- United States

- /

- Food

- /

- NYSE:ADM

Archer-Daniels-Midland (ADM) Valuation in Focus Following Recent Share Price Momentum

Reviewed by Simply Wall St

Archer-Daniels-Midland (ADM) stock has caught the attention of investors recently, fueled by shifts in the company’s performance and the food and agriculture sector’s evolving landscape. ADM’s returns over the past year offer some interesting insights.

See our latest analysis for Archer-Daniels-Midland.

Archer-Daniels-Midland’s share price has gathered some upward momentum lately, with a 15.65% 90-day share price return helping fuel a 26.11% gain year-to-date. Looking at a broader timeframe, the 1-year total shareholder return stands at 16.45%, which may indicate that sentiment is shifting after a difficult stretch in previous years.

If you're watching ADM's rebound and want to see what other stocks offer interesting growth stories and insider conviction, this could be a great time to explore fast growing stocks with high insider ownership

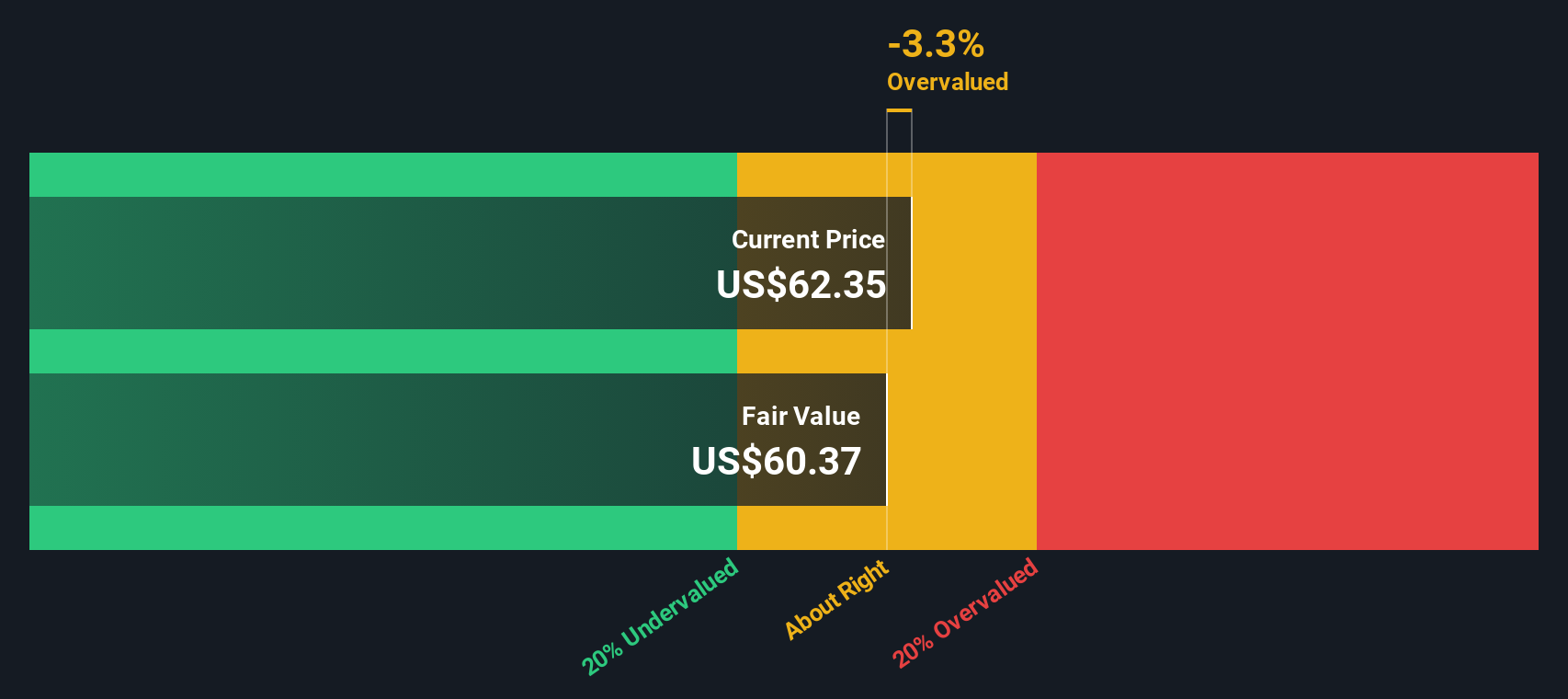

With shares rebounding and recent gains outpacing analyst price targets, the key question now is whether ADM’s stock is trading below its true value, or if the market has already factored in the company’s next chapter of growth.

Most Popular Narrative: 8.6% Overvalued

At $63.33, Archer-Daniels-Midland shares trade well above the most followed narrative’s fair value estimate of $58.30, raising eyebrows over whether recent optimism has gone too far. This sets the stage for a closer look at the assumptions and inflection points driving the narrative’s price target.

Policy clarity and ongoing government support for biofuels, including the extension of the 45Z tax credit, favorable RVOs, and domestic feedstock incentives, are expected to drive increased soybean oil demand and improved crush margins, directly supporting ADM's revenue and net margins from late 2025 into 2026.

Curious what powers this narrative when it bets on new policy to ignite future margins and earnings? It’s not just tax credits or regulation. The bold numbers baked into this fair value come from operational upgrades and strong margin forecasts that could change everything if they hold true. Tempted to peek at the forecasted surge for revenue and profits? Dive deeper to discover the full financial leap imagined by this narrative.

Result: Fair Value of $58.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainty around biofuel policy and declining volumes in key segments could quickly challenge the more optimistic scenario that is priced into ADM shares.

Find out about the key risks to this Archer-Daniels-Midland narrative.

Another View: Discounted Cash Flow Perspective

While analyst narratives suggest ADM is overvalued at current prices, our SWS DCF model offers a slightly different story. According to our estimates, ADM trades around 1.9% below its fair value, which could signal a potential opportunity for investors who trust in long-term cash flows over market sentiment. Which view will prove closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer-Daniels-Midland for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer-Daniels-Midland Narrative

If the current conclusions do not align with your own outlook or you would rather chart your own course, there is an easy way to build and personalize your own Archer-Daniels-Midland narrative in just a few minutes. Do it your way

A great starting point for your Archer-Daniels-Midland research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Open the door to tomorrow's top performers by checking out hand-picked opportunities fit for forward-thinking investors. Don't let these actionable angles pass you by. Take the next step now.

- Boost your dividend income by targeting stable companies with market-beating yields through these 17 dividend stocks with yields > 3%.

- Tap into the artificial intelligence revolution by following these 27 AI penny stocks making waves in automation, analytics, and machine learning.

- Get ahead of the curve with these 877 undervalued stocks based on cash flows offering strong cash flow potential before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives