- United States

- /

- Food

- /

- NYSE:CAG

Has Conagra’s 37% Slide in 2025 Uncovered a Value Opportunity?

Reviewed by Bailey Pemberton

- Ever wondered if Conagra Brands stock is a hidden value play, or if there's a reason it looks cheap? You're in the right place to find out what the numbers might not be telling you at first glance.

- Shares have slid by 5.7% over the past week and nearly 37% year-to-date, signaling that something big might be shifting in how investors are thinking about the company.

- Recent news cycles have focused on shifts in consumer spending and the competitive pressure in the packaged foods sector, with analysts speculating about the effects of changing grocery habits and input costs. This conversation has added even more attention to Conagra's current valuation and future prospects.

- When it comes to undervaluation checks, Conagra scores a solid 5 out of 6, which is a strong starting point for any value hunter. We will dive into each of the mainstream approaches to valuation in the next section. Stick around, as the most insightful perspective might be the one waiting for you at the end of this article.

Find out why Conagra Brands's -35.7% return over the last year is lagging behind its peers.

Approach 1: Conagra Brands Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors understand what the business is worth based on its ability to generate cash over time.

For Conagra Brands, the DCF model starts with a current Free Cash Flow (FCF) of $1.17 Billion. Analyst estimates project annual FCF growth over the next several years, with forecasts reaching $1.29 Billion by 2029. While analyst predictions are provided for the first five years, projections beyond that period are extrapolated by Simply Wall St to give a full ten-year outlook on future cash generation.

After discounting these future cash flows to reflect their value in today's terms, the estimated intrinsic value for Conagra Brands stock stands at $76.38 per share. This calculation suggests the market is pricing the company at a steep discount. According to the DCF model, the stock is currently trading 77.2% below its fair value.

Given these projections, the DCF model indicates that Conagra Brands may be significantly undervalued compared to its estimated future earnings power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Conagra Brands is undervalued by 77.2%. Track this in your watchlist or portfolio, or discover 834 more undervalued stocks based on cash flows.

Approach 2: Conagra Brands Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Conagra Brands, as it highlights how much investors are willing to pay for each dollar of current earnings. It's especially useful when a company generates steady profits and you want a quick sense of how it stacks up to similar businesses.

What counts as a fair PE ratio can depend on several factors. Higher growth prospects usually justify a higher multiple, while greater risks or slower expected growth push that “normal” multiple lower. Comparing a company’s PE to its sector and direct peers can give you perspective, but it does not tell the full story about its unique outlook and characteristics.

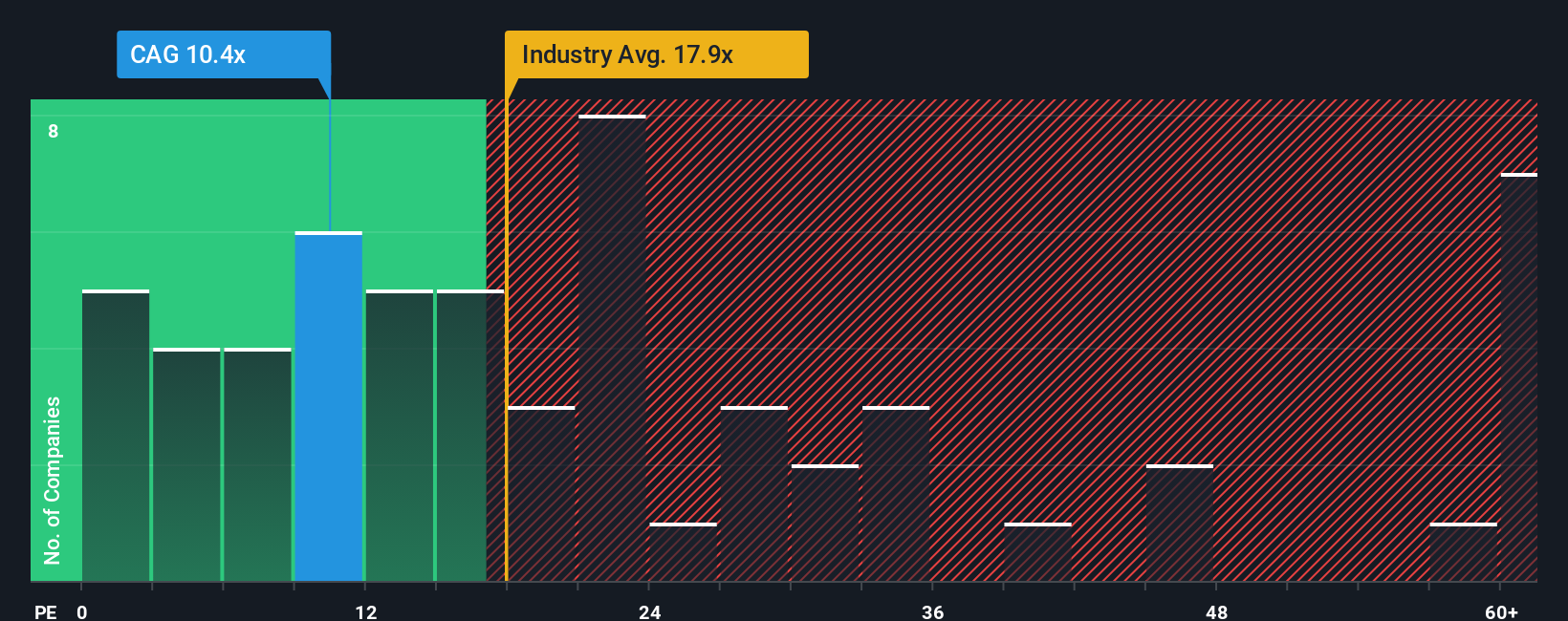

Currently, Conagra Brands trades at a PE ratio of 9.8x. For context, the average PE ratio among its food industry peers is 15.5x, and the wider industry average stands at 17.9x. At first glance, this price looks attractively low. However, Simply Wall St’s proprietary Fair Ratio, which factors in growth, profit margin, risk profile, and market cap, suggests a fair value PE ratio for Conagra of 17.0x. Unlike basic comparisons, this Fair Ratio provides a more accurate picture by tailoring the benchmark to the company’s specific circumstances.

In simple terms, Conagra’s current PE is well below both its peer group and its Fair Ratio, indicating the stock is undervalued based on its earnings potential and fundamental outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Conagra Brands Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company that connects the dots between the business’s strategy, future financial forecasts, and what you believe its shares should be worth.

Unlike traditional valuation tools, Narratives empower investors to make sense of the numbers by tying them to real-world trends, assumptions about revenue, margins, and risk, and your expectations for the company’s future. Each Narrative links your view of Conagra Brands’ path ahead to an explicit financial forecast, culminating in a calculated fair value tailored to your outlook.

Narratives are easy to use and fully accessible via Simply Wall St’s Community page, where millions of investors share, compare, and refine their investment stories. They provide actionable confidence by letting you see at a glance if the market price is below or above your own fair value, helping you decide when a stock is truly a buy or a sell in your playbook.

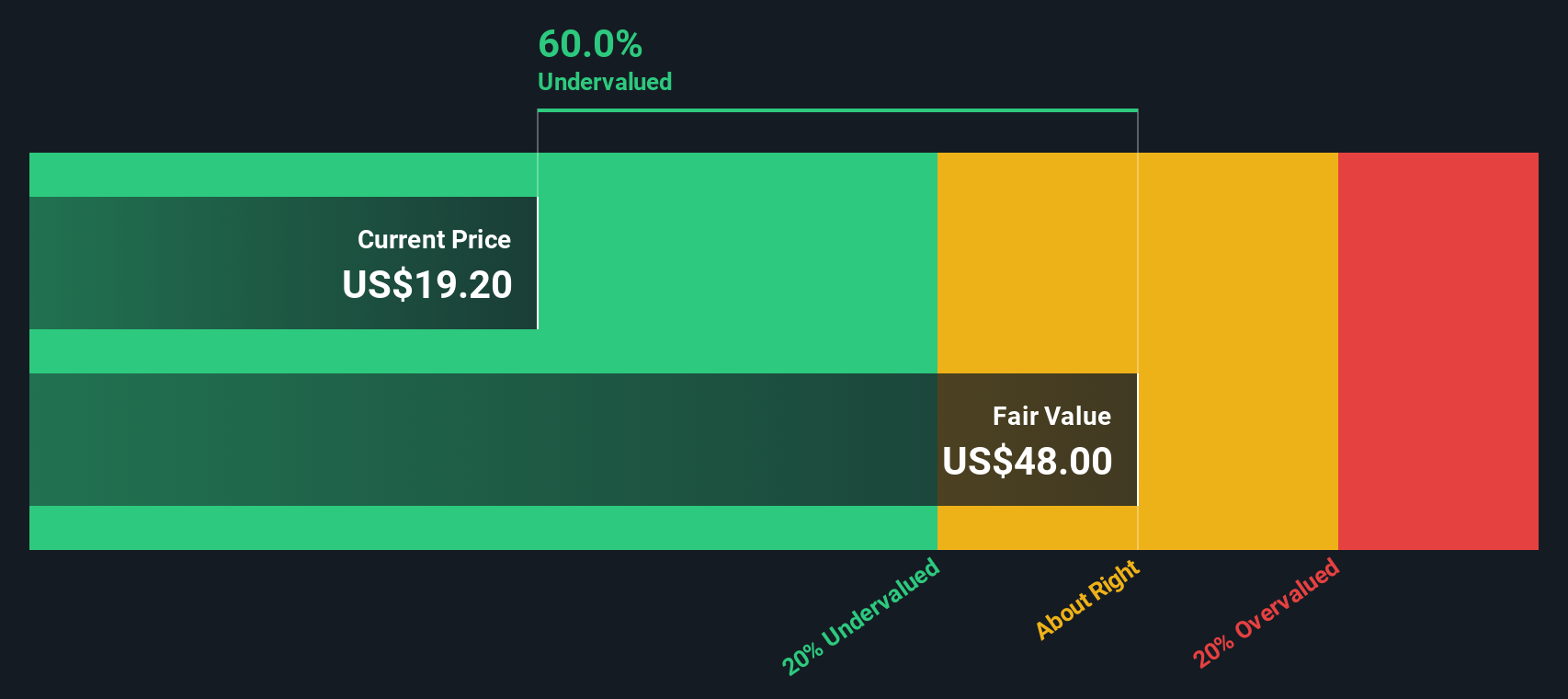

As news breaks or earnings are released, Narratives update dynamically, so your story and valuation always reflect the latest facts. For example, one investor might believe that Conagra’s strong brands and improved supply chain will drive stable margins and assign a fair value near $26 per share, while another could focus on industry headwinds and see fair value closer to $18. Both are valid stories with real numbers behind them.

Do you think there's more to the story for Conagra Brands? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAG

Conagra Brands

Operates as a consumer packaged goods food company primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives