- United States

- /

- Food

- /

- NasdaqGM:VITL

Vital Farms (VITL): Evaluating Valuation After Strong Q3 Growth and Raised 2025 Revenue Outlook

Reviewed by Simply Wall St

Vital Farms (VITL) just delivered impressive third quarter results, with both sales and net income seeing substantial year-over-year growth. The company also raised its full-year revenue guidance, which highlights ongoing momentum and confidence in future performance.

See our latest analysis for Vital Farms.

Despite posting big jumps in sales and profit, plus raising its outlook, Vital Farms’ share price is down 20% over the past month and 33% over the last quarter. Still, investors who have held on longer term are sitting on a 14.4% one-year total shareholder return and a 131% return over three years. This shows that momentum has been strong even as the stock cools off after a period of rapid growth.

If you’re curious to see what else savvy investors are watching beyond this quarter’s headlines, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares in retreat despite robust results and a bullish outlook, investors now face a key question: Is Vital Farms trading at an attractive discount, or is the market already pricing in all its future growth?

Most Popular Narrative: 38.8% Undervalued

Vital Farms' most popular narrative puts fair value nearly 40% above the last close, pointing to significant upside compared to current market pricing. A closer look at the drivers behind this view reveals a blend of unique strengths and rapid operational expansion fueling investor optimism.

Significant expansion of farm and production network, including acceleration of CapEx to build out capacity (two production lines at the Seymour, Indiana facility and additional cold storage), positions Vital Farms to fully capitalize on unmet or pent-up demand, removing prior supply constraints and unlocking further revenue and earnings growth.

What’s really behind this bullish outlook? It’s not just about selling more eggs. There’s a bold playbook of ambitious top and bottom line targets, margin expansion, and a valuation multiple that rivals even high-growth sectors. Think you know what numbers power this premium? Don’t miss the full narrative; the specifics may surprise you.

Result: Fair Value of $52.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid expansion and heavy capital spending could squeeze margins if demand slows or if rising costs catch the company off guard.

Find out about the key risks to this Vital Farms narrative.

Another View: Premium Price Tag Signals Caution

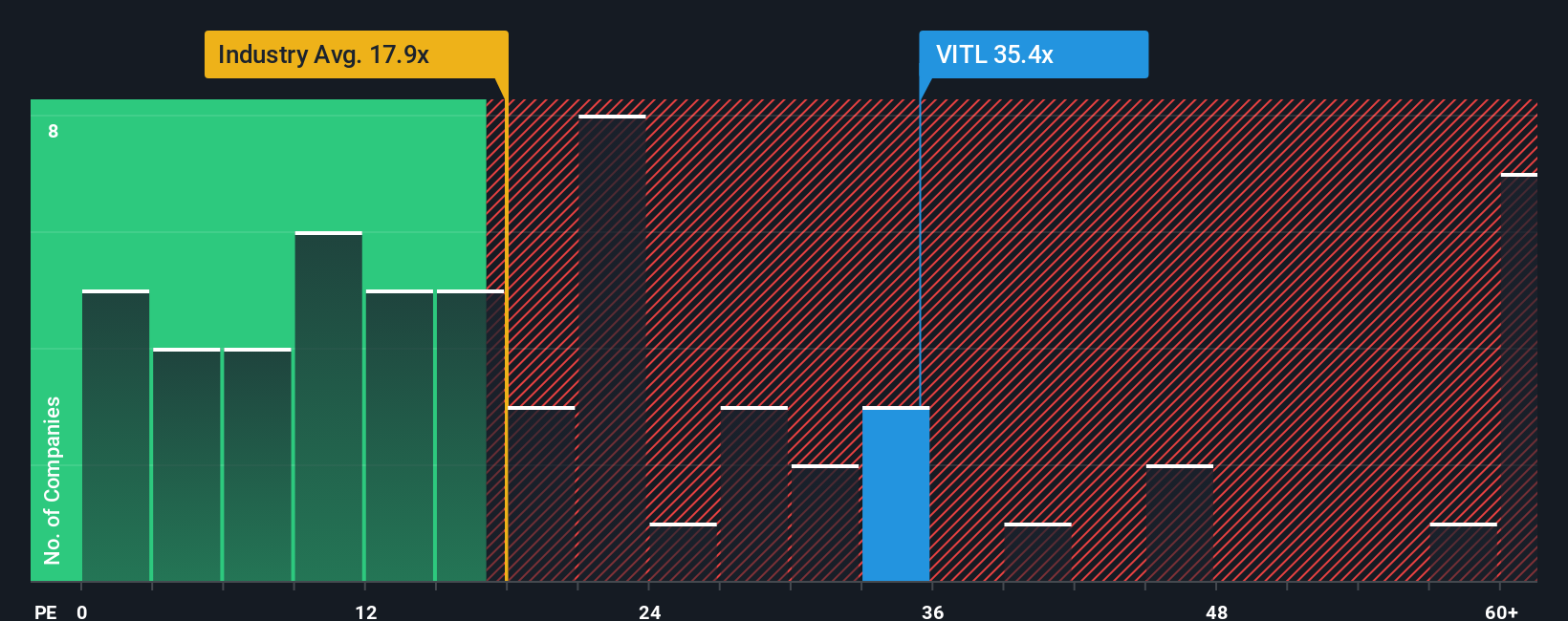

While analyst forecasts suggest Vital Farms is undervalued based on its growth and future earnings, a look at its price-to-earnings ratio tells a different story. At 23.8x, it is significantly higher than both the industry average of 17.8x and a fair ratio of 19.2x. This means investors are paying a steep premium for future potential, raising the bar for performance and leaving little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vital Farms Narrative

If you want to dig into the numbers yourself or approach the story from a different angle, it's quick and easy to craft your own take in just a few minutes, so Do it your way.

A great starting point for your Vital Farms research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunity does not wait for anyone. Now is the time to give yourself an edge by searching for investments beyond the obvious, using our smart screeners. Make sure you are staying ahead of the curve with curated stock ideas that can boost and diversify your strategy.

- Capitalize on tomorrow's breakthroughs by tapping into market leaders reshaping industries with these 24 AI penny stocks.

- Pursue value opportunities by targeting potential bargains using these 882 undervalued stocks based on cash flows that could deliver real upside.

- Grow your passive income stream and spot reliable yield plays with these 16 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VITL

Vital Farms

A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives