- United States

- /

- Food

- /

- NasdaqGS:MZTI

Is Marzetti's (MZTI) Dividend Streak and ESOP Move Reinforcing Its Long-Term Capital Discipline?

Reviewed by Sasha Jovanovic

- On November 19, 2025, The Marzetti Company announced its 63rd consecutive annual increase in its regular quarterly cash dividend to US$1.00 per share and filed a US$255.32 million shelf registration, including 1,500,000 shares for an ESOP-related offering.

- This continued streak of dividend increases underscores Marzetti’s longstanding commitment to shareholder returns, while the ESOP-related shelf registration points to ongoing efforts in employee ownership and capital flexibility.

- We’ll look at how Marzetti’s latest dividend hike and ESOP shelf registration might influence the company’s future growth and stability.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Marzetti Investment Narrative Recap

To see Marzetti as a long-term investment, you’d likely place value on its consistency and established dividend record in the packaged foods sector. The latest dividend hike and ESOP shelf registration demonstrate ongoing capital flexibility and commitment to shareholder returns, but do not appear to change the immediate importance of product innovation as a catalyst or alter near-term risks from shifting consumer preferences toward fresher or “clean-label” foods.

Among recent announcements, the launch of new products in partnership with Buffalo Wild Wings stands out. This new branded offering directly ties into Marzetti’s push for retail volume growth, which remains critical as consumer choices evolve and retail competition intensifies, affecting both short-term momentum and longer-term brand relevance.

However, investors should be aware that despite continued dividend increases, the risk from accelerating demand for fresher, less-processed foods still poses a challenge if Marzetti cannot...

Read the full narrative on Marzetti (it's free!)

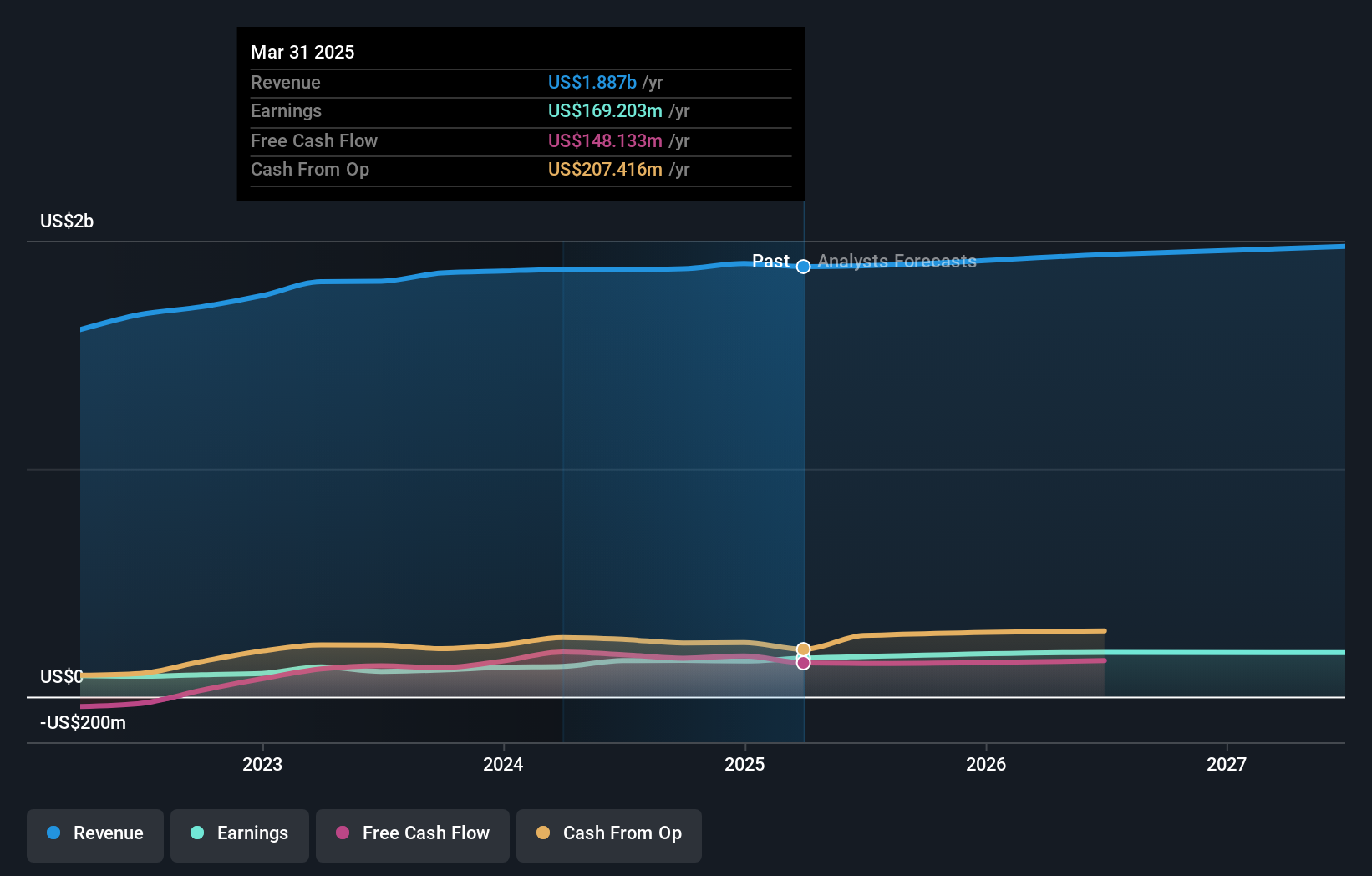

Marzetti's projection anticipates $2.0 billion in revenue and $201.0 million in earnings by 2028. This outlook is based on a 1.7% annual revenue growth rate and reflects an earnings increase of $34.1 million from the current $166.9 million.

Uncover how Marzetti's forecasts yield a $199.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community estimate Marzetti’s fair value between US$132.85 and US$199, based on three separate forecasts. With outlooks for packaged food evolving rapidly, you’ll see opinions on growth drivers and risks vary across the community’s forecasts.

Explore 3 other fair value estimates on Marzetti - why the stock might be worth as much as 16% more than the current price!

Build Your Own Marzetti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marzetti research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Marzetti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marzetti's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MZTI

Marzetti

Engages in manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success