- United States

- /

- Food

- /

- NasdaqGS:MZTI

A Fresh Look at Marzetti (MZTI) Valuation Following Q1 Profitability Gains

Reviewed by Simply Wall St

Marzetti (MZTI) just released its first quarter earnings, showing both sales and net income up from last year. These results point to improved profitability, a detail that often shapes investor sentiment around the stock.

See our latest analysis for Marzetti.

Marzetti’s improved profitability seems to be sparking renewed investor interest, with the stock posting a 6.2% share price return over the past month despite a dip in recent quarters. Over the last twelve months, however, the total shareholder return is still down 5.4%, so momentum has only started to pick up.

If Marzetti’s latest rebound has you rethinking your portfolio, now is a great time to discover fast growing stocks with high insider ownership

With shares still down for the year and trading below analysts' price targets, the question now is whether Marzetti is truly undervalued or if the recent gains mean future growth is already being accounted for.

Most Popular Narrative: 12.5% Undervalued

With Marzetti’s fair value estimate at $199 compared to the last close of $174.10, the stock appears to be trading at a significant discount. Here is what is driving the optimistic outlook, according to the most widely followed narrative.

Expanded marketing investments and data-driven digital initiatives are improving household penetration rates and repeat purchases across core brands. This is positioning the company to capture a larger share of the continued shift toward at-home meal preparation and fueling sustainable revenue growth.

Want to know the secret behind this steep discount? The narrative points to a powerful mix of stronger margins, digital transformation, and surprising future profit assumptions. See how these ingredients combine for a bullish target, and then decide if you agree with their bold projections.

Result: Fair Value of $199 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing demand for fresh, minimally processed foods or increased retail consolidation could easily challenge Marzetti’s current growth assumptions and margin outlook.

Find out about the key risks to this Marzetti narrative.

Another View: What Do Market Multiples Say?

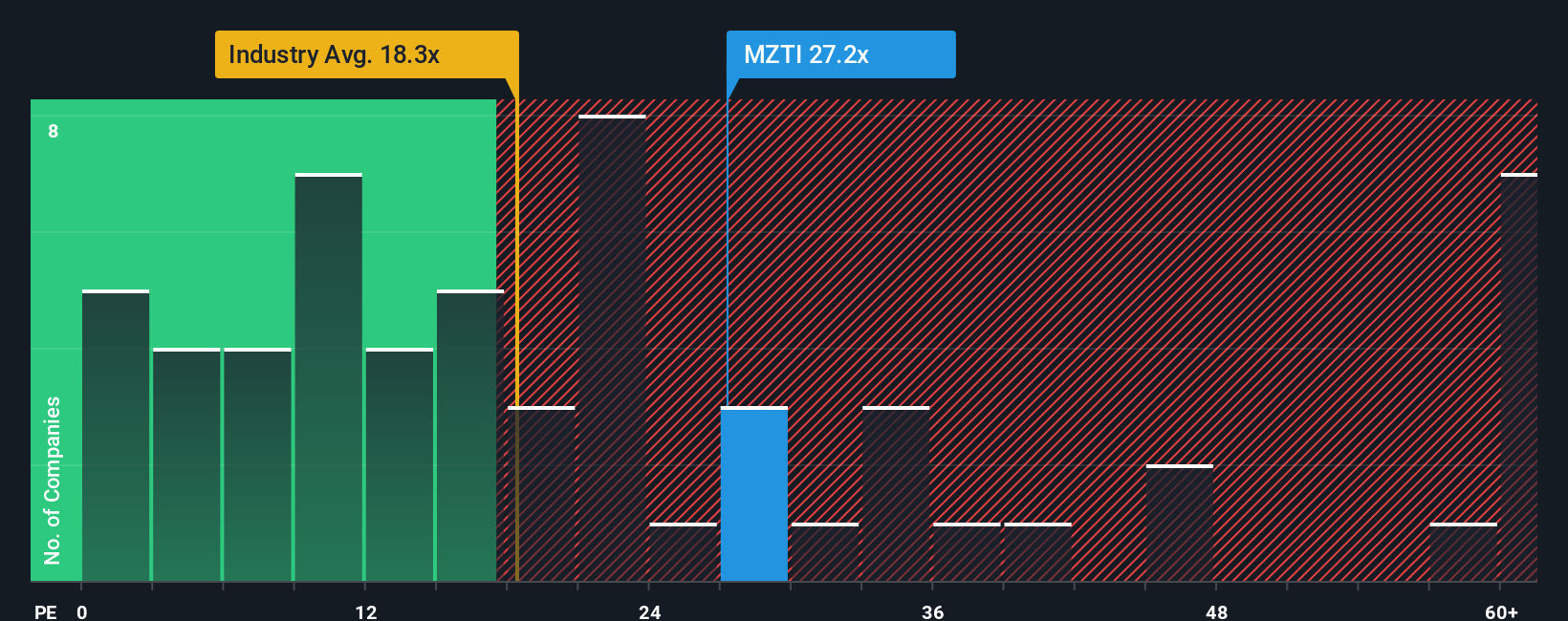

While the narrative and fair value suggest Marzetti is undervalued, market multiples tell a more cautious story. The company trades at a price-to-earnings ratio of 28.2x, which is well above the US Food industry average of 18.3x and the peer average of 14.8x. The fair ratio is 15.4x, so the market could re-rate the stock lower if sentiment shifts. Does this premium signal justified optimism, or is there valuation risk investors should not ignore?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marzetti Narrative

If the story from analysts or the community doesn't match your view, you can always dive into the data and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Marzetti.

Looking for more investment ideas?

Level up your investing by checking out market-defining stocks that you might be overlooking. The next big opportunity could be just a click away. See what else could transform your strategy right now.

- Capitalize on untapped potential by finding these 865 undervalued stocks based on cash flows that are flying under the radar and priced below their fair value.

- Boost your passive income streams through these 14 dividend stocks with yields > 3% with high yields and strong financial health.

- Ride the future of healthcare as you uncover these 32 healthcare AI stocks set to shape the next wave of medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MZTI

Marzetti

Engages in manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives