- United States

- /

- Food

- /

- NasdaqGM:VITL

Vital Farms (VITL): Evaluating the Latest Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Vital Farms (VITL) has caught the eye of investors after a noteworthy stretch in the market. The company’s shares have pulled back over the past month, prompting a closer look at what might be driving sentiment now.

See our latest analysis for Vital Farms.

Vital Farms’ share price has pulled back sharply in the last month, with a 1-month share price return of -16.8 percent and a year-to-date dip of 10.2 percent. Its three-year total shareholder return still sits at an impressive 170 percent. Momentum has faded recently as investors digest the company’s growth story and consider whether risk perception around the stock is beginning to shift.

If you’re looking to spot the next breakout, now is a great moment to expand your investing universe and discover fast growing stocks with high insider ownership

With shares down and fundamentals still showing double-digit growth, investors are left wondering if this dip signals a genuine undervaluation or if the market has already factored in all of Vital Farms’ future prospects.

Most Popular Narrative: 33.7% Undervalued

Vital Farms' most-followed narrative suggests there is a sizeable gap between its consensus fair value and the recent close price. With the consensus fair value at $52.60 and a last close of $34.89, the stock is viewed as deeply discounted by the narrative’s proponents. This sets the stage for a look at the factors fueling that call.

Significant expansion of farm and production network, including acceleration of CapEx to build out capacity (two production lines at the Seymour, Indiana facility and additional cold storage), positions Vital Farms to fully capitalize on unmet/pent-up demand. This would remove prior supply constraints and unlock further revenue and earnings growth.

Can expansion alone propel Vital Farms to the narrative's ambitious targets? The real twist is in the underlying expectations for outpaced earnings growth, margin leverage, and a premium multiple rarely seen outside high-growth sectors. Uncover which bold assumptions push this price target so far above consensus and what it would take for the fair value case to actually play out.

Result: Fair Value of $52.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital spending or disappointing demand growth could pressure margins and profits, which could quickly challenge the optimistic valuation narrative for Vital Farms.

Find out about the key risks to this Vital Farms narrative.

Another View: The Market’s Multiple

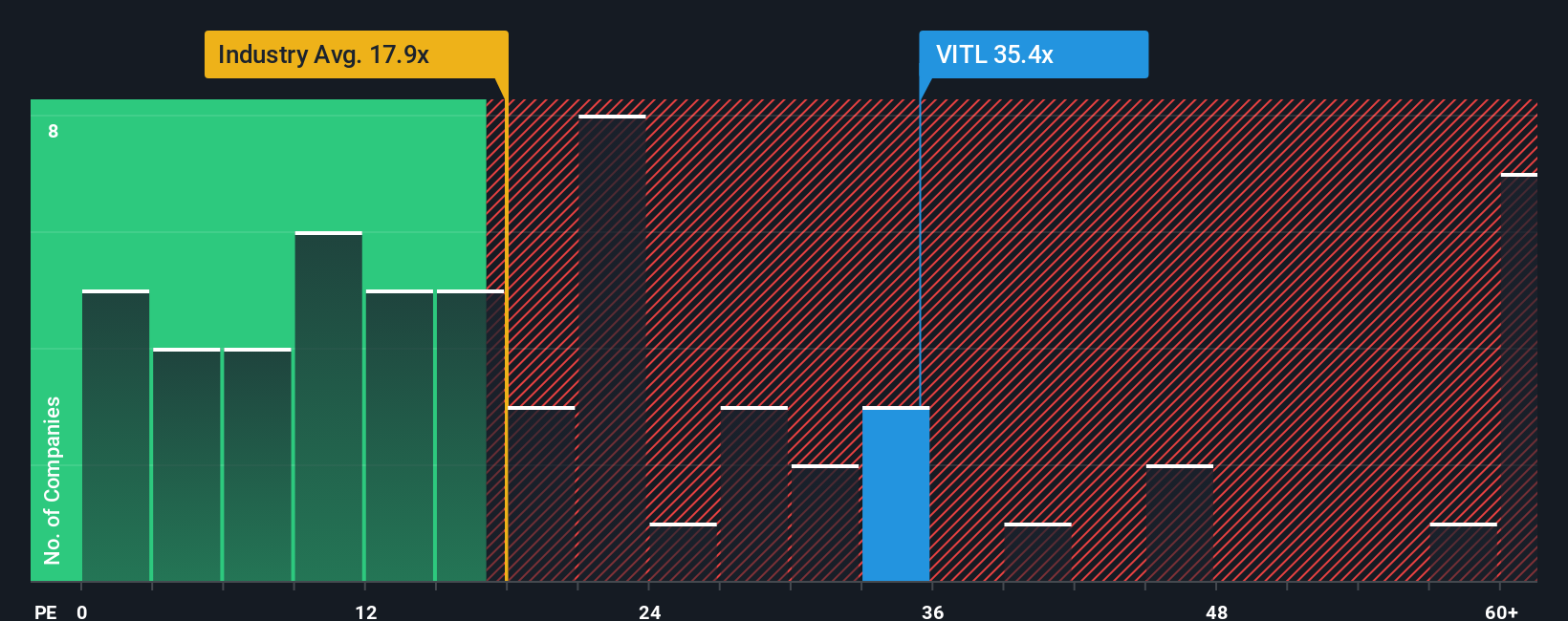

Taking a look at valuation through the lens of the price-to-earnings ratio tells a different story. Vital Farms trades at 30.2x earnings, which is above both the US Food industry average of 18.5x and its peer average of 30.7x. Notably, this is also higher than the fair ratio of 23.3x that the market could move toward. This suggests some valuation risk, despite strong fundamentals. Could the premium assigned to Vital Farms narrow if earnings or sentiment slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vital Farms Narrative

If you see things differently, or want to dig into the details on your own terms, it only takes a few minutes to build your own perspective. Why not Do it your way?

A great starting point for your Vital Farms research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Skip the guesswork and power up your portfolio. The Simply Wall Street Screener spotlights trends, value, and technology to help you uncover opportunities others might miss.

- Access cash flow bargains with strong upside by checking out these 848 undervalued stocks based on cash flows where overlooked value stocks await your attention.

- Catch the next digital breakthrough, as these 26 AI penny stocks help you tap into companies fueling the AI-driven economy.

- Secure steady income streams when you tap into these 21 dividend stocks with yields > 3%, featuring stocks with reliable yields over 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VITL

Vital Farms

A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives