- United States

- /

- Food

- /

- NasdaqGM:VITL

Vital Farms (VITL) Is Down 8.0% After Raising 2025 Outlook and Reporting Strong Q3 Results – Has the Growth Story Shifted?

Reviewed by Sasha Jovanovic

- Vital Farms reported third quarter results on November 4, 2025, highlighting US$198.94 million in sales and US$16.42 million in net income, along with an upgraded 2025 net revenue forecast to at least US$775 million.

- An interesting detail is that the company continues to post substantial improvements in both quarterly and year-to-date sales and earnings, accompanied by increased guidance, reflecting heightened confidence in its growth trajectory.

- We'll now explore how Vital Farms' raised full-year guidance and strong earnings contribute to the company's investment narrative and future prospects.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Vital Farms Investment Narrative Recap

To be a shareholder in Vital Farms, you need to believe that demand for ethically produced, premium eggs and dairy will keep supporting the company’s growth investments and brand strength. The latest uptick in Vital Farms’ revenue forecast and strong third quarter results underscore heightened market confidence, but do not remove the immediate risk: heavy capital expenditure for new capacity could weigh on free cash flow if demand projections fall short. In the short term, Vital Farms’ ability to balance rapid expansion with profitability remains the most important catalyst, while possible margin pressure from aggressive spending is the biggest operational risk.

The company’s raised 2025 revenue guidance, now at a minimum of US$775 million, stands out as the key recent announcement tied to these catalysts. This firmer outlook follows substantial gains in both quarterly and nine-month sales, directly reinforcing the thesis that Vital Farms can convert consumer tailwinds and capacity expansion into higher sales and improved earnings, though the timing and sustainability of this momentum remain subject to operational execution.

On the other hand, information that investors should be aware of is whether rising costs from new facilities might strain Vital Farms’ margins just as revenue accelerates…

Read the full narrative on Vital Farms (it's free!)

Vital Farms' outlook anticipates $1.2 billion in revenue and $103.0 million in earnings by 2028. This scenario assumes a 22.5% annual revenue growth rate and a $51.4 million increase in earnings from current earnings of $51.6 million.

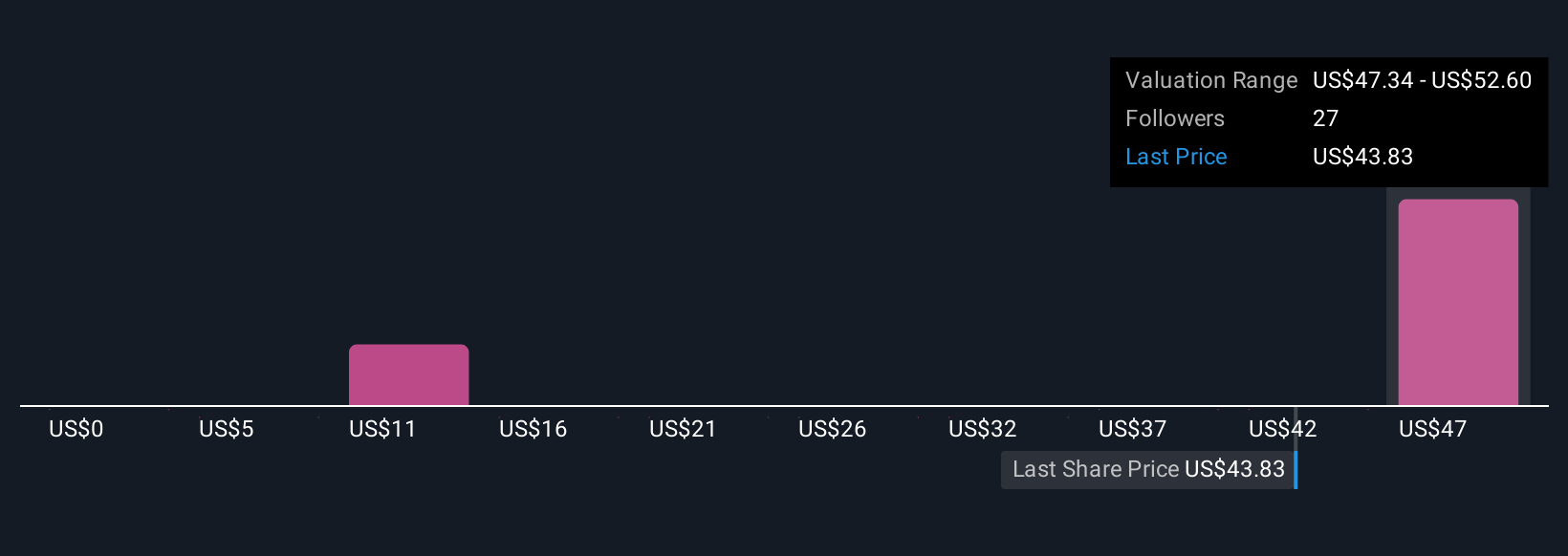

Uncover how Vital Farms' forecasts yield a $52.60 fair value, a 61% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community have set fair values for the stock, spanning from US$6.71 to US$67.10. While opinions vary widely, the risk that Vital Farms’ elevated capital spending might squeeze margins if projected demand doesn’t materialize is a key theme you’ll want to explore in depth across different viewpoints.

Explore 6 other fair value estimates on Vital Farms - why the stock might be worth less than half the current price!

Build Your Own Vital Farms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vital Farms research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vital Farms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vital Farms' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VITL

Vital Farms

A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives