David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that S&W Seed Company (NASDAQ:SANW) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for S&W Seed

How Much Debt Does S&W Seed Carry?

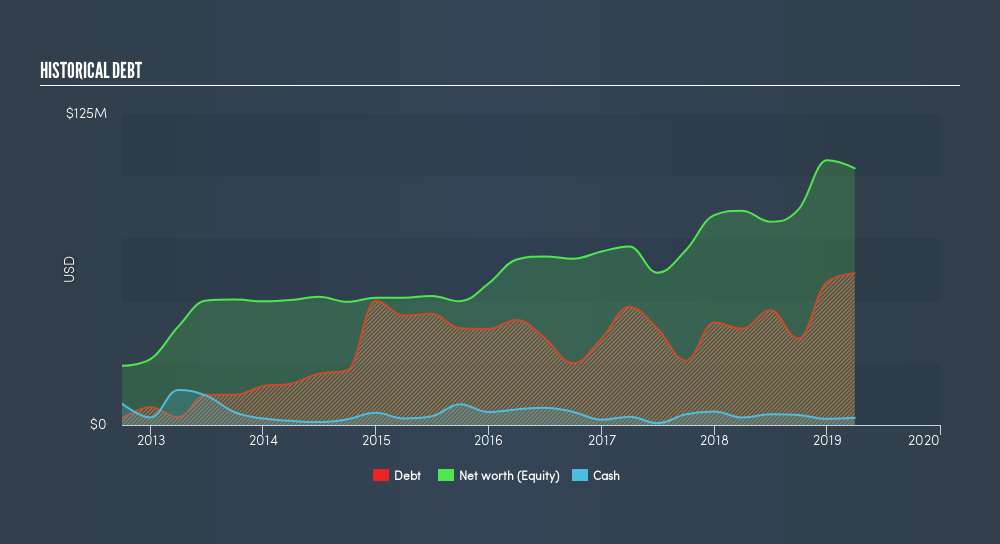

As you can see below, at the end of March 2019, S&W Seed had US$63.2m of debt, up from US$38.7m a year ago. Click the image for more detail. On the flip side, it has US$2.88m in cash leading to net debt of about US$60.3m.

How Healthy Is S&W Seed's Balance Sheet?

The latest balance sheet data shows that S&W Seed had liabilities of US$69.5m due within a year, and liabilities of US$12.7m falling due after that. Offsetting this, it had US$2.88m in cash and US$17.0m in receivables that were due within 12 months. So its liabilities total US$62.3m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of US$96.8m. So should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Either way, since S&W Seed does have more debt than cash, it's worth keeping an eye on its balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if S&W Seed can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, S&W Seed saw its revenue hold pretty steady. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Over the last twelve months S&W Seed produced an earnings before interest and tax (EBIT) loss. Indeed, it lost US$6.4m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled US$26m in negative free cash flow over the last twelve months. So in short it's a really risky stock. For riskier companies like S&W Seed I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:SANW

S&W Seed

An agricultural company, engages in breeding, growing, processing, and sale of alfalfa and sorghum seeds in North and South America, Australia, and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives