- United States

- /

- Food

- /

- NasdaqCM:VFF

Outdoor Holding And Two Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market rebounds on optimism surrounding a potential resolution to the government shutdown, investors are exploring various opportunities across different sectors. Penny stocks, though often considered a throwback term, continue to offer intriguing prospects for those willing to look beyond established giants. In this article, we explore several penny stocks that combine strong financials with growth potential, highlighting opportunities that may be underappreciated in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.81 | $357.89M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.66 | $578.66M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.985 | $164.35M | ✅ 4 ⚠️ 3 View Analysis > |

| LexinFintech Holdings (LX) | $4.25 | $720.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.98 | $56.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.15 | $25.73M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.53 | $590.99M | ✅ 4 ⚠️ 0 View Analysis > |

| Cricut (CRCT) | $4.78 | $1.01B | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8811 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.22 | $69.33M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 359 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Outdoor Holding (POWW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Outdoor Holding Company operates an online marketplace business with a market cap of $202.60 million.

Operations: Outdoor Holding does not have any reported revenue segments.

Market Cap: $202.6M

Outdoor Holding Company, with a market cap of US$202.60 million, has shown recent financial improvements despite being a penny stock. The company reported stable sales of US$11.98 million for the second quarter and achieved a net income of US$1.4 million, reversing from a previous loss of US$12.43 million. This marks progress in its financial health, although it remains unprofitable over the longer term with significant losses reported in prior years. Recent strategic moves include filing for a shelf registration to raise up to $15.6 million and relocating headquarters to Atlanta to cut costs further enhancing its operational efficiency prospects.

- Click here and access our complete financial health analysis report to understand the dynamics of Outdoor Holding.

- Understand Outdoor Holding's track record by examining our performance history report.

Stran (SWAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stran & Company, Inc. offers outsourced marketing solutions across the United States, Canada, and Europe with a market cap of $56.78 million.

Operations: The company generates $108.41 million in revenue from its operations within the United States.

Market Cap: $56.78M

Stran & Company, Inc., with a market cap of US$56.78 million, has demonstrated significant revenue growth, reporting US$32.58 million for the second quarter compared to US$16.69 million a year ago and achieving net income of US$0.643 million from a previous net loss. The company has no debt and its short-term assets exceed both short-term and long-term liabilities, indicating financial stability despite high share price volatility over recent months. Management is experienced with an average tenure of 3.3 years; however, the board is relatively new with an average tenure of 2.2 years, suggesting potential for fresh strategic perspectives.

- Get an in-depth perspective on Stran's performance by reading our balance sheet health report here.

- Examine Stran's past performance report to understand how it has performed in prior years.

Village Farms International (VFF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Village Farms International, Inc. operates in North America producing, marketing, and distributing greenhouse-grown tomatoes, bell peppers, cucumbers, and mini-cukes with a market cap of $389.75 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: $389.75M

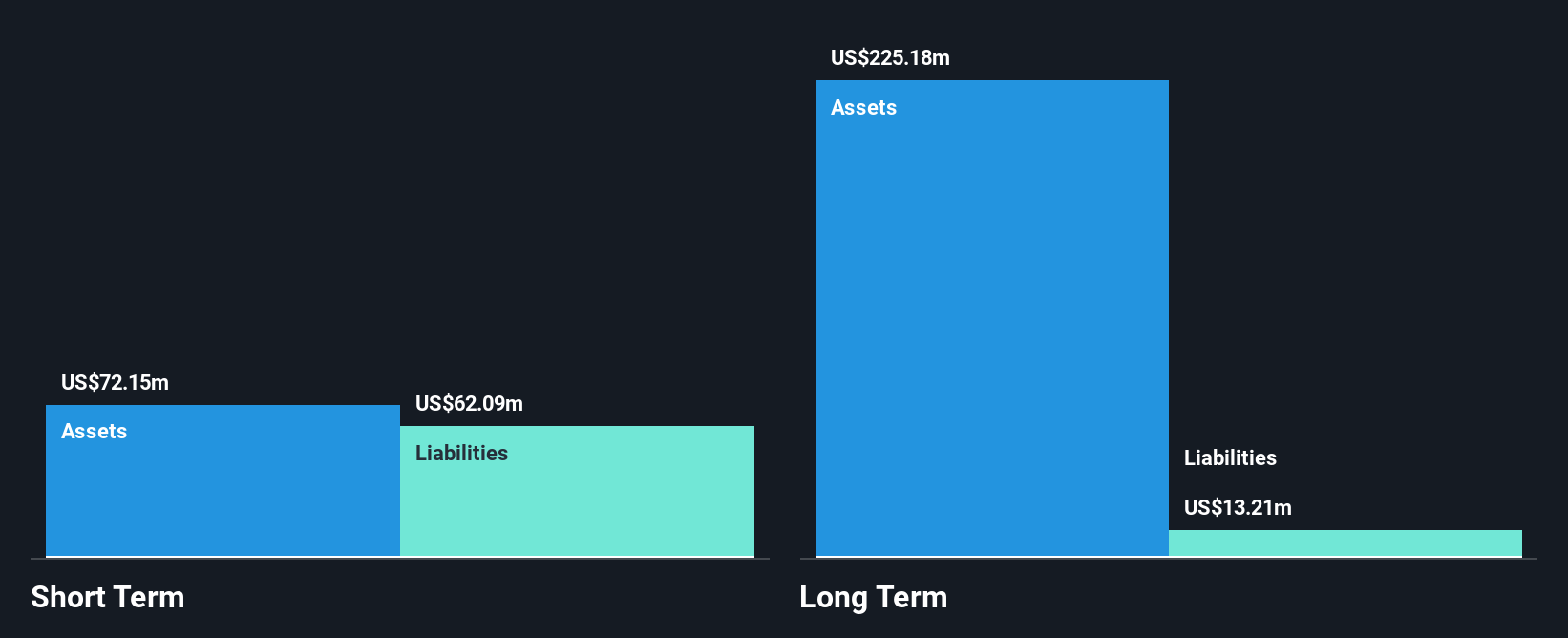

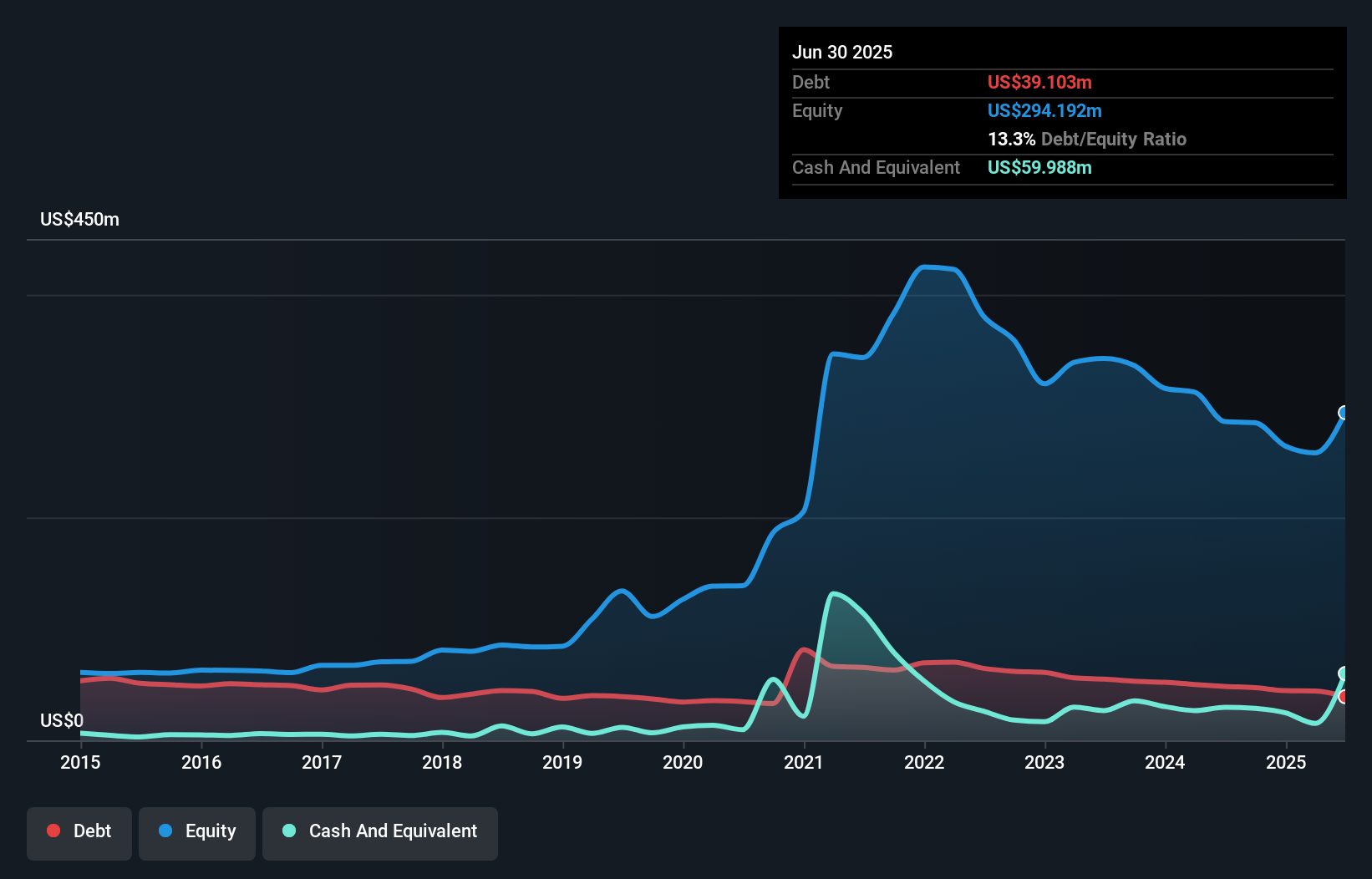

Village Farms International, Inc., with a market cap of US$389.75 million, has shown improved financial performance recently, reporting third-quarter sales of US$66.74 million and net income of US$10.22 million compared to a net loss previously. Despite being unprofitable over the past five years with increasing losses, the company maintains a positive cash flow and sufficient cash runway for over three years. The stock trades below its estimated fair value but exhibits high volatility compared to most U.S. stocks. Recent strategic moves include hiring an experienced Chief Information and Technology Officer and launching innovative cannabis packaging products in Canada’s growing convenience segment.

- Unlock comprehensive insights into our analysis of Village Farms International stock in this financial health report.

- Assess Village Farms International's future earnings estimates with our detailed growth reports.

Summing It All Up

- Embark on your investment journey to our 359 US Penny Stocks selection here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VFF

Village Farms International

Produces, markets, and distributes greenhouse grown tomatoes, bell peppers, cucumbers, and mini-cukes in North America.

Flawless balance sheet and fair value.

Market Insights

Community Narratives