- United States

- /

- Food

- /

- NasdaqGS:PPC

Pilgrim's Pride (PPC): Exploring Current Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

Pilgrim's Pride (PPC) has seen its stock price slip nearly 22% over the past 3 months. Investors are examining what might be weighing on shares and considering whether the recent downturn suggests opportunity or caution ahead.

See our latest analysis for Pilgrim's Pride.

Zooming out, Pilgrim's Pride has struggled to regain momentum after a sharp slide in recent months, with its 1-year total shareholder return down 13.7%. Still, looking longer term, shareholders have seen impressive gains of nearly 75% over three years and 138% over five, even as near-term share price performance fades and risk perceptions shift.

If you’re rethinking your portfolio in light of Pilgrim’s latest moves, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

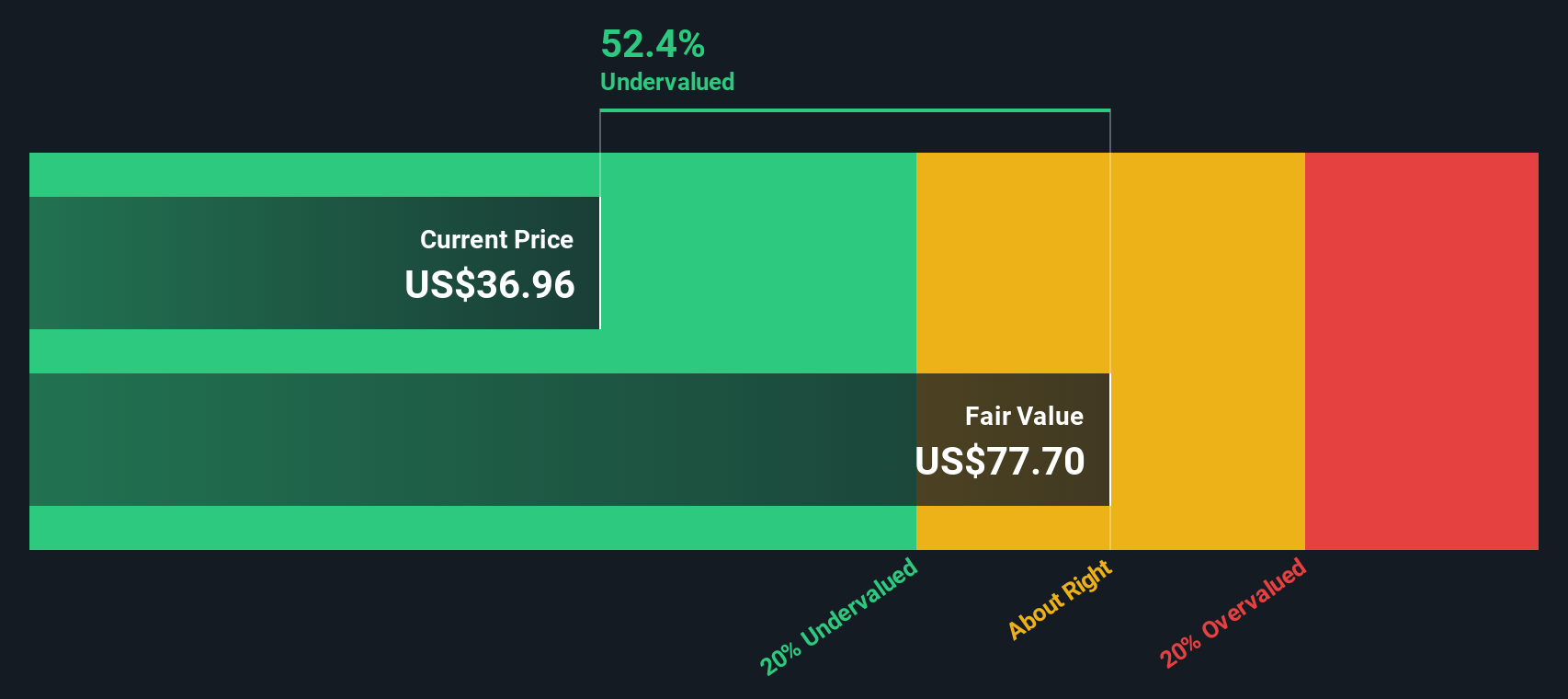

With shares down significantly, investors are left to weigh whether Pilgrim’s Pride is now trading below its true value, or if recent challenges mean the market already reflects the company’s growth prospects. Is there a genuine buying opportunity, or is everything priced in?

Most Popular Narrative: 15% Undervalued

Pilgrim's Pride closed at $37.52, while the most popular narrative sees the fair value significantly higher. This sets up a critical debate about the company's prospects and what justifies the apparent discount.

The company and the broader industry are benefiting from robust growth in global chicken demand, both due to expanding middle classes in emerging markets and the growing affordability gap between chicken and other proteins like beef and pork. If investors are overestimating the durability or pace of this demand, for instance by overlooking potential substitution pressure from alternative proteins or cyclical demand slowdowns, it could result in unrealistically high revenue growth expectations.

Want to know the assumptions powering this bullish narrative? The analysts behind it are banking on a key variable: future margins holding firm even as sector dynamics shift. Curious what their projections actually reveal? Check the full narrative for the financial forecasts behind this valuation.

Result: Fair Value of $44.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if consumer demand softens or input costs unexpectedly surge, Pilgrim’s Pride may face steeper margin pressure than analysts anticipate.

Find out about the key risks to this Pilgrim's Pride narrative.

Another View: What Does Our DCF Model Say?

Taking a different approach, our SWS DCF model suggests a fair value for Pilgrim's Pride of just $0.57 per share, which is far below the current market price. This method evaluates all future cash flows and indicates that the shares may be significantly overvalued based on underlying fundamentals. Does this deep discount reflect real risks, or might the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pilgrim's Pride for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pilgrim's Pride Narrative

If you see things differently or want to follow your own instincts, creating a personal narrative is quick and straightforward. Do it your way

A great starting point for your Pilgrim's Pride research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take the next step toward smarter investing by tapping into these standout opportunities perfectly tailored for today's market. Don't let potential winners slip through your fingers.

- Find better value for your money by using these 879 undervalued stocks based on cash flows to spot stocks trading well below their intrinsic worth and position yourself for future upside.

- Boost your portfolio's income by targeting these 16 dividend stocks with yields > 3% that consistently offer yields above 3%, helping you grow wealth through steady cash flow.

- Expand your reach into innovation by joining early movers in artificial intelligence with these 25 AI penny stocks reshaping tomorrow's industries as we speak.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PPC

Pilgrim's Pride

Produces, processes, markets, and distributes fresh, frozen, and value-added chicken and pork products to retailers, distributors, and foodservice operators in the United States, Europe, and Mexico.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives