- United States

- /

- Beverage

- /

- NasdaqGS:PEP

Has the Recent 4.3% Share Price Jump Made PepsiCo Fairly Priced in 2025?

Reviewed by Bailey Pemberton

- Wondering if PepsiCo shares are trading at a bargain, or if the price tag is too steep for what you’re getting? You’re not the only one asking these questions right now.

- After a 4.3% pop over the last 30 days, PepsiCo’s shares have still logged a -8.7% return over the past year. This has made for a bumpy ride and is drawing plenty of attention from value-focused investors.

- Recent headlines highlight PepsiCo’s push into healthier products and big sustainability investments. These efforts have kept the company in the spotlight and are prompting debate about whether near-term volatility is masking longer-term opportunity.

- On our six-point valuation check, PepsiCo scores a 3 out of 6, suggesting the picture is mixed. We will explore both traditional and alternative valuation approaches next, so stay tuned for a potentially smarter way to assess value that you may not have considered.

Find out why PepsiCo's -8.7% return over the last year is lagging behind its peers.

Approach 1: PepsiCo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those cash flows back to today’s value. This approach aims to reveal what PepsiCo might truly be worth, based on how much money it is expected to generate over time.

For PepsiCo, the most recent twelve months of Free Cash Flow came in at $6.4 Billion. Analysts forecast consistent growth, projecting Free Cash Flow to reach $11.4 Billion by the end of 2027. Looking further out, using Simply Wall St’s extrapolations, PepsiCo’s Free Cash Flow could rise to nearly $15 Billion by 2035. These figures reflect a steady upward trajectory in the company’s ability to generate cash, with analysts directly estimating the first five years and later years forecasted using trend-based calculations.

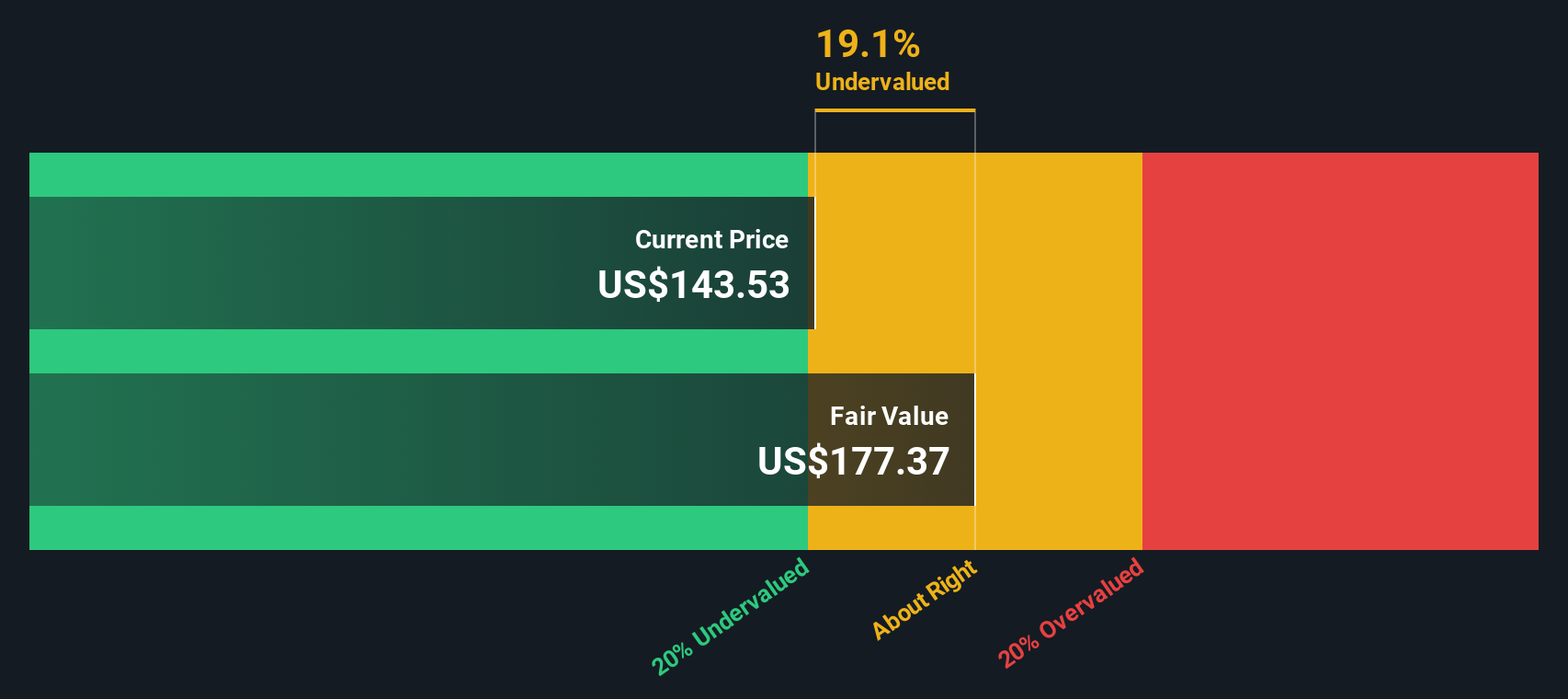

The resulting intrinsic value from this DCF analysis is $223.84 per share. Based on the current share price, this represents a 34.7% discount, suggesting that PepsiCo stock is significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PepsiCo is undervalued by 34.7%. Track this in your watchlist or portfolio, or discover 847 more undervalued stocks based on cash flows.

Approach 2: PepsiCo Price vs Earnings

For established, profitable companies like PepsiCo, the Price-to-Earnings (PE) ratio is a trusted valuation tool. Because earnings are the direct result of a company’s operations, comparing a company’s stock price to its earnings provides investors with a simple gauge of how much they’re paying for each dollar of profit.

However, not all PE ratios should be treated equally. What counts as a “fair” PE ratio depends on several factors, including a company’s expected earnings growth, the risks it faces, and overall market conditions. Fast-growing or lower-risk companies often deserve a higher PE, while slower-growing or riskier businesses tend to trade at lower multiples.

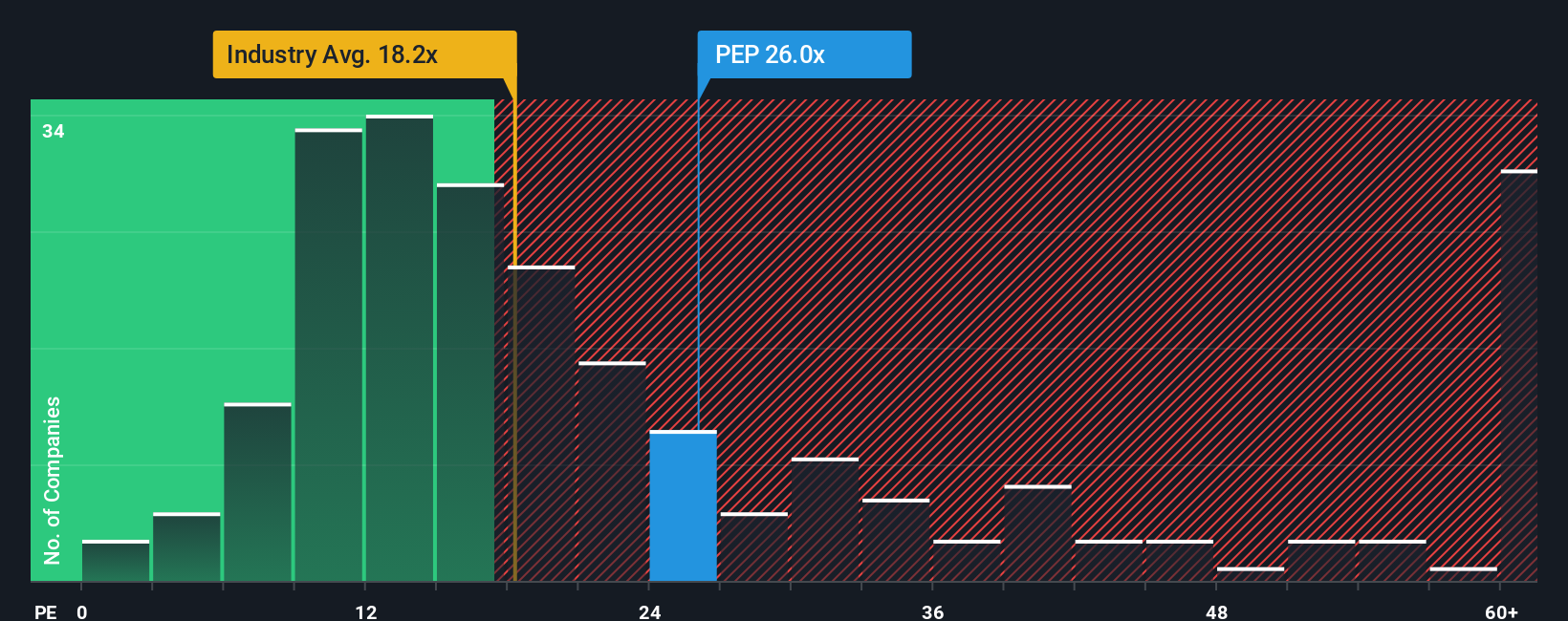

PepsiCo’s current PE ratio stands at 27.7x. This is above the average for the Beverage industry, which is 17.3x, and higher than the average for its peers at 25.3x. While these comparisons offer some context, Simply Wall St’s proprietary “Fair Ratio” takes things further. The Fair Ratio for PepsiCo, calculated at 29.3x, quantifies the PE you’d expect for a stock with PepsiCo’s unique combination of growth prospects, risk profile, profit margin, market cap, and sector. This delivers a more tailored and meaningful benchmark than generic industry or peer averages.

Because PepsiCo’s actual PE ratio of 27.7x is quite close to its Fair Ratio of 29.3x, the stock looks to be valued about right by the market at this time.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1380 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PepsiCo Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is the story you, as an investor, tell about PepsiCo based on your view of its future. This story combines your forecasts for revenue, profit margins, or growth with your own sense of what the company’s fair value should be.

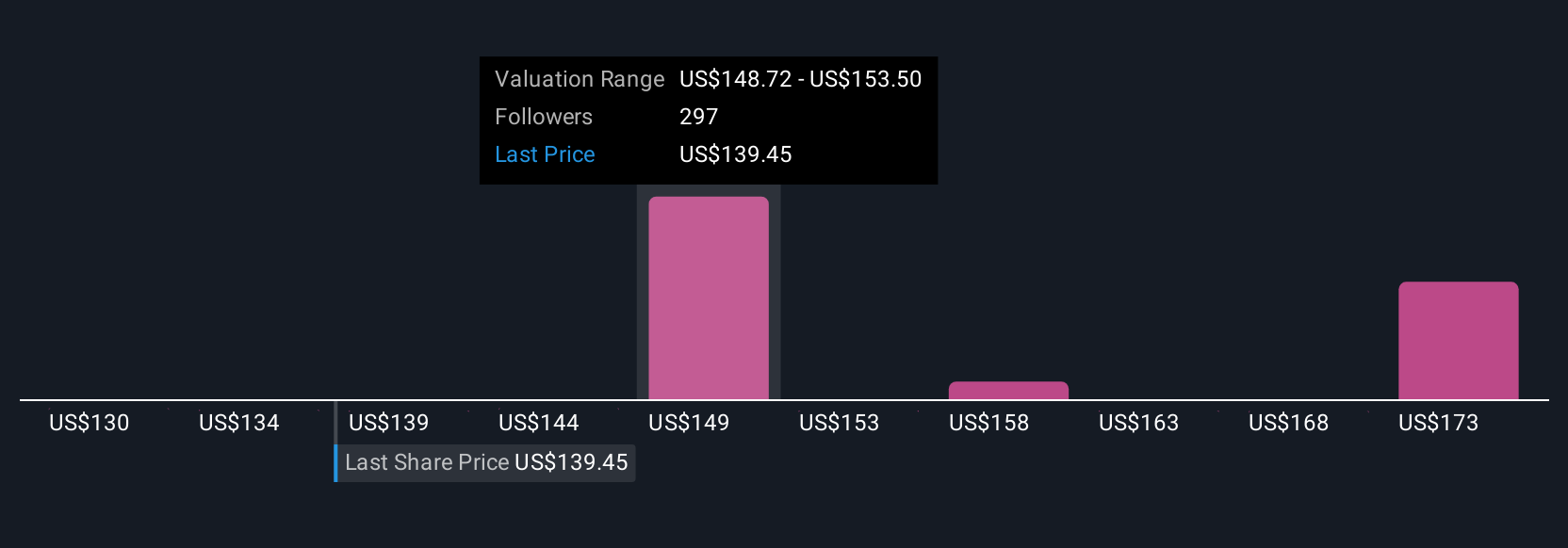

Narratives bridge the gap between hard numbers and real-world context. They help you connect the company’s business story, such as new markets, product launches, or emerging risks, to a tailored financial forecast so you can decide what PepsiCo is truly worth to you. Narratives are easy to use and accessible right on Simply Wall St’s Community page, trusted by millions of investors. They allow you to anchor your investment decision around your assumptions. For example, when the Narrative’s fair value you set is above the current price, the stock could be a buy, and vice versa.

What’s unique is that as new information comes in, such as a quarterly result, a major news announcement, or a shift in consumer trends, Narratives automatically update to reflect the latest data instantly. For example, among PepsiCo Narratives shared by investors, the most optimistic currently sees fair value above $160 per share driven by global expansion and digitalization, while the most cautious pegs it near $115 based on slower health product uptake and margin pressures.

Do you think there's more to the story for PepsiCo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives