- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP): Is the Current Valuation Justified After Recent Trading Trends?

Reviewed by Simply Wall St

PepsiCo (PEP) shares are up slightly over the past week; however, the stock has lagged broader markets in the past month and past 3 months. Even with moderate annual growth in revenue and net income, recent investor sentiment remains cautious.

See our latest analysis for PepsiCo.

Despite a modest share price bounce this week, PepsiCo’s momentum has faded compared to earlier highs, with a 1-year total shareholder return of -1.4% and longer-term returns also trailing broader market averages. Investors appear cautious as growth expectations are being reassessed in light of persistent market headwinds.

If you’re looking to expand your perspective beyond the familiar names, now could be the perfect opportunity to discover fast growing stocks with high insider ownership.

With shares hovering just below analyst price targets but facing lackluster returns, the question remains: Is PepsiCo a bargain hiding in plain sight, or has the market already accounted for all its future growth potential?

Most Popular Narrative: 2.5% Undervalued

The current narrative points to a fair value for PepsiCo just above its last close, suggesting limited upside in the short run. Eyes are now on the company’s next strategic move and its ability to sustain growth momentum.

Operational efficiencies from technology investments, including AI, ERP systems, and the integration of North American businesses, are enabling ongoing multiyear productivity gains, lowering fixed and variable costs, and supporting net margin improvement. (Expected impact: Operating margins and long-term earnings.)

Want to know the real driver behind this “about right” price call? The full narrative hints at bold earnings expansion and margin gains tied to international scale-ups and a slimming future profit multiple. Curious what assumptions analysts are betting on for future profit power? Take a closer look—surprises await.

Result: Fair Value of $152.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish adoption of healthier products and lingering cost pressures could undermine PepsiCo's growth narrative if consumer preferences or input costs shift more aggressively.

Find out about the key risks to this PepsiCo narrative.

Another View: What Do Market Ratios Say?

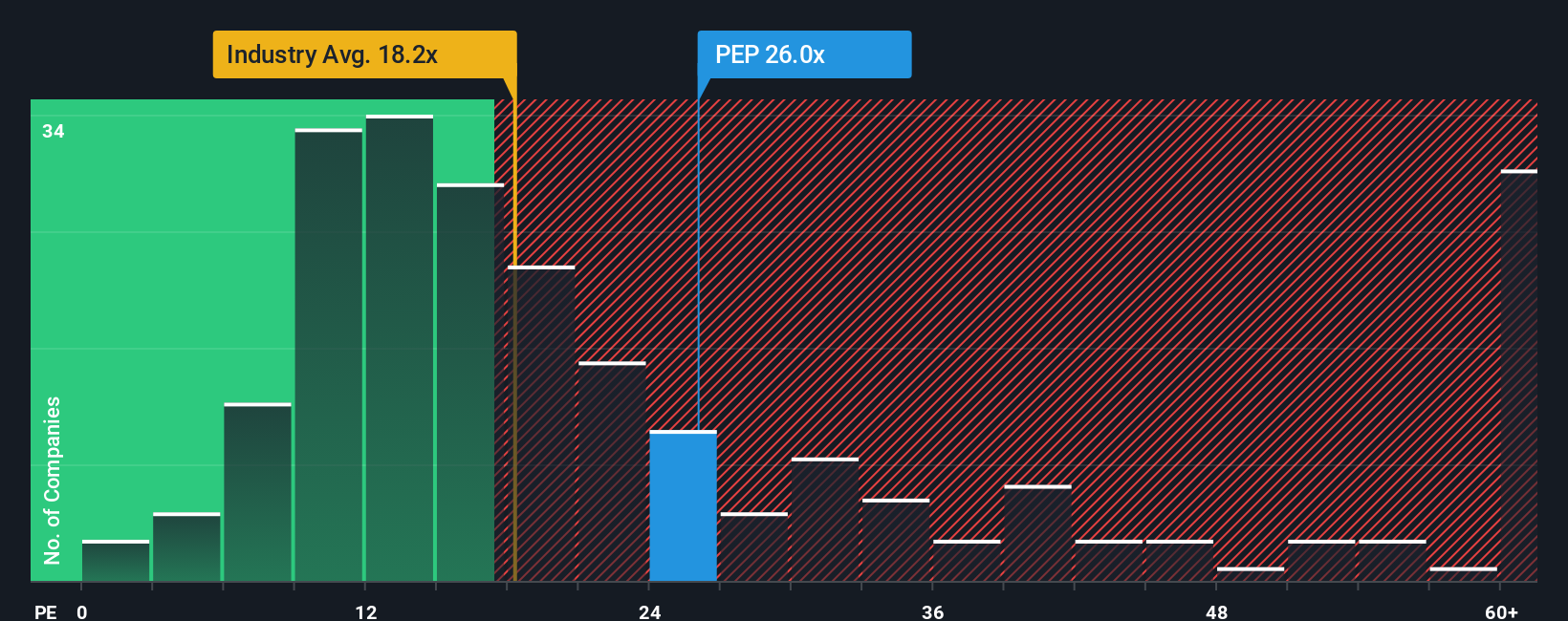

Looking from a different angle, PepsiCo appears pricey when measured against commonly used valuation ratios. The company’s earnings multiple stands at 28.2, noticeably higher than both the global beverage industry average (17.8) and even its peer group (25.6). The fair ratio suggests the market could re-rate PepsiCo towards 26.6, which would pressure the stock to trade lower if sentiment softens. Are investors paying too much for predictability and brand strength?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PepsiCo Narrative

If you see things differently or want to dig deeper into the numbers, you can explore the details yourself and shape your own interpretation in just minutes: Do it your way.

A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Shake up your watchlist with stocks making headlines in disruptive sectors. Don’t wait; these opportunities move fast and the next big winner could slip past.

- Uncover potential with future-focused companies racing ahead in artificial intelligence by starting with these 27 AI penny stocks.

- Tap into strong yields by reviewing these 18 dividend stocks with yields > 3% for reliable payouts above 3% that bolster your returns.

- Step ahead of the crowd with early access to bold blockchain and crypto innovators featured in these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives