- United States

- /

- Food

- /

- NasdaqCM:SMPL

Simply Good Foods (SMPL) Is Down 17.5% After Guiding for Flat Sales and Lower Margins – What’s Changed

Reviewed by Sasha Jovanovic

- The Simply Good Foods Company recently announced a net loss for its fiscal fourth quarter of 2025, missing profit expectations and issuing a cautious outlook for 2026, including net sales guidance of between a 2% decline and a 2% increase year-over-year and a projected gross margin decline of 100 to 150 basis points.

- Despite challenges in the Atkins brand and ongoing inflationary pressures, the company is seeking to counteract headwinds by increasing marketing investments in Quest and OWYN, expanding product innovation, and authorizing an additional US$150 million in share buybacks.

- With management guiding for subdued growth and persistent margin pressures, we'll consider how these factors reshape the longer-term investment narrative for Simply Good Foods.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Simply Good Foods Investment Narrative Recap

The core belief behind owning Simply Good Foods centers on the potential for continued growth in its core brands, especially Quest and OWYN, as the company shifts resources away from the declining Atkins line. Recent fiscal 2026 guidance for flat to slightly negative sales and margin contraction supports a cautious approach, as input cost inflation and further Atkins brand weakness remain the most significant risks. Short-term momentum relies increasingly on product innovation and effective brand repositioning; the recent news confirms these issues are now central to the outlook.

Among recent announcements, Quest Nutrition's new protein-rich donut launch stands out due to its alignment with the company’s push for innovation in higher-growth categories. This product introduction reflects management’s priority to expand Quest’s offering and supports one of the most important potential growth drivers, which is accelerating household penetration and retail presence of Quest products. This is particularly relevant as Atkins declines, making success in new Quest product categories a key short-term catalyst.

However, while investors may focus on fresh launches, it’s just as important to closely watch …

Read the full narrative on Simply Good Foods (it's free!)

Simply Good Foods' narrative projects $1.6 billion revenue and $204.1 million earnings by 2028. This requires 4.1% yearly revenue growth and a $58.8 million earnings increase from $145.3 million.

Uncover how Simply Good Foods' forecasts yield a $35.20 fair value, a 74% upside to its current price.

Exploring Other Perspectives

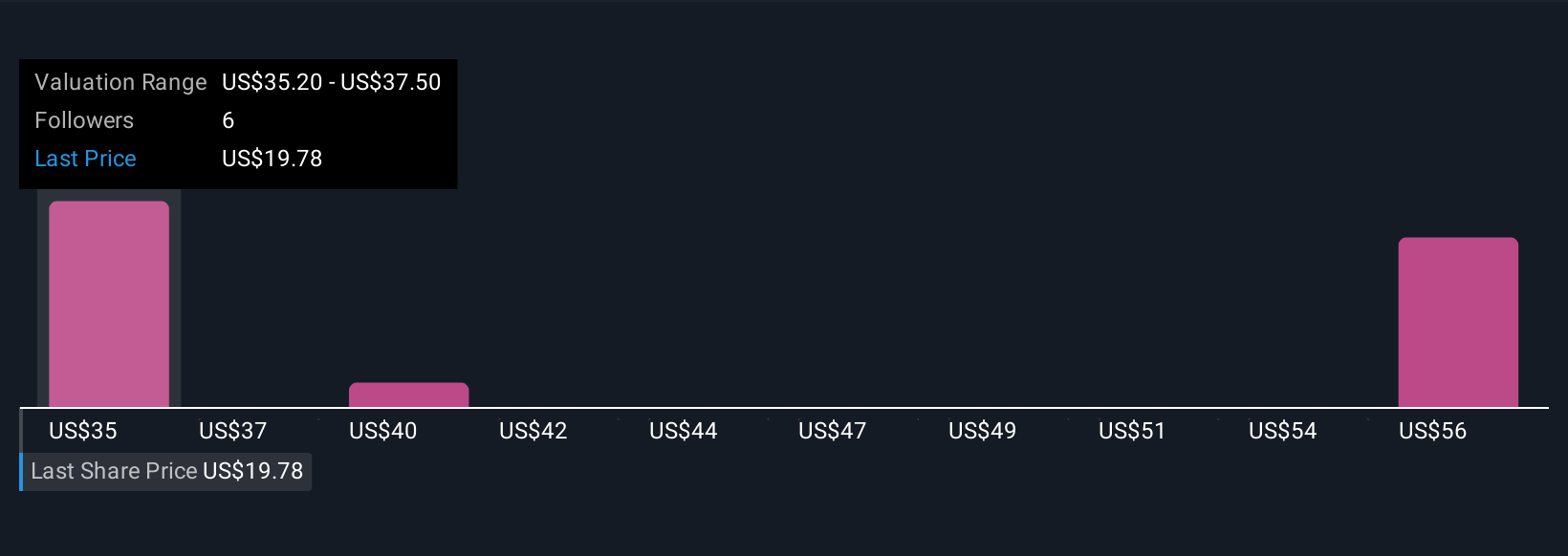

Three Simply Wall St Community estimates put fair value for the company between US$35.20 and US$58.07 per share. With Atkins representing a shrinking share of sales, the future hinges on whether growth in Quest and OWYN can offset these declines, your outlook could differ widely from the consensus.

Explore 3 other fair value estimates on Simply Good Foods - why the stock might be worth just $35.20!

Build Your Own Simply Good Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simply Good Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simply Good Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simply Good Foods' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMPL

Simply Good Foods

A consumer-packaged food and beverage company, engages in the development, marketing, and sale of snacks and meal replacements, and other products in North America and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives