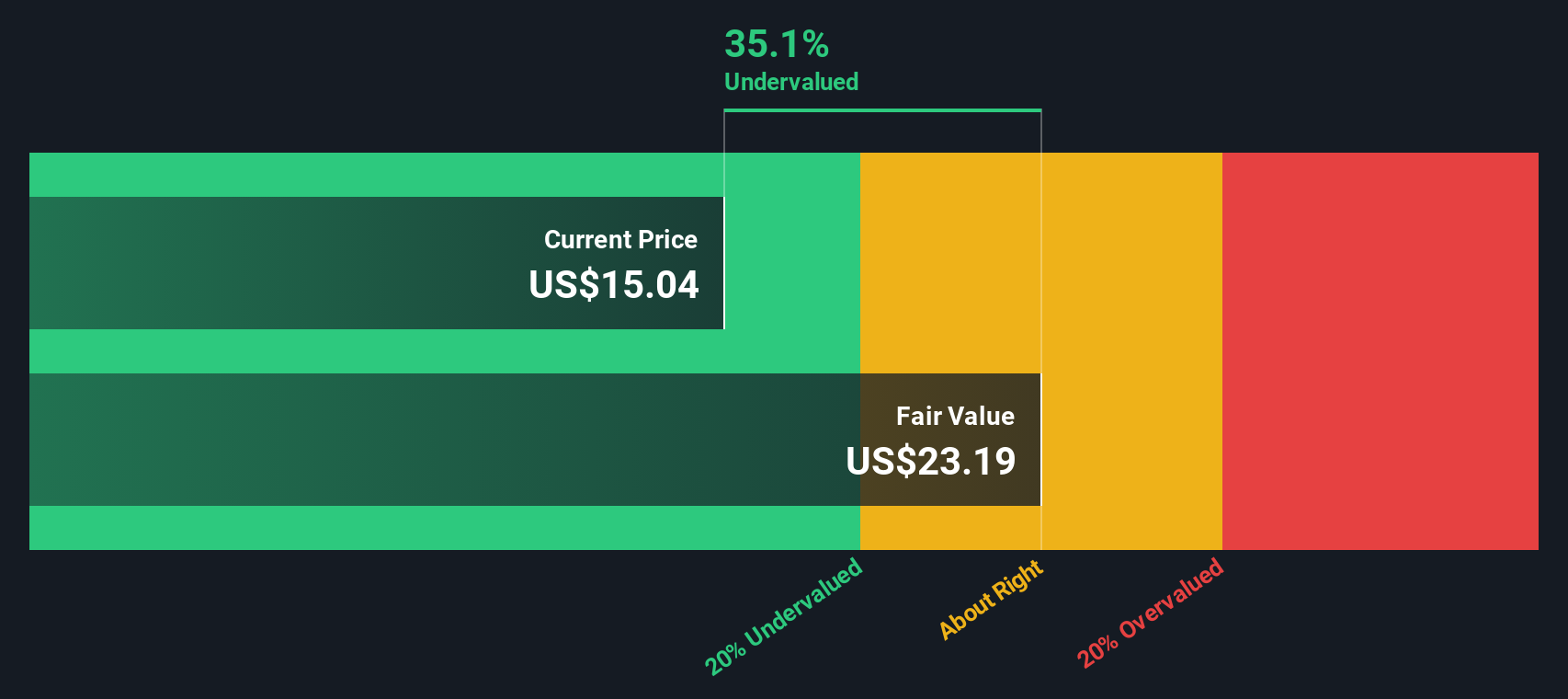

For Flowers Foods, the analysis starts with its latest reported Free Cash Flow of $371.9 million. While analyst estimates extend about five years, projections beyond that are extrapolated by Simply Wall St using reasonable assumptions. The company’s free cash flow is forecasted to gradually decrease, with a projected FCF of $234.1 million in 2035. Each year’s future cash flow is discounted back to reflect its value in today’s terms, ensuring a more realistic, risk-adjusted estimate.

According to this DCF approach, the intrinsic value per share is calculated at $23.84. With the current market price reflecting nearly a 49.3% discount to this fair value, Flowers Foods appears to be trading well below what its underlying cash flow would suggest.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Flowers Foods is undervalued by 49.3%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: Flowers Foods Price vs Earnings

For profitable companies like Flowers Foods, the Price-to-Earnings (PE) ratio is a widely used valuation tool. It helps investors weigh how much the market is willing to pay today for a dollar of the company’s earnings. This makes it especially relevant for stable, established firms where profits provide an anchor for valuation.

What counts as a "fair" PE ratio depends on a company’s future growth prospects and the risks it faces. Higher expected growth or lower risk can justify paying a bigger premium, meaning a higher PE ratio. Conversely, slower growth or greater risk should lead to a lower PE multiple.

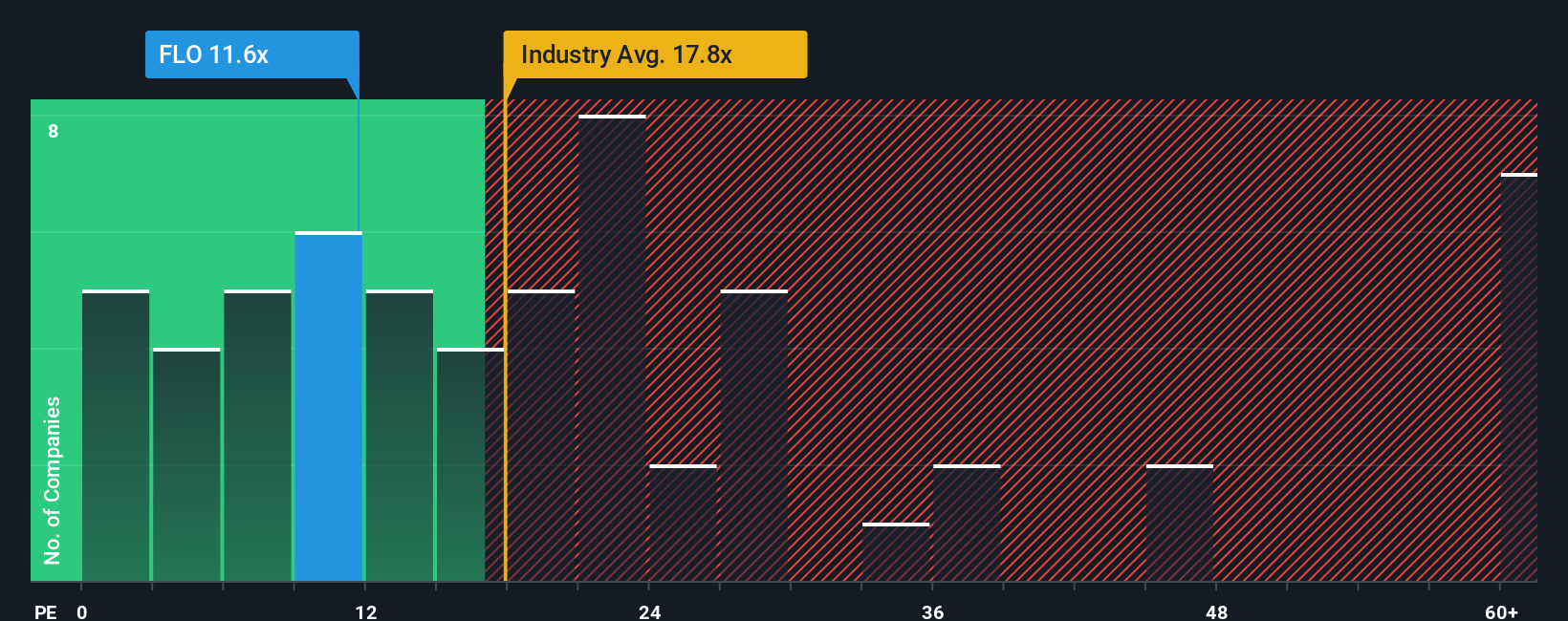

Currently, Flowers Foods trades at 11.6x earnings. To put this in perspective, the average for the Food industry is 17.8x, with close competitors averaging 16.4x. On paper, Flowers Foods appears much cheaper than both its sector and direct peers.

However, comparing companies solely on industry or peer averages can be misleading, since these benchmarks miss nuances like individual risk, earnings quality, and growth outlook. That is where Simply Wall St’s Fair Ratio comes in. It builds a bespoke benchmark for each company, factoring in their expected profit growth, risk, margins, size, and more. For Flowers Foods, the Fair Ratio sits at 11.3x, almost exactly matching its actual PE ratio.

This close alignment suggests the current stock price fairly reflects the company's risk and growth profile. Investors may not be getting a significant bargain, but they are not overpaying either.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Flowers Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simple, powerful stories investors create to explain what they think will drive a company's future, tying your personal view about Flowers Foods’ business prospects directly to financial forecasts and a fair value estimate.

Rather than relying solely on static metrics or consensus numbers, Narratives let you define your own assumptions about revenue growth, profit margins, and valuation multiples, building a full picture of what you believe the future holds. This approach connects the company’s story to numbers, showing the logic behind your expectations and the fair value those forecasts generate.

Narratives are available on Simply Wall St’s Community page, where millions of investors use them to share and compare perspectives. You can quickly create or browse different Narratives, each dynamically updating as new announcements, results, or news arrives, always keeping your analysis relevant and current.

By comparing your Narrative’s fair value to the current market price, you can make clearer buy or sell decisions based on your personal convictions. For example, you could side with a more optimistic Narrative targeting $20 per share due to growth from new product lines, or take a cautious view with a $12 target if you are concerned about debt and competitive pressure.

Do you think there's more to the story for Flowers Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLO

Flowers Foods

Produces and markets packaged bakery food products in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives