- United States

- /

- Food

- /

- NasdaqCM:SMPL

A Look at Simply Good Foods (SMPL) Valuation Following Q4 Loss, Impairment Charge and Downbeat 2026 Outlook

Reviewed by Simply Wall St

Simply Good Foods (SMPL) captured investor attention after reporting a net loss for Q4 2025, missing profit expectations and dealing with a steep downturn in Atkins brand sales. The company also booked a $60.9 million impairment charge as it reset expectations for Atkins, and its outlook for fiscal 2026 points to flat or declining sales and shrinking gross margins.

See our latest analysis for Simply Good Foods.

Simply Good Foods has hit some roadblocks lately, with momentum fading fast. After a tough quarter and cautious outlook for 2026, the share price has plunged nearly 39% over the past three months and sits almost 48% below its level at the start of the year. Looking further back, long-term investors have seen a 39% total shareholder return decline in the past year, though gains over a five-year horizon remain modestly positive. Recent buyback expansions and new product launches at Quest show management is still investing for the future. However, right now, the market has reset its view on risk and growth potential.

If broad consumer trends and rebound stories interest you, now’s a great time to explore fast growing stocks with high insider ownership.

The stock’s sharp selloff and persistent headwinds raise an important question for investors: are shares now trading at a meaningful discount to their intrinsic value, or is the market already reflecting the company’s uncertain path forward?

Most Popular Narrative: 42.4% Undervalued

At $20.26, Simply Good Foods trades far below the consensus narrative’s fair value of $35.20. This suggests a sharp misalignment between market sentiment and forward-looking expectations grounded in robust growth drivers.

Expansion of OWYN’s distribution channels and SKUs offers a substantial opportunity for revenue growth and doubled net sales potential.

Curious what future scenario justifies such a steep gap from the current stock price? The answer depends on pivotal financial expectations, future earnings power, and a bold long-term profit target that could reset how this business is valued. Don’t miss the deeper story that makes this narrative stand out from the crowd.

Result: Fair Value of $35.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in Atkins and challenges integrating OWYN could derail growth projections and cast doubt on Simply Good Foods’ future earnings power.

Find out about the key risks to this Simply Good Foods narrative.

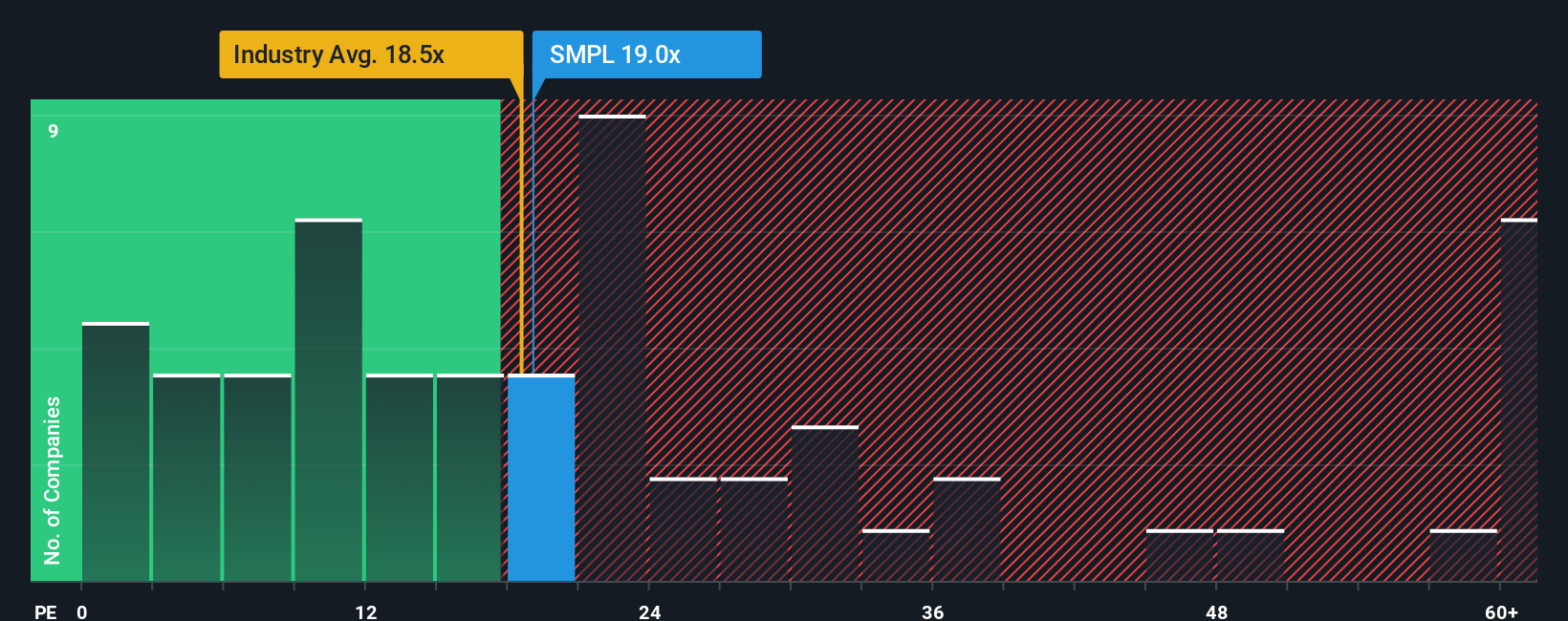

Another View: Market Multiples Send Mixed Signals

While our fair value estimate says Simply Good Foods is deeply undervalued, a look at its current price-to-earnings ratio tells another story. The company’s ratio of 19.5x is higher than both the US Food industry average of 17.8x and its peer average of 17.6x. This means shares are actually more expensive than most rivals when measured by current earnings. However, compared to its fair ratio of 20x, there could still be some room to grow if the market shifts its expectations. Does this suggest a hidden value or a sign that the risk is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Simply Good Foods Narrative

If you have a different viewpoint or want to dig into the numbers yourself, you can craft a personalized story in just a few minutes with Do it your way.

A great starting point for your Simply Good Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize your next big opportunity by checking out unique stock lists only available with Simply Wall St’s Screener. Don’t let standout companies pass you by. Outsmart the market and take your research further now.

- Expand your potential with assets offering regular income and above-average yields. Start with these 17 dividend stocks with yields > 3% to see which companies are delivering.

- Catch the momentum in fast-moving technology by tapping into these 27 AI penny stocks focused on artificial intelligence innovation and disruption.

- Target untapped opportunities by searching these 877 undervalued stocks based on cash flows to identify stocks trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMPL

Simply Good Foods

A consumer-packaged food and beverage company, engages in the development, marketing, and sale of snacks and meal replacements, and other products in North America and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives