- United States

- /

- Beverage

- /

- NYSE:BF.B

Will Expected Lower Profits From Brand Changes Shift Brown-Forman's (BF.B) Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- Brown-Forman recently announced that it expects lower second-quarter earnings, with analysts projecting a 12.7% profit per share decline compared to last year, following a drop in revenue after concluding partnerships with Korbel Champagne Cellars, Sonoma-Cutrer, and Finlandia.

- These changes have led to cautious analyst sentiment, as the company’s shifting business relationships have not been fully offset by gains in other segments.

- We'll examine how anticipated lower profits from recent brand relationship changes may impact Brown-Forman’s long-term growth expectations and market strategy.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Brown-Forman Investment Narrative Recap

To be a Brown-Forman shareholder, you need to believe in the company’s ability to adapt to changing consumer trends and overcome headwinds in developed markets. The recent announcement of lower expected second-quarter earnings after ending key partnerships directly affects short-term profit momentum, while persistent weakness in major developed markets remains the biggest risk. If this impact is not reversed, it could place sustained pressure on growth hopes.

Among recent announcements, the authorization of a $400 million share buyback program stands out, especially as the company faces softer earnings. Buybacks can support shareholder value during periods of near-term earnings pressure, providing a potential offset to negative sentiment driven by challenging revenue developments found in this quarter. With this financial tool in hand, Brown-Forman is signaling a commitment to its shareholders even as it adjusts to a shifting commercial environment.

But what really matters is how ongoing softness in the US, UK, and Germany could wind up limiting Brown-Forman’s future earnings growth if...

Read the full narrative on Brown-Forman (it's free!)

Brown-Forman's outlook anticipates $4.1 billion in revenue and $870.2 million in earnings by 2028. This is based on a 1.5% annual revenue growth rate and a modest earnings increase of $26.2 million from the current $844.0 million.

Uncover how Brown-Forman's forecasts yield a $30.91 fair value, a 14% upside to its current price.

Exploring Other Perspectives

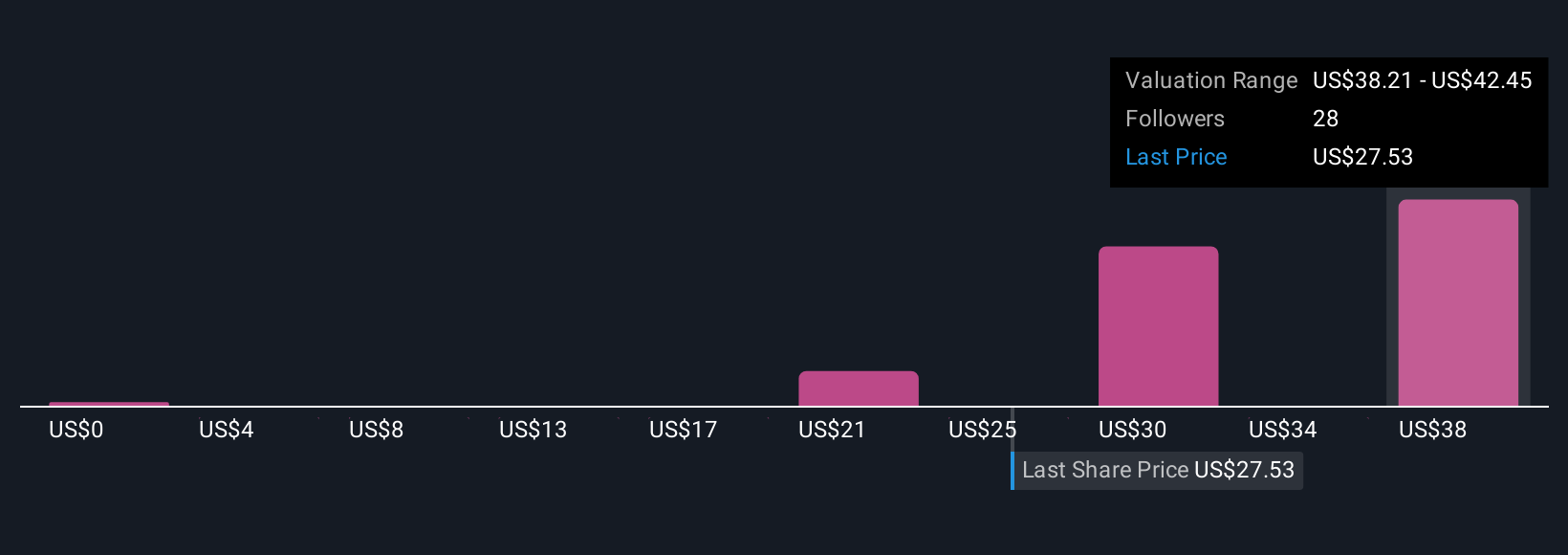

Simply Wall St Community members have shared nine fair value estimates for Brown-Forman ranging from US$4.25 to US$42.45 per share. While opinions differ widely, persistent developed market challenges remain an important consideration for assessing the company’s future performance.

Explore 9 other fair value estimates on Brown-Forman - why the stock might be worth less than half the current price!

Build Your Own Brown-Forman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brown-Forman research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brown-Forman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brown-Forman's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown-Forman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BF.B

Brown-Forman

Manufactures, distills, bottles, imports, exports, markets, and sells a variety of alcohol beverages.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives