- United States

- /

- Food

- /

- NasdaqGS:MZTI

Marzetti (MZTI) Is Up 8.8% After Strong Q1 Sales and Profit Beat – What's Changed

Reviewed by Sasha Jovanovic

- The Marzetti Company recently reported its first quarter 2026 earnings, posting sales of US$493.47 million and net income of US$47.18 million, both higher than the same period last year.

- This year-over-year growth in both sales and net income suggests the company may be benefiting from recent product initiatives and operational improvements.

- Given these stronger quarterly results, we'll now examine how Marzetti's sales and profit momentum might influence the company's investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Marzetti Investment Narrative Recap

Being a Marzetti shareholder means believing in the company’s ability to grow profitably through brand innovation, operational efficiency, and ongoing consumer demand for at-home meal solutions. The latest quarterly results, with higher sales and net income, show positive momentum but do not appear to materially change the short-term catalyst: maintaining strong revenue growth through new product launches and retail partnerships. The biggest current risk remains potential margin pressure from higher input costs and increased competition from private labels.

Among Marzetti’s recent announcements, the summer launch of four new Buffalo Wild Wings hot sauces on Amazon stands out as particularly relevant. This product initiative builds on the positive sales momentum and is directly tied to the current catalyst of leveraging partnerships and innovation for volume growth across channels, crucial as the company works to expand its premium product offerings and reach new customer segments.

However, investors should be mindful that rising input costs for core ingredients could squeeze profits if pricing strategies or supply efficiencies don’t keep pace…

Read the full narrative on Marzetti (it's free!)

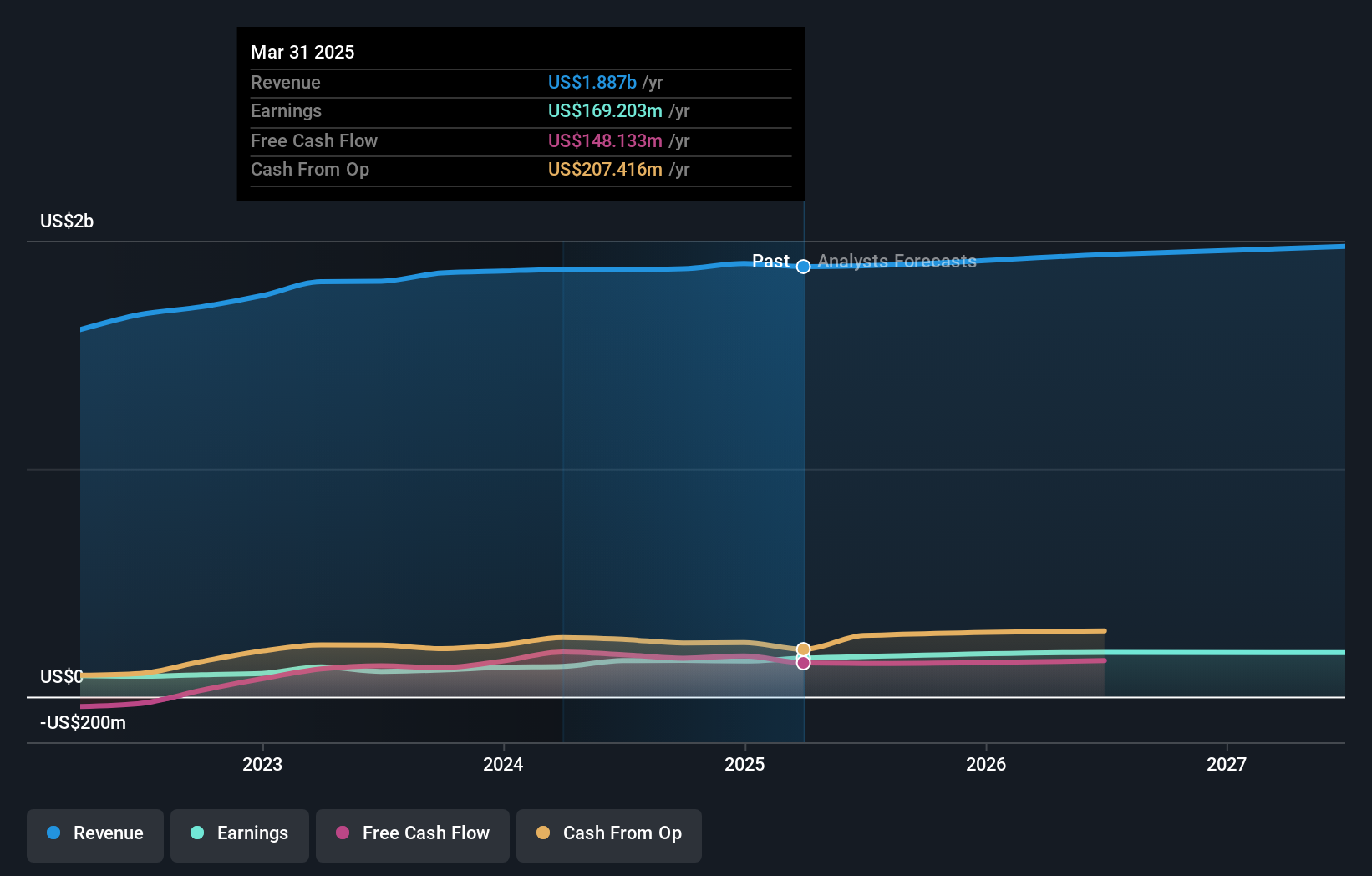

Marzetti's narrative projects $2.0 billion in revenue and $201.0 million in earnings by 2028. This assumes 1.7% yearly revenue growth and a $34.1 million increase in earnings from the current $166.9 million level.

Uncover how Marzetti's forecasts yield a $199.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$138.07 to US$199 based on three user forecasts. While this reflects varied outlooks, the recent sales-driven momentum shows that product innovation still plays a defining role in Marzetti’s future. Consider the spread of opinions as an invitation to explore multiple approaches to assessing the company.

Explore 3 other fair value estimates on Marzetti - why the stock might be worth as much as 15% more than the current price!

Build Your Own Marzetti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marzetti research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Marzetti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marzetti's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MZTI

Marzetti

Engages in manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026