- United States

- /

- Food

- /

- NYSE:DAR

Could Darling Ingredients’ (DAR) Tax Credit Sale Reveal Its Strategy for Clean Energy Leadership?

Reviewed by Sasha Jovanovic

- Earlier this month, BofA Securities initiated coverage of Darling Ingredients with a Buy rating, while Birch Risk Advisors announced facilitating the company's sale of US$125 million in clean fuel production tax credits generated through a joint venture.

- This combination of positive analyst coverage and successful tax credit monetization underscores Darling Ingredients' position at the forefront of renewable fuels and the evolving clean energy marketplace.

- We'll explore how the company's sale of a large package of clean fuel production tax credits could shape its investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Darling Ingredients Investment Narrative Recap

To be a shareholder in Darling Ingredients, you need to believe in the company’s role as a global supplier of sustainable feed, food, and fuel solutions, with a particular emphasis on the long-term demand for renewable fuels driven by policy support. This month’s sale of US$125 million in clean fuel production tax credits marks a milestone in monetizing federal incentives, but it does not materially resolve the key short-term catalyst, clarity on US biofuel policy requirements, or the main risk of continued regulatory and margin volatility in renewable diesel operations.

Among recent announcements, the agreement to monetize these clean fuel tax credits generated via the Diamond Green Diesel joint venture stands out. This transaction highlights Darling Ingredients' ability to realize value from US clean energy incentives, which is directly relevant as policy and regulatory shifts remain a powerful force in shaping near-term margin recovery and earnings visibility for its renewable fuels business.

But while tax credit sales help the balance sheet, investors should not overlook the risks from continued policy uncertainty and...

Read the full narrative on Darling Ingredients (it's free!)

Darling Ingredients is projected to reach $6.5 billion in revenue and $673.1 million in earnings by 2028. This outlook is based on an assumed 4.3% annual revenue growth rate and represents a $567.7 million increase in earnings from the current $105.4 million.

Uncover how Darling Ingredients' forecasts yield a $46.17 fair value, a 53% upside to its current price.

Exploring Other Perspectives

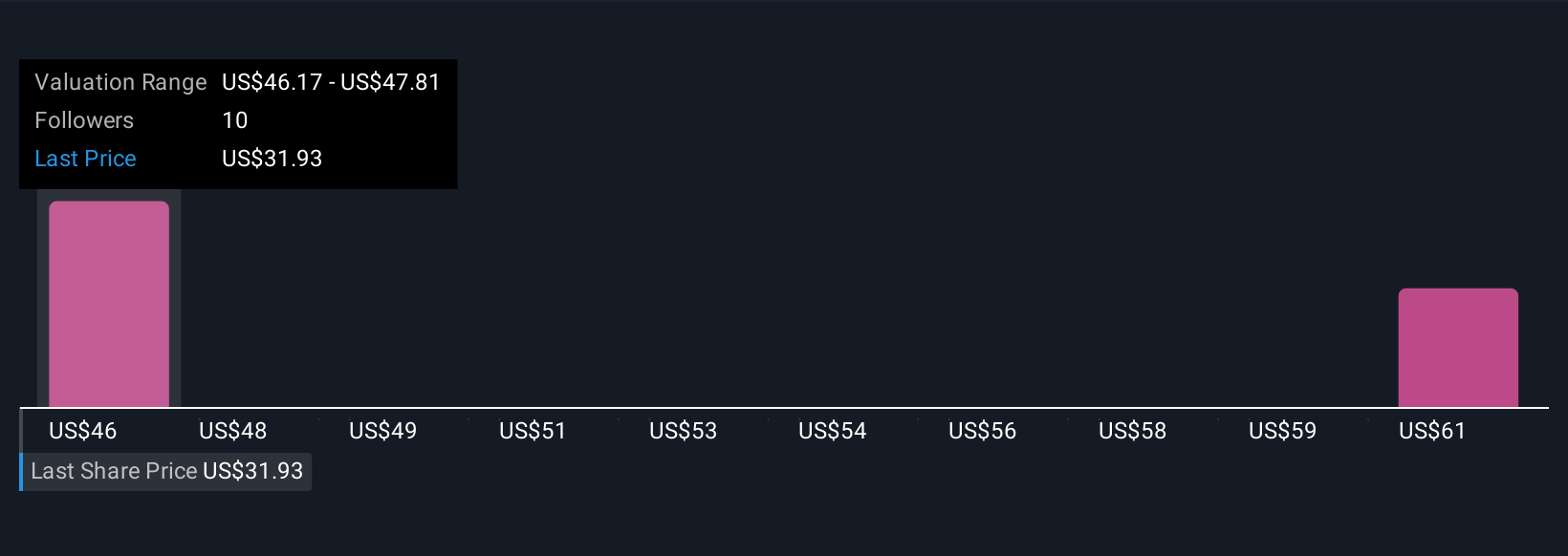

Community fair value estimates for Darling Ingredients range from US$46.17 to US$65.51 based on two different analyses from the Simply Wall St Community. Regulatory changes driving renewable fuel margins remain a central focus and could explain why market participants often see wide differences in the company’s longer-term outlook.

Explore 2 other fair value estimates on Darling Ingredients - why the stock might be worth over 2x more than the current price!

Build Your Own Darling Ingredients Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Darling Ingredients research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Darling Ingredients research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Darling Ingredients' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAR

Darling Ingredients

Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives