- United States

- /

- Food

- /

- NYSE:ADM

Does ADM’s New Carbon Capture Project Signal a Turning Point in Its Sustainability Strategy? (ADM)

Reviewed by Sasha Jovanovic

- ADM recently commenced operations at its new carbon capture and storage project at the Columbus, Nebraska Corn Processing Complex, utilizing Tallgrass's Trailblazer pipeline to transport and permanently store CO2 underground in Wyoming.

- This initiative positions ADM as a leader in large-scale bioethanol carbon capture, reflecting rising industry emphasis on environmental innovation and emissions reduction.

- We'll explore how ADM's investment in carbon capture technology could affect its overall sustainability profile and future investment outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Archer-Daniels-Midland Investment Narrative Recap

Being a shareholder in ADM often means believing in the long-term demand for agricultural processing, biofuels, and sustainability-driven innovation. ADM's new carbon capture project highlights its efforts to address emissions and reinforce its sustainability profile, but this initiative may not materially shift the most immediate catalyst, which is policy clarity around biofuels and related government support. The biggest risk remains ongoing volatility from policy uncertainty and shifting commodity margins that can quickly affect earnings.

Among recent announcements, the continued declaration of a regular dividend, most recently at US$0.51 per share, shows ADM's commitment to shareholder returns, even as it invests in longer-term environmental projects. This focus may be reassuring for some investors, particularly in a sector exposed to rapidly changing policy and margin environments.

On the other hand, investors should be aware that risks tied to regulatory changes and unpredictable biofuel policy could...

Read the full narrative on Archer-Daniels-Midland (it's free!)

Archer-Daniels-Midland's narrative projects $88.6 billion revenue and $2.1 billion earnings by 2028. This requires 2.3% yearly revenue growth and a $1.0 billion increase in earnings from the current $1.1 billion.

Uncover how Archer-Daniels-Midland's forecasts yield a $57.60 fair value, in line with its current price.

Exploring Other Perspectives

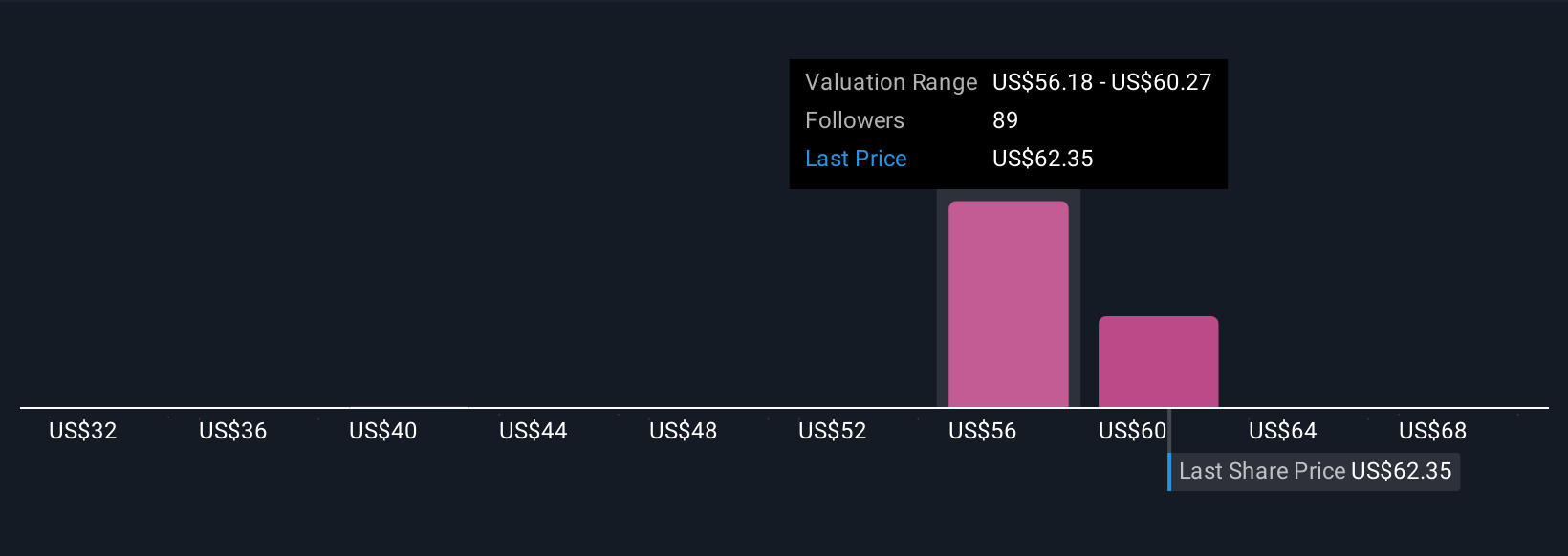

Thirteen members of the Simply Wall St Community estimate ADM's fair value from US$31.64 to US$72.54 per share. With biofuel policy still in flux, these divergent views reflect how a single catalyst can alter expectations about ADM's future cash generation and returns; consider multiple perspectives as you assess your position.

Explore 13 other fair value estimates on Archer-Daniels-Midland - why the stock might be worth 45% less than the current price!

Build Your Own Archer-Daniels-Midland Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Archer-Daniels-Midland research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Archer-Daniels-Midland research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Archer-Daniels-Midland's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives