- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP): Evaluating Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for PepsiCo.

PepsiCo’s share price has climbed nearly 8% over the past month, suggesting renewed optimism after a stretch of weaker performance. Despite this momentum, the total shareholder return has been negative over the past year, reminding investors to keep an eye on the bigger picture as sentiment shifts.

If you’re interested in where the next wave of fast-moving stocks could come from, consider broadening your search and discover fast growing stocks with high insider ownership

With recent gains and a strong long-term track record, investors may wonder if PepsiCo’s current price reflects its growth potential or if there is still an opportunity to buy before the market fully recognizes it.

Most Popular Narrative: 70% Undervalued

PepsiCo’s most followed narrative values shares at much more than the recent close, citing major strategic changes and growth drivers that could reshape its market standing. Investors are watching whether anticipated international gains and evolving product portfolios can justify the stark disconnect to the market price.

Operational efficiencies from technology investments, including AI, ERP systems, and the integration of North American businesses, are enabling ongoing multiyear productivity gains. These initiatives are lowering fixed and variable costs and supporting net margin improvement. (Expected impact: Operating margins and long-term earnings.)

Curious about the bold financial moves and efficiency assumptions behind this valuation gap? Unlock what lies at the heart of these forecasts and how market leadership, not just numbers, is driving the story. Will future margins really leap, and what’s fueling the optimism? See the details behind the headline growth and profit expectations. Read the full narrative to get the inside scoop.

Result: Fair Value of $223.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower adoption of healthier products and ongoing input cost pressures could challenge PepsiCo’s growth and test the strength of this optimistic narrative.

Find out about the key risks to this PepsiCo narrative.

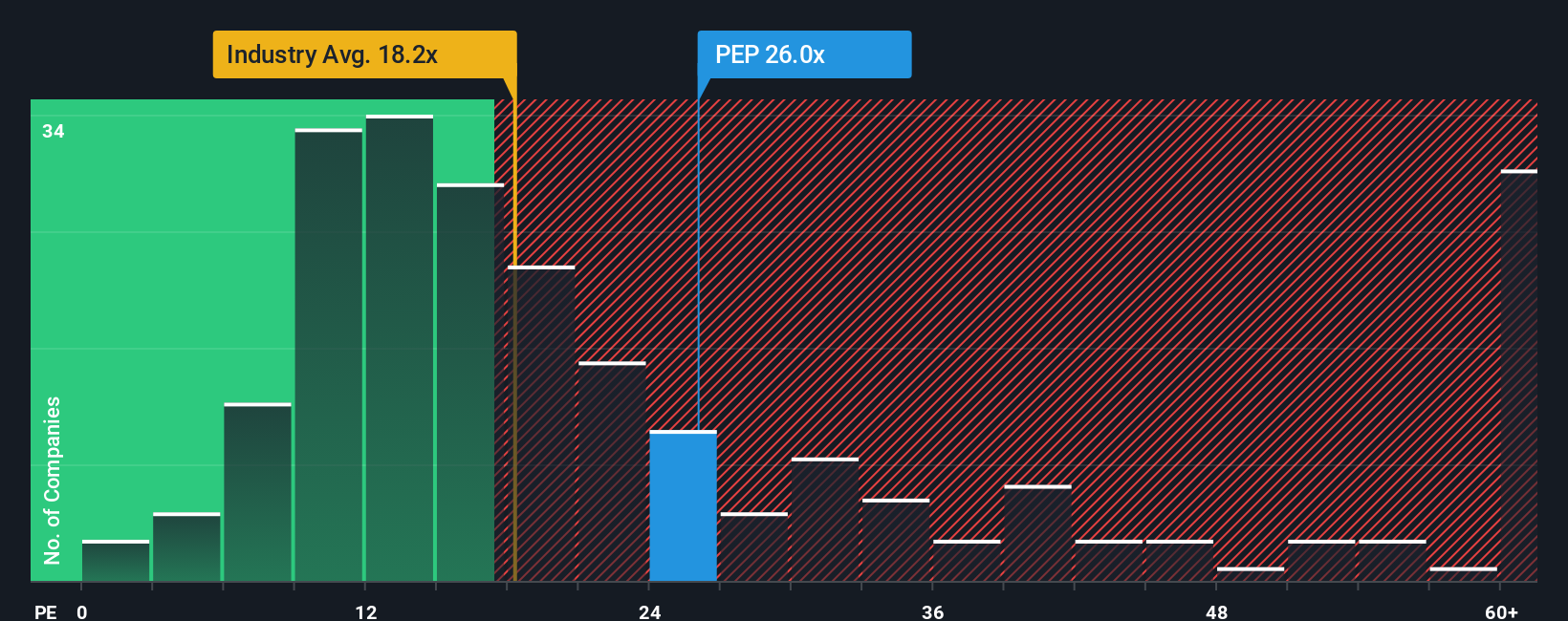

Another View: The Market Multiple Perspective

Another way to value PepsiCo is by comparing its price-to-earnings ratio to industry benchmarks. Currently, PepsiCo trades at 28.7 times earnings, which is significantly more expensive than both the global beverage industry average (17.7x) and its peer average (26.1x). The fair ratio estimate, based on historical trends, sits slightly higher at 29.3x. This suggests the market may eventually narrow the gap, but at this price, investors are paying up for perceived quality. Does this premium reflect real potential, or is there caution in these high expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PepsiCo Narrative

If you have a different perspective, or want to investigate the numbers for yourself, it's easy to shape your own analysis in just minutes. Do it your way

A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Stay ahead of the market by putting your money to work where trends, innovation, and value meet real potential.

- Tap into powerful cash flow opportunities and find tomorrow’s market leaders by tracking these 873 undervalued stocks based on cash flows with strong fundamentals at compelling prices.

- Seize new trends in medicine and innovation by reviewing these 33 healthcare AI stocks, where artificial intelligence powers advancements in healthcare outcomes and investment potential.

- Collect reliable yields for your portfolio by targeting these 17 dividend stocks with yields > 3% offering attractive payouts despite market uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives