- United States

- /

- Food

- /

- NYSE:ADM

Should You Reassess ADM After Its 24.5% Surge in 2025?

Reviewed by Bailey Pemberton

If you’re looking at Archer-Daniels-Midland stock and wondering whether now is the time to buy, hold, or sell, you’re definitely not alone. ADM has been on quite a ride lately, and its price movements are giving investors plenty to think about. Over the past week, shares dipped by just 0.6%, but zooming out a bit, the 1-month gain of 3.0% and a substantial 24.5% increase year-to-date tell a more encouraging story. Factor in a 15.1% rise over the last year and an impressive 43.8% growth over five years, and you might see why some consider this a stock that rewards patience. A 27.2% decline over three years serves as a reminder that it hasn’t been all smooth sailing.

Industry headlines have been swirling around global supply chain shifts, renewable biofuels momentum, and food security themes, each impacting how investors perceive both the opportunities and the risks that ADM faces. New investments in sustainability and strategic partnerships have generated buzz but haven’t yet transformed the company’s overall valuation profile.

Speaking of valuation, ADM currently scores a 1 out of 6 based on our value assessment checks. This signals that by most traditional measures, the stock may not be as deeply undervalued as bargain hunters might hope. Still, numbers can only tell part of the story, and the real insight comes from understanding exactly how those valuations are determined. Up next, we will break down the major approaches analysts use to judge whether ADM is cheap or costly, and later in the article, we will share a smarter way to interpret what those valuations actually mean for you as an investor.

Archer-Daniels-Midland scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Archer-Daniels-Midland Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them back to today’s dollars. This gives investors an estimate of the business’s intrinsic value based on its ability to generate cash in the years ahead. This approach is widely used for stocks like Archer-Daniels-Midland, where long-term results matter as much as short-term earnings.

Currently, Archer-Daniels-Midland’s Free Cash Flow stands at $4.2 Billion, and analysts model how these cash flows will change over the coming decade. Forecasts show Free Cash Flow reaching an estimated $2.2 Billion by 2027, with projections extending as far as $1.3 Billion by 2035 based on more uncertain long-range assumptions. The DCF model used here is the 2 Stage Free Cash Flow to Equity version, which incorporates both near-term analyst predictions and more speculative longer horizon estimates.

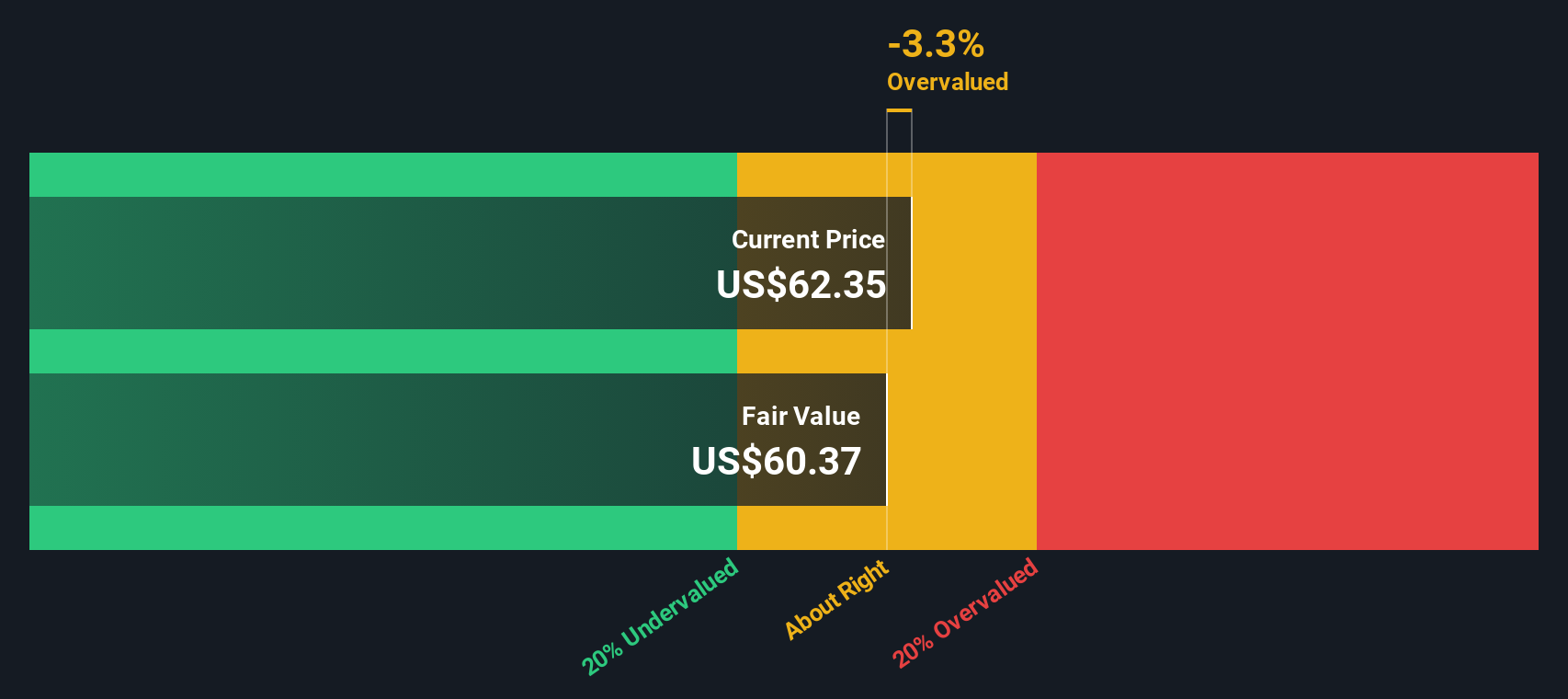

Combining these projections, the DCF analysis calculates an intrinsic share value of $64.53. With the current share price just 3.1% below this estimate, the stock appears to be trading very close to its fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Archer-Daniels-Midland's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Archer-Daniels-Midland Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to tool for valuing profitable companies like Archer-Daniels-Midland because it connects a company's share price directly to its bottom-line earnings. It is especially useful as it gives investors a quick sense of whether the stock is priced appropriately for its recent profitability.

Growth expectations and perceived risk play a big part in what a “normal” or “fair” PE ratio should be. Companies with higher expected earnings growth or more stable performance typically command higher PE multiples, while riskier or slower-growing firms tend to trade at lower valuations.

Right now, Archer-Daniels-Midland trades at a PE ratio of 27.3x, which is noticeably above the Food industry average of 17.8x, and also higher than its peer average of 22.1x. However, just looking at these averages can be misleading since they do not account for company-specific factors.

This is where the Simply Wall St Fair Ratio comes in. The Fair Ratio for ADM is 22.6x. Unlike basic comparisons, the Fair Ratio considers not just industry and market cap, but also ADM’s earnings growth prospects, risk profile, and profit margins, giving a more accurate benchmark for a company’s unique situation.

Comparing the Fair Ratio of 22.6x to ADM’s current PE of 27.3x, the stock is trading a bit above what the fundamentals and its business profile warrant, signaling it may be slightly overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Archer-Daniels-Midland Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story: the explanation behind your view of a company’s future, bringing together your assumptions about Archer-Daniels-Midland’s revenue growth, profit margins, and fair value into a single vision. Narratives move beyond just the numbers, connecting what is happening in the business and the industry to a clear, easy-to-follow financial forecast. This approach helps you link your expectations of ADM’s future to what you believe is a reasonable price for the stock.

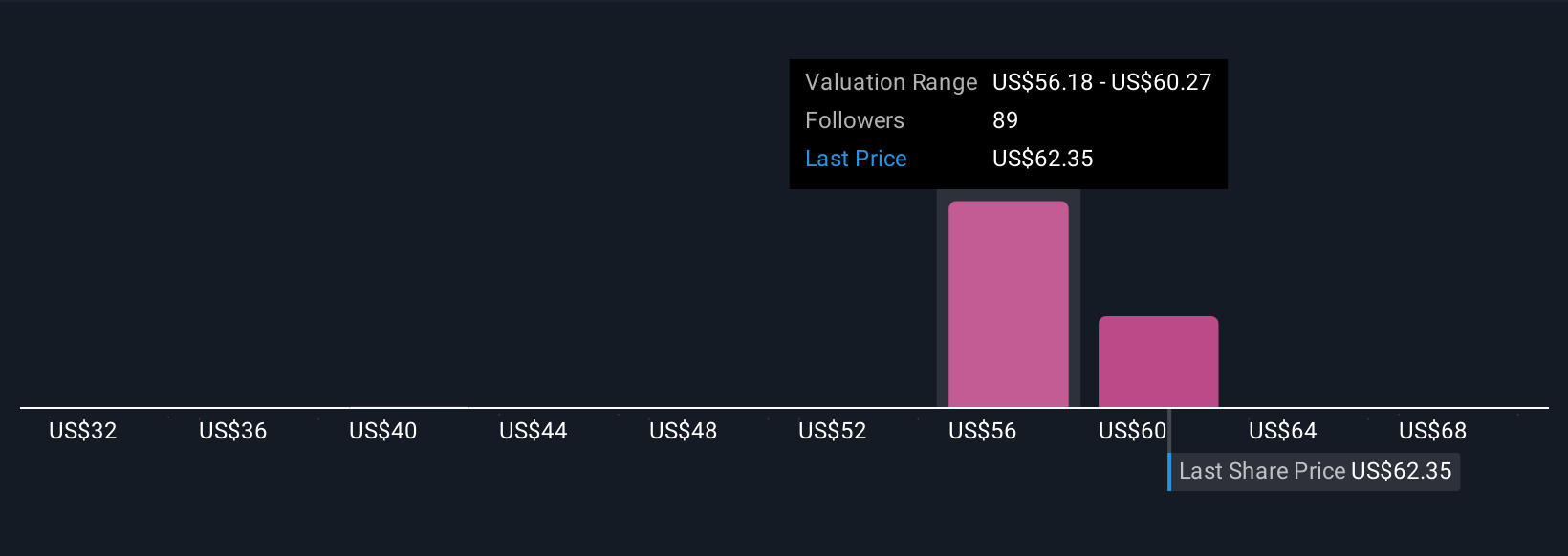

You do not need to be a finance professional to use Narratives; millions of investors on Simply Wall St’s Community page use this accessible tool to make sense of markets and share their perspectives. By creating or following a Narrative, you can clearly see whether your view of fair value is above or below the current share price, making it much simpler to decide when a stock may be a buy, hold, or sell for you.

The power of Narratives is their dynamic, real-time updates as new news or earnings arrive, allowing your outlook to stay relevant as conditions change. For example, in the Community, the most optimistic view on Archer-Daniels-Midland sets a target price as high as $70.00, while the most cautious sees just $54.00. Both outcomes are supported by different assumptions about policy support, margin recovery, and long-term growth. Ultimately, Narratives let you weigh the story you believe in and invest accordingly.

Do you think there's more to the story for Archer-Daniels-Midland? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives