- United States

- /

- Food

- /

- NYSE:DAR

Darling Ingredients (DAR): Evaluating Valuation Signals After Recent Share Price Rebound

Reviewed by Simply Wall St

Darling Ingredients (DAR) has recently seen its stock movement catch the eye of market-watchers, as investors weigh the company’s recent performance and try to gauge what might be next for this diverse ingredients producer.

See our latest analysis for Darling Ingredients.

After a stretch of lackluster long-term performance, Darling Ingredients stock has finally shown some spark, posting an 11% share price gain over the past 90 days. However, its 1-year total shareholder return remains down nearly 19%. Momentum may be rebuilding, signaling investors are rethinking the company’s potential after a difficult run.

If you’re watching for fresh opportunities beyond the usual names, this could be the moment to broaden your perspective and explore fast growing stocks with high insider ownership

With shares still trading at a sizable discount to analyst price targets and fundamentals showing fresh signs of life, the question for investors is clear: is Darling Ingredients truly undervalued, or is the market already factoring in all of its potential growth?

Most Popular Narrative: 24.7% Undervalued

Darling Ingredients closed at $34.75, but the most widely followed narrative places its fair value at $46.17, indicating a significant premium. This group sees catalysts building beneath the surface despite the stock’s recent struggles.

Ongoing expansion into high-growth, high-margin specialty ingredients via the Nextida JV and rising global demand for health & wellness products (e.g., collagen, functional peptides), backed by scientific validation and early repeat orders, is expected to meaningfully broaden Darling's product portfolio, diversify revenues, and drive Food segment EBITDA growth starting in 2026.

Want to know what’s supercharging this ambitious valuation? Growth forecasts point to future profits and margins you might not expect from a traditional ingredients company. Find out what assumptions the narrative is making about Darling’s next chapter. These are bold numbers that could shake up your view.

Result: Fair Value of $46.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and weak growth in the Food segment could derail Darling Ingredients’ bullish outlook. As a result, near-term optimism is far from guaranteed.

Find out about the key risks to this Darling Ingredients narrative.

Another View: The Multiples Perspective

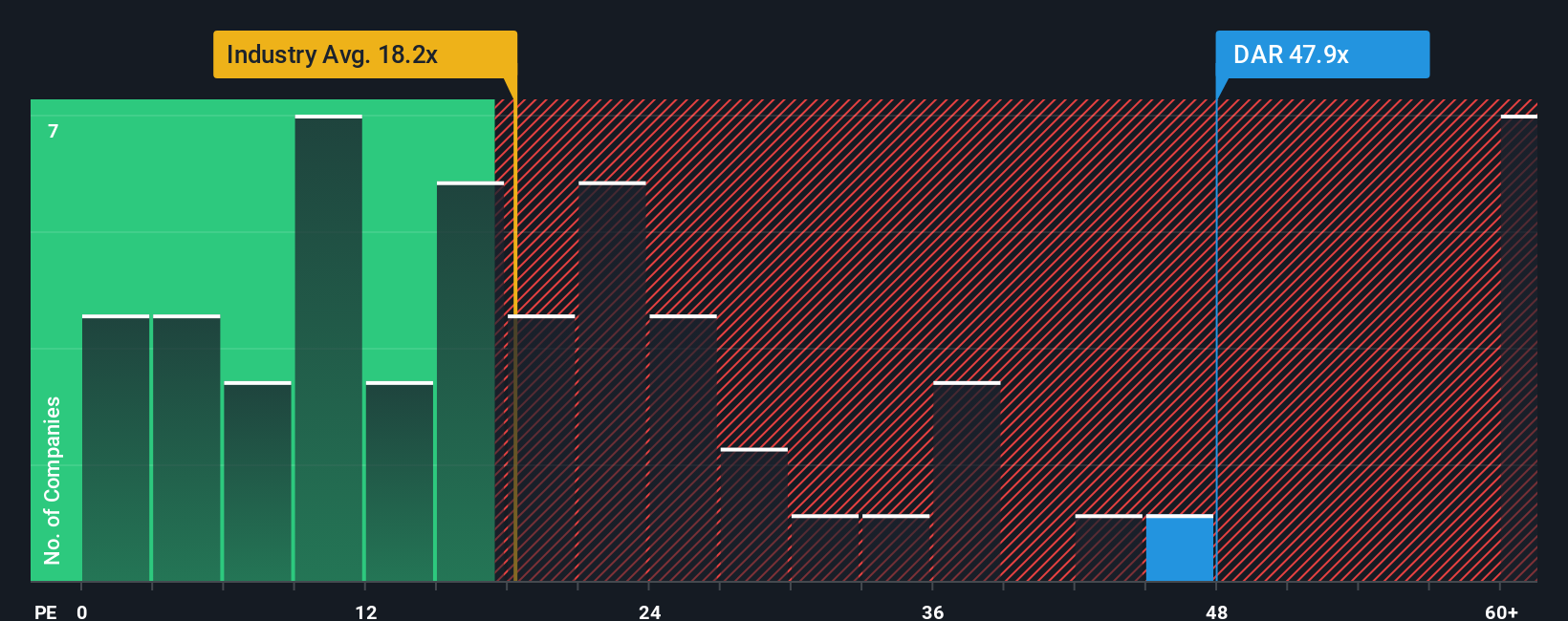

Looking through the lens of price-to-earnings, the story is very different. Darling Ingredients trades at about 51 times earnings, while the US Food industry average is just 18.5. Even the fair ratio is closer to 59.6, so there is clear tension: is the market betting on big profit growth, or ignoring valuation risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Darling Ingredients Narrative

If you want to dig into the numbers yourself or see where your analysis leads, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your Darling Ingredients research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize the best opportunities first, so now is the time to expand your watchlist with high-potential stocks tailored to your strategy.

- Capitalize on rising demand for smarter healthcare by screening for leaders in medical innovation and AI breakthroughs with these 31 healthcare AI stocks.

- Unlock passive income streams by finding stocks offering substantial dividend yields and financial stability using these 16 dividend stocks with yields > 3%.

- Ride the next technology wave by targeting companies pushing the limits of quantum computing potential through these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAR

Darling Ingredients

Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives