- United States

- /

- Food

- /

- NYSE:DAR

A Look at Darling Ingredients’s Valuation After Strong Q3 Revenue Beat and Upgraded Guidance

Reviewed by Simply Wall St

Darling Ingredients (DAR) delivered an encouraging set of third-quarter results, topping revenue forecasts as its core ingredients business accelerated. Along with stronger sales, the company raised guidance and unveiled plans to sell production tax credits.

See our latest analysis for Darling Ingredients.

The upbeat revenue news sparked a sharp rally, with a 9% share price return in just the last week as investors welcomed signs of turnaround in the core ingredients business. However, despite this burst of momentum, Darling Ingredients’ total shareholder return over the past year remains down nearly 12%, which highlights that the longer-term performance has yet to match the recent optimism.

If today’s shift leaves you curious about other moving parts of the market, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership.

Given the company’s surge in momentum but continued long-term underperformance, is Darling Ingredients now trading at a discount as a turnaround gathers steam? Or is the market already factoring in all of its future growth potential?

Most Popular Narrative: 25.2% Undervalued

Darling Ingredients’ consensus fair value sits well above the last closing price, signalling analysts see more room for the stock to climb. With future expectations heavily influencing this estimate, let’s explore one of the core reasons behind this valuation.

Ongoing expansion into high-growth, high-margin specialty ingredients via the Nextida JV and rising global demand for health & wellness products (e.g., collagen, functional peptides), backed by scientific validation and early repeat orders, is expected to meaningfully broaden Darling's product portfolio, diversify revenues, and drive Food segment EBITDA growth starting in 2026.

Curious how bold global ambitions and fresh product bets could rewrite growth for Darling Ingredients? The valuation narrative hinges on a radical transformation, and surprising numbers underscore just how much is projected to change. Only the full story reveals the financial leaps tied to these assumptions.

Result: Fair Value of $46.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and volatile feedstock costs could present challenges for Darling Ingredients in maintaining margin improvements and meeting ambitious earnings forecasts.

Find out about the key risks to this Darling Ingredients narrative.

Another View: The Multiples Perspective

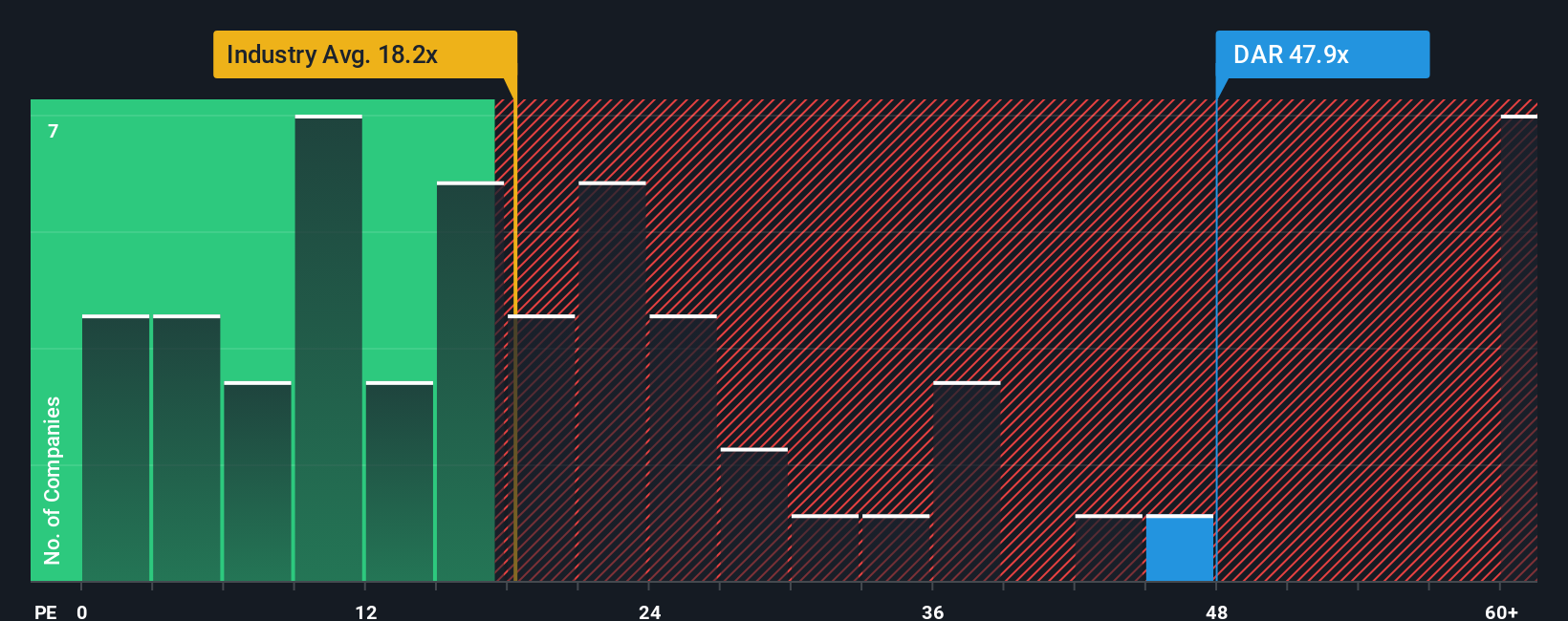

Looking at Darling Ingredients from a different angle, its current price-to-earnings ratio stands at 50.7 times, which is much higher than both the peer average of 16 times and the US Food industry average of 18.3 times. Notably, the fair ratio the market could move towards is 46.6 times. This gap signals a valuation risk. Even as growth hopes run high, the stock is priced well above its industry and historic benchmarks. Could the market's enthusiasm be setting up for disappointment, or is this premium justified by long-term transformation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Darling Ingredients Narrative

If your perspective differs or you enjoy digging into the data firsthand, you can craft your own analysis in just a few minutes. Do it your way

A great starting point for your Darling Ingredients research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to raise your portfolio game? Harness powerful insights and give yourself an edge by searching for fresh opportunities many investors overlook, before they make headlines.

- Uncover hidden high-yield plays by zeroing in on these 17 dividend stocks with yields > 3%, which routinely reward investors with steady income and attractive payouts.

- Supercharge your returns by following these 27 AI penny stocks, where AI-driven innovation is creating new frontiers and transforming entire industries.

- Spot tomorrow’s breakout bargains among these 877 undervalued stocks based on cash flows, allowing you to buy quality stocks the market may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAR

Darling Ingredients

Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives