- United States

- /

- Beverage

- /

- NasdaqGS:PEP

How PepsiCo’s (PEP) 53rd Consecutive Dividend Increase Reinforces Its Shareholder Commitment

Reviewed by Sasha Jovanovic

- PepsiCo's Board of Directors recently declared a quarterly dividend of $1.4225 per share, marking a 5% increase compared to the same period last year and continuing the company's commitment to annualized dividend growth, with the latest raise starting in June 2025.

- This move marks PepsiCo's 53rd consecutive annual dividend increase, underlining the company's emphasis on long-term shareholder returns despite facing ongoing challenges in the consumer beverages sector.

- We'll explore how PepsiCo's sustained dividend growth signals management's confidence in its financial stability and future investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

PepsiCo Investment Narrative Recap

To be a shareholder in PepsiCo, you need to believe in its ability to maintain resilient cash flows and shareholder payouts through changing consumer trends and sector challenges. The recent 5% dividend increase and 53rd consecutive annual raise reinforce a commitment to long-term returns, but the news does not materially impact the primary short-term catalyst: PepsiCo’s capacity to drive international expansion and enhance productivity. The greatest near-term risk continues to be pressure on core category volumes and execution of cost-control efforts.

Among recent developments, PepsiCo’s launch of CRP 2.0, a climate resilience platform for agriculture, stands out as relevant to both future operational efficiency and risk management. This initiative ties directly to catalysts like global supply chain optimization and digital transformation, which underpin both productivity gains and potential margin improvements moving forward.

However, investors should also be alert to the flip side: even as dividend growth continues, the pace of free cash flow growth relative to dividend and buyback commitments remains an area to watch if…

Read the full narrative on PepsiCo (it's free!)

PepsiCo's outlook anticipates $101.5 billion in revenue and $11.8 billion in earnings by 2028. This scenario is based on a 3.4% annual revenue growth rate and a $4.2 billion increase in earnings from the current $7.6 billion.

Uncover how PepsiCo's forecasts yield a $152.57 fair value, a 4% upside to its current price.

Exploring Other Perspectives

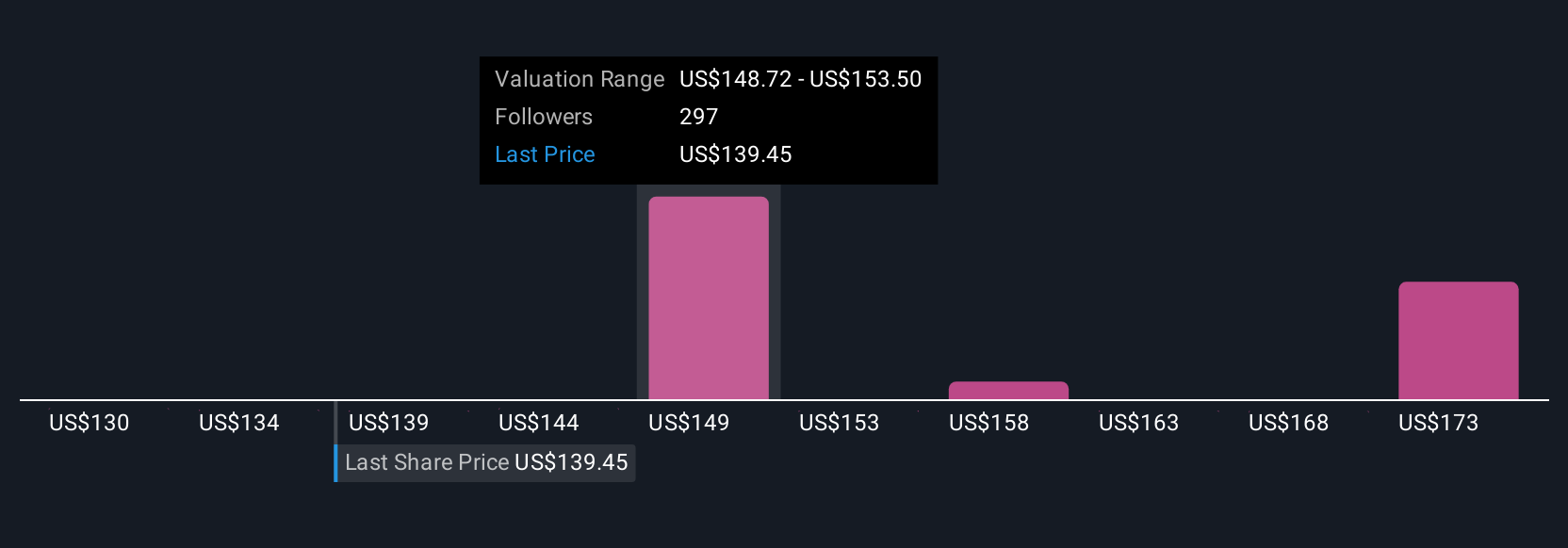

Forty-one members of the Simply Wall St Community set fair value estimates for PepsiCo ranging from US$116.47 to US$249.78 per share. Despite this broad span of views, ongoing pressure on free cash flow growth highlights why performance and payout sustainability are on many minds, explore these diverse perspectives to inform your outlook.

Explore 41 other fair value estimates on PepsiCo - why the stock might be worth as much as 70% more than the current price!

Build Your Own PepsiCo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PepsiCo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PepsiCo's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives