- United States

- /

- Food

- /

- NasdaqGS:MZTI

What Marzetti (MZTI)'s Strong Q1 Sales and Earnings Growth Means For Shareholders

Reviewed by Sasha Jovanovic

- Marzetti recently released its first quarter earnings results for the period ended September 30, 2025, reporting sales of US$493.47 million and net income of US$47.18 million, both higher than the prior year period.

- This earnings report also revealed an increase in basic and diluted earnings per share to US$1.71, highlighting continued earnings growth from the company's core operations.

- We'll explore how Marzetti's year-over-year growth in sales and net income influences its investment narrative and future outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Marzetti Investment Narrative Recap

To be a Marzetti shareholder, you need to believe in the company’s ability to boost branded product sales despite shifting consumer tastes and margin pressures. The company’s latest quarter of higher sales and earnings per share confirms ongoing operational strength but doesn’t meaningfully shift the main catalyst: new branded product launches and retail partnerships. The biggest short-term risk remains exposure to fast-changing consumer preferences, which has not lessened with these results.

Among Marzetti’s recent announcements, the summer 2025 rollout of Buffalo Wild Wings hot sauces on Amazon stands out. This aligns with the strategic effort to grow retail volumes by leveraging new licensed products and partnerships, one of the key drivers that underpins near-term growth potential discussed above. If these launches sustain momentum, they could help offset risks from consumer shifts toward cleaner, less processed foods.

By contrast, investors should also be mindful of shrinking shelf space and pricing power at major retailers if...

Read the full narrative on Marzetti (it's free!)

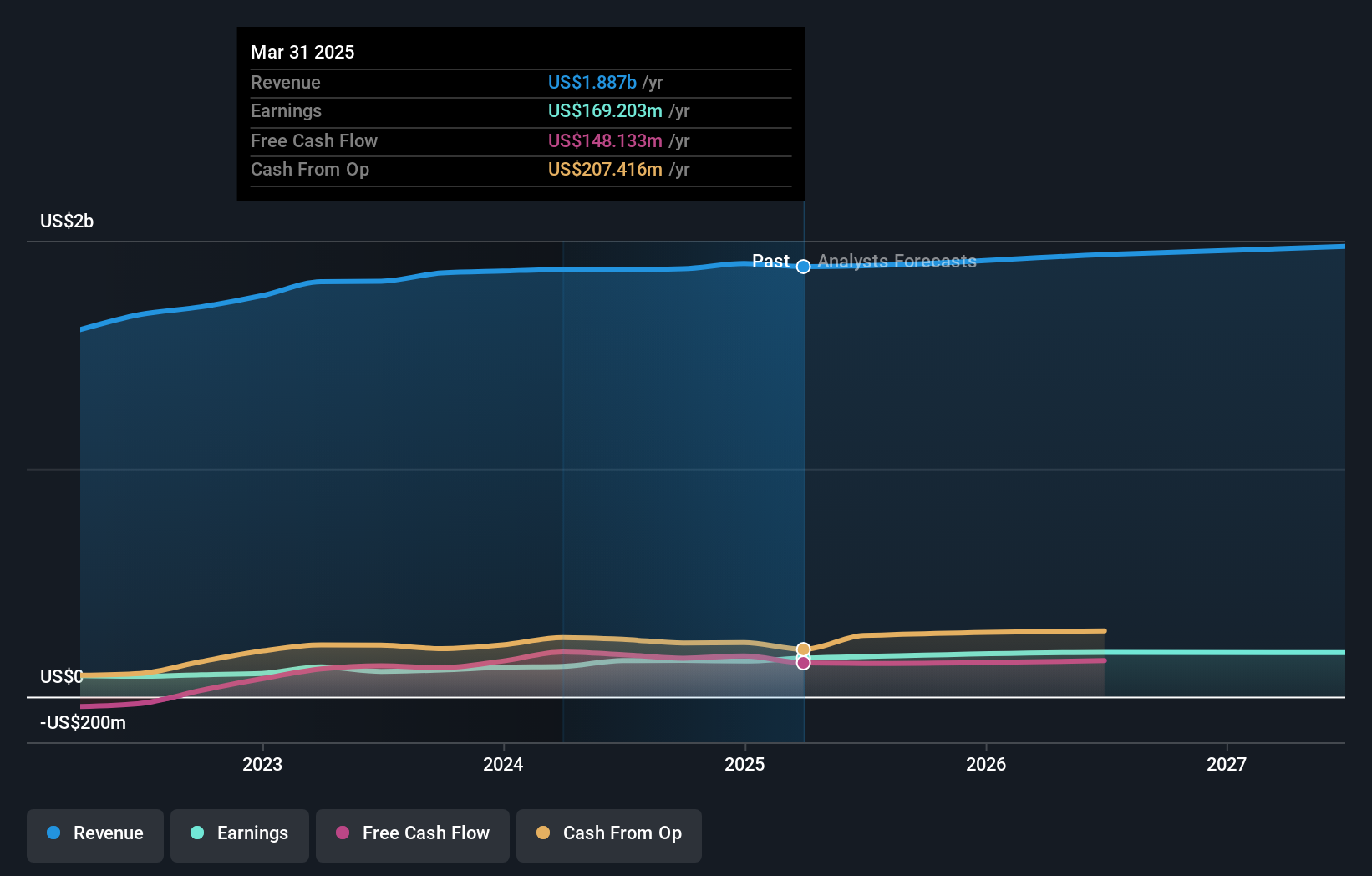

Marzetti's outlook anticipates $2.0 billion in revenue and $201.0 million in earnings by 2028. This scenario is based on a 1.7% annual revenue growth rate and a $34.1 million increase in earnings from the current level of $166.9 million.

Uncover how Marzetti's forecasts yield a $199.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Three individual valuations from the Simply Wall St Community span from US$139.54 to US$199. Recent branded product launches are top-of-mind for many, but opinions clearly show that investors weigh the risk of rapid consumer preference shifts very differently, explore these perspectives for a fuller view.

Explore 3 other fair value estimates on Marzetti - why the stock might be worth as much as 15% more than the current price!

Build Your Own Marzetti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marzetti research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Marzetti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marzetti's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MZTI

Marzetti

Engages in manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives