- United States

- /

- Food

- /

- NYSE:DOLE

Is Dole’s Valuation Attractive After Shares Jumped 12% in the Last Month?

Reviewed by Bailey Pemberton

- Curious if Dole is a hidden value play or just another produce stock? You are not alone, and we are digging into the facts to find out if now is the right time to pay attention.

- Dole shares have perked up lately, jumping 5.3% in the past week and 12.3% over the last month. This signals that the market is paying fresh attention to the stock, even though it is down just under 2% over the past year.

- Several recent headlines have focused on the company’s role in evolving food sustainability standards and a boost in global demand for fresh produce. This has put Dole back in the spotlight as market watchers note investors weighing these developments alongside supply chain updates in the broader food space.

- On the numbers front, Dole earns a strong 6 out of 6 on our valuation checks, a rare feat that hints at real value based on classic measures. Next, we will break down the common ways investors size up Dole’s worth and finish with a perspective that may offer an even clearer picture of what the stock is really worth.

Approach 1: Dole Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation tool that estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today to reflect their current worth. This helps investors gauge whether a stock is attractively priced compared to its true underlying value.

For Dole, the latest reported Free Cash Flow (FCF) stands at $43.7 Million. Analysts offer estimates for the next few years, and longer-term projections are extrapolated to forecast cash flows a decade into the future. By 2027, Dole’s FCF is projected at $147.3 Million, with forecasts continuing steady uptrends in subsequent years. All figures are measured in US dollars.

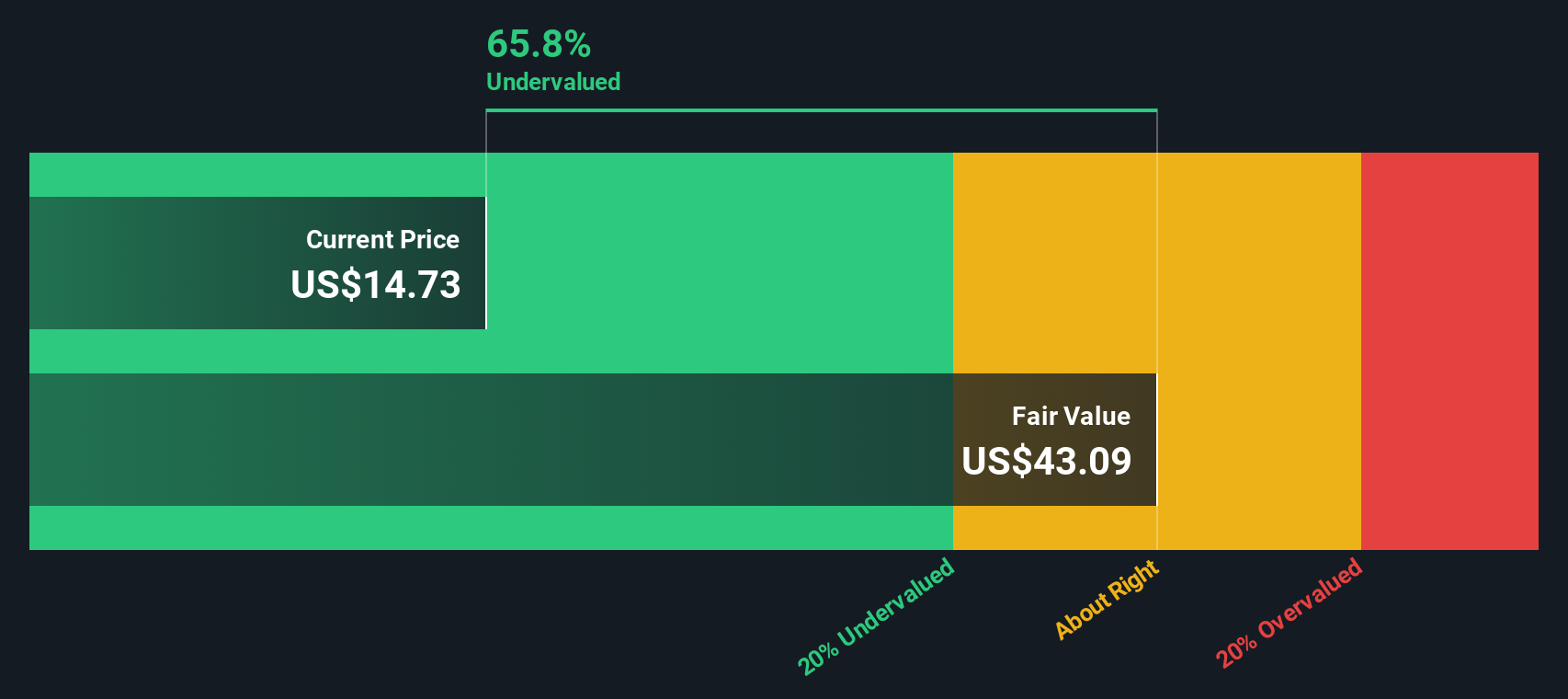

Applying the DCF model using these projections, the estimated intrinsic value of Dole’s stock is $31.36 per share. Compared to the current market price, this valuation suggests Dole is trading at a substantial 54.0% discount. In other words, the stock appears significantly undervalued by this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dole is undervalued by 54.0%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: Dole Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like Dole, as it relates a company’s share price to its per-share earnings. This allows investors to quickly gauge whether a stock is trading at a premium or a discount relative to its actual profitability.

What counts as a “fair” PE ratio often depends on growth prospects and risk. Fast-growing or low-risk companies can sustain higher PE ratios, whereas companies with slower earnings growth or higher risk profiles typically warrant lower ones.

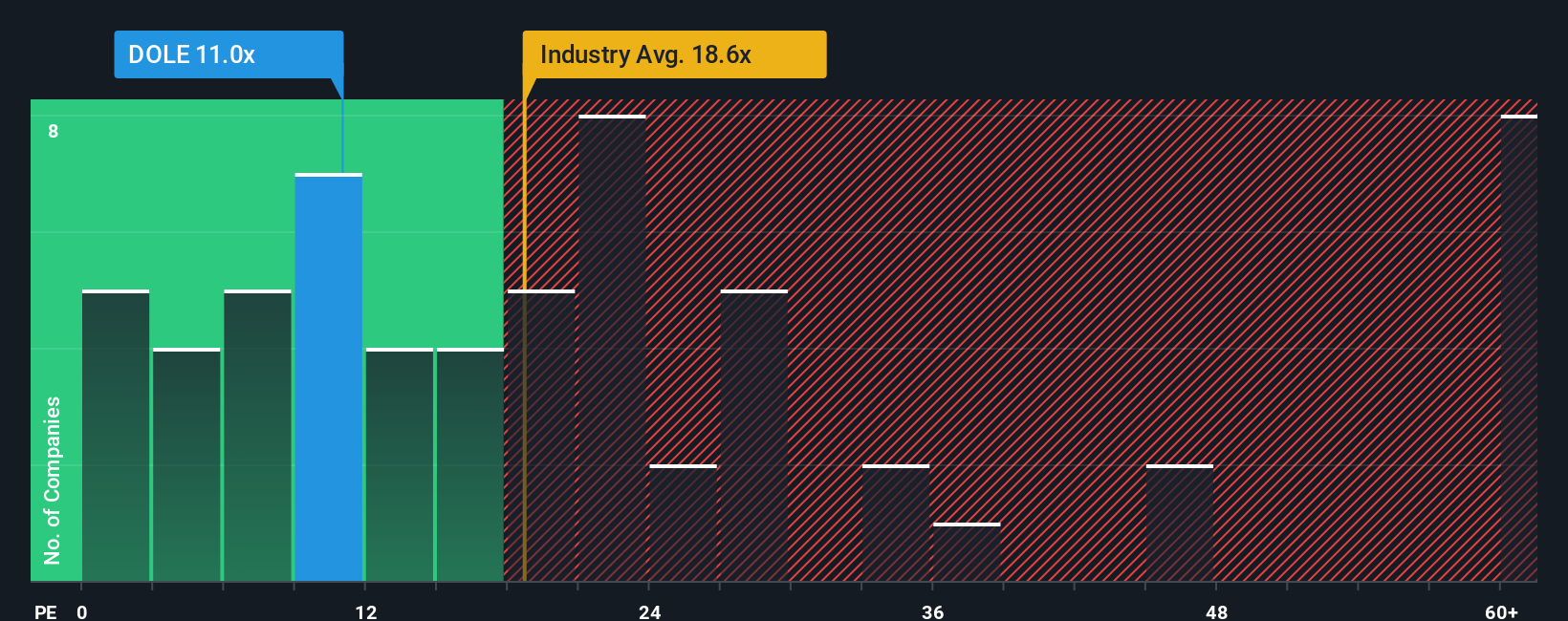

Dole currently trades at a PE ratio of 11.3x, which is noticeably below both its peer group (20.8x) and the broader food industry average (20.9x). This suggests that the market may not be assigning full value to Dole’s earnings compared to its competitors.

Simply Wall St’s proprietary “Fair Ratio” for Dole, at 13.8x, estimates what a justified PE should be by factoring in Dole’s earnings growth, market risks, profit margins, industry, and company size. Unlike a plain peer or industry comparison, this approach sets expectations tailored to Dole’s unique position in the market.

With the current PE of 11.3x versus a Fair Ratio of 13.8x, Dole appears undervalued on an earnings basis, reinforcing the value theme seen in the DCF model.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

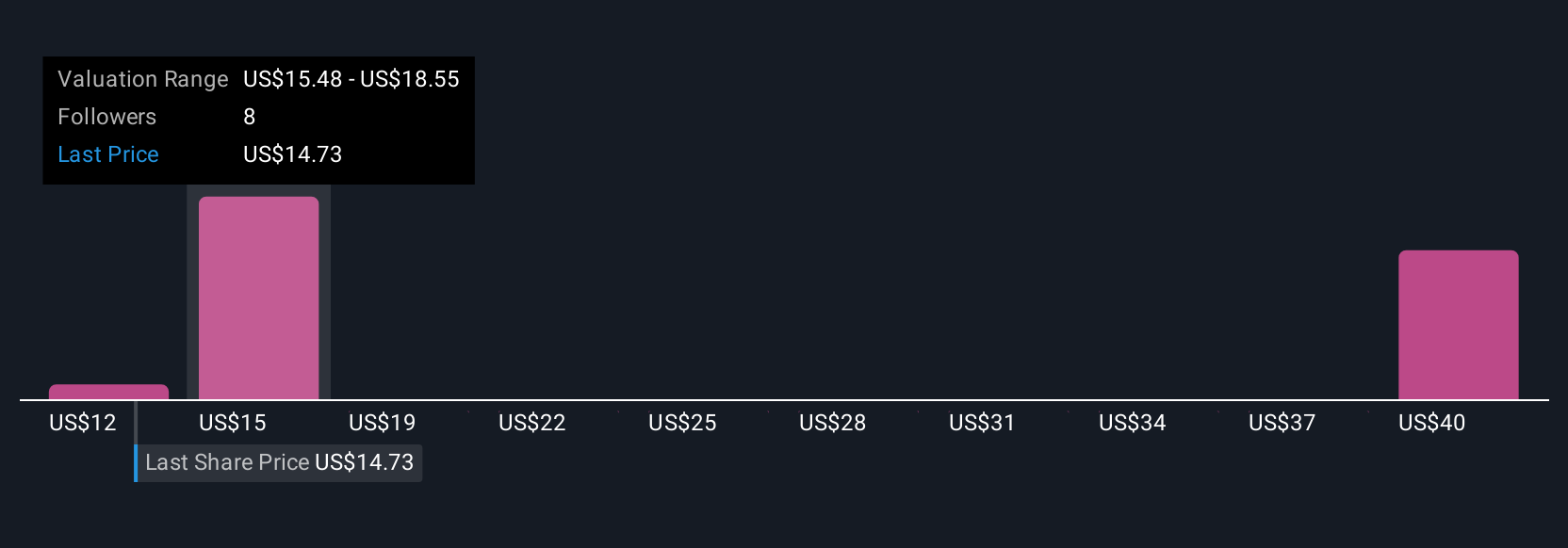

Upgrade Your Decision Making: Choose your Dole Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives help investors go beyond the numbers by telling the story behind a company’s future by combining your view on Dole’s prospects, your assumptions on revenue and earnings, and what you believe is a fair value.

With Narratives, you connect what you know about Dole, including its strategy, operational moves, market shifts, and risks, to a concrete financial projection and fair value estimate. This transforms your gut feeling or research into a quantitative model you can act on.

Available to millions of investors on Simply Wall St’s Community page, Narratives make this process simple and collaborative. You can craft, track, and compare your Narrative with others, helping you decide whether to buy, hold, or sell based on your own fair value versus the latest market price. As news breaks or earnings are announced, your Narrative updates automatically, always reflecting the freshest outlook.

For example, some Dole investors highlight strong global demand and margin expansion, setting a bullish price target of $21.50, while others see risks like climate volatility and concentrated product exposure, resulting in a more conservative target of $14.00. Narratives let you choose which story makes sense for you and act with confidence.

Do you think there's more to the story for Dole? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOLE

Dole

Engages in sourcing, processing, marketing, and distribution of fresh fruit and vegetables worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success