- United States

- /

- Food

- /

- NasdaqGM:VITL

Vital Farms (VITL) Net Margin Holds at 8.5%, Challenging Ongoing Earnings Quality Concerns

Reviewed by Simply Wall St

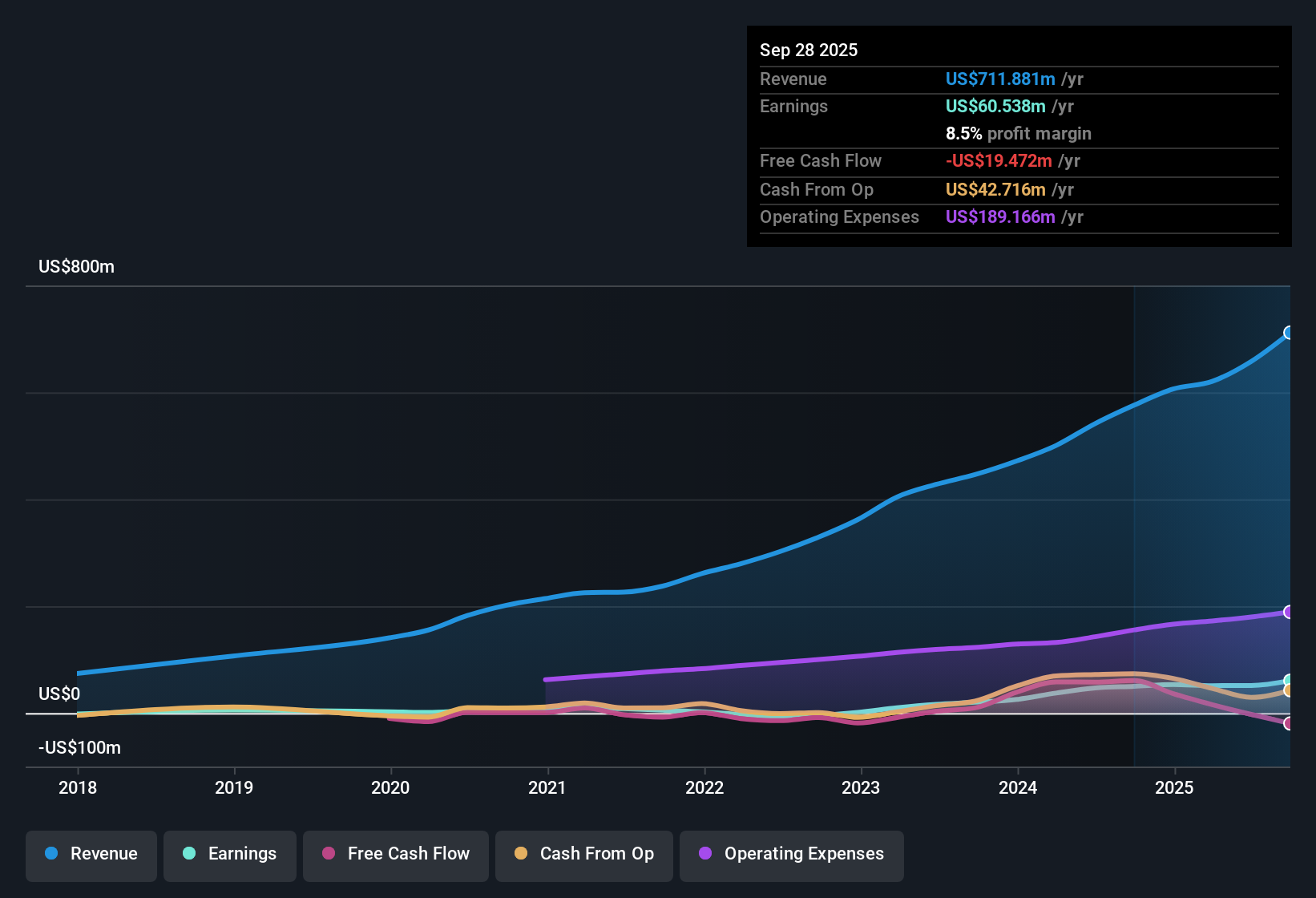

Vital Farms (VITL) reported earnings forecasted to grow at 18.02% annually, with revenue projected to rise by 19.2% per year, both outpacing the broader US market. Net profit margins now stand at 8.5%, just below last year's 8.7%, while recent annual earnings growth reached 21.1%. Over the past five years, average yearly earnings growth has been an impressive 54.5%.

See our full analysis for Vital Farms.The real test is how these results stack up against the broader narratives shaping market sentiment. Some expectations will be confirmed, while others could be turned on their head.

See what the community is saying about Vital Farms

Price-to-Earnings Ratio Sits Below Peer Average

- Vital Farms trades at a Price-to-Earnings (PE) ratio of 27.6x, which stands well below the peer group average of 51.1x, signaling stronger value on a relative basis.

- According to the analysts' consensus view, Vital Farms' premium to the US Food industry average PE of 17.8x is balanced out by its robust brand and effective marketing, with

- double-digit volume growth and premium price points supporting the higher multiple,

- continued expansion of distribution and improved operational efficiencies anchoring future capacity and long-term profit growth.

- Bulls argue that a strong brand and marketing enable Vital Farms to justify its higher PE versus the industry average, and see further upside if premium margins hold. See whether analysts are convinced in the full Consensus Narrative. 📊 Read the full Vital Farms Consensus Narrative.

Non-Cash Earnings and Margin Resilience

- The EDGAR filing highlights a notable presence of non-cash earnings in recent results, while net profit margins remained stable at 8.5% versus 8.7% a year ago.

- Analysts' consensus narrative emphasizes that improved production, expanded facilities, and operational upgrades are expected to hold margins steady,

- with expanded farm and storage capacity removing prior supply bottlenecks and unlocking new growth,

- and a focus on cost management likely to lower per-unit expenses and reinforce long-term profitability despite the higher proportion of non-cash earnings.

Share Price Trails Analyst Target

- Vital Farms last traded at $37.37 per share, sitting 30% below the current analyst price target of $53.70.

- The consensus narrative flags that while analysts predict ongoing growth in both revenue and profits, some caution remains due to risks around accelerated capital expenditures and intensifying competition,

- as heavy capex could turn free cash flow negative in coming years if expected demand does not materialize,

- and increased reliance on premium brand positioning may become vulnerable as rivals introduce similar products.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vital Farms on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different interpretation of the numbers? Share your unique perspective and shape your own narrative in just a few minutes: Do it your way

A great starting point for your Vital Farms research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Vital Farms' reliance on premium brand positioning and growing capital expenditure could put future profits at risk if demand or margins falter.

If you want more confidence in sustainable performance, find businesses consistently growing revenue and earnings through all cycles by using stable growth stocks screener (2077 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VITL

Vital Farms

A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives